Form 8854 2012

What is the Form 8854

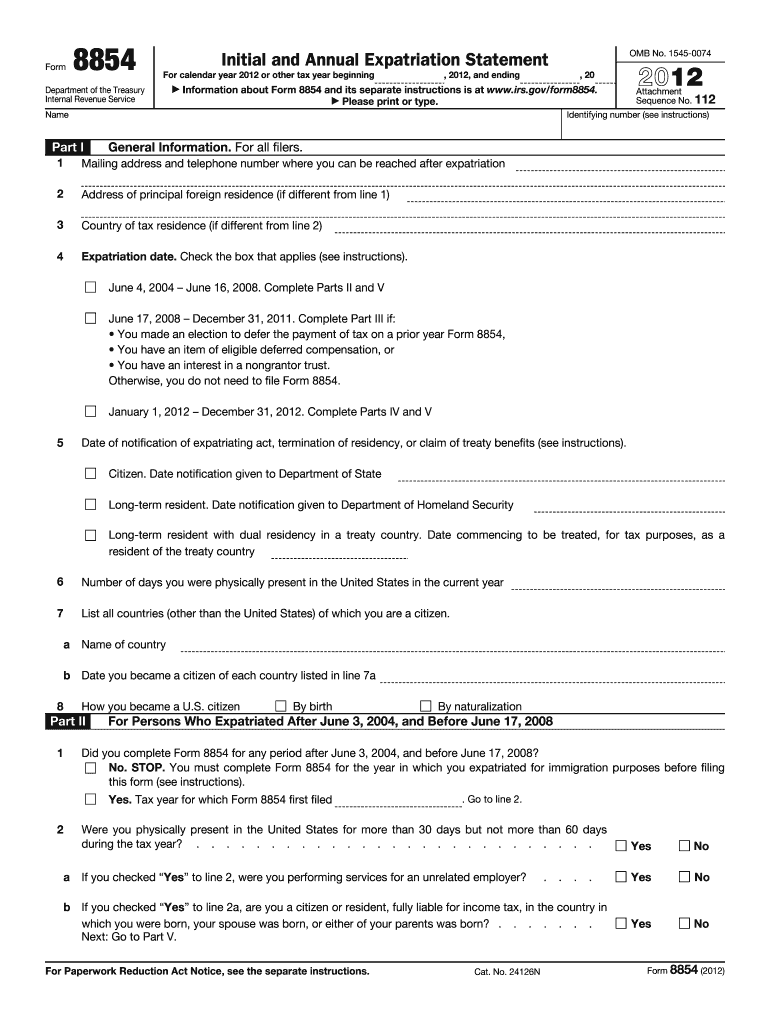

The Form 8854, also known as the Initial and Annual Expatriation Statement, is a tax form used by individuals who are expatriating from the United States. This form is essential for reporting your expatriation status to the Internal Revenue Service (IRS) and for disclosing any tax obligations that may arise from the expatriation process. It is particularly relevant for individuals who have renounced their U.S. citizenship or terminated their long-term resident status. Completing this form is a crucial step in ensuring compliance with U.S. tax laws following expatriation.

How to use the Form 8854

Using the Form 8854 involves several key steps to ensure accurate reporting of your expatriation. First, gather all necessary financial information, including your worldwide income and assets. The form requires you to report your income for the five years preceding your expatriation, along with details about your net worth. After completing the form, it must be filed with your annual tax return for the year of expatriation. If you do not have a tax return due for that year, the form should be submitted separately. It is advisable to consult with a tax professional to navigate the complexities of the form.

Steps to complete the Form 8854

Completing the Form 8854 requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather your financial documents, including income statements and asset valuations.

- Fill out Part I of the form, which includes personal information and expatriation details.

- Complete Part II, where you report your income and net worth for the relevant years.

- Review the form for completeness and accuracy, ensuring all required fields are filled.

- Submit the form with your tax return or as a standalone document, depending on your situation.

Legal use of the Form 8854

The legal use of the Form 8854 is governed by IRS regulations. It is a legally required document for individuals who expatriate, ensuring that they fulfill their tax obligations. Failure to file the form can result in significant penalties, including the imposition of an exit tax on unrealized gains. The form must be completed accurately to avoid complications with the IRS regarding your expatriation status. It is important to understand the legal implications of expatriation and to ensure compliance with all associated tax requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8854 are critical to avoid penalties. Generally, the form must be filed by the due date of your tax return for the year of expatriation, typically April fifteenth for most taxpayers. If you are living abroad, you may qualify for an automatic two-month extension. However, if you miss the deadline, you may face penalties and interest on any unpaid taxes. Staying informed about these deadlines is essential for maintaining compliance with IRS regulations.

Penalties for Non-Compliance

Non-compliance with the Form 8854 requirements can lead to severe penalties. If you fail to file the form or provide inaccurate information, the IRS may impose an exit tax based on your net worth at the time of expatriation. Additionally, there may be a penalty of $10,000 for failing to file the form, which can increase with continued non-compliance. Understanding these potential consequences is crucial for anyone considering expatriation, as it underscores the importance of accurate and timely filing.

Quick guide on how to complete 2012 form 8854

Prepare Form 8854 effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers a perfect environmentally-friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Handle Form 8854 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest way to edit and eSign Form 8854 without hassle

- Find Form 8854 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and press the Done button to save your changes.

- Choose your preferred method to send your form: via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Form 8854 and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2012 form 8854

Create this form in 5 minutes!

How to create an eSignature for the 2012 form 8854

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is Form 8854 and why do I need it?

Form 8854 is the Expatriation Statement required by the IRS for individuals who are relinquishing their U.S. citizenship or long-term residency. Completing Form 8854 accurately is crucial to avoid potential tax liabilities and to comply with U.S. tax obligations after expatriation.

-

How can airSlate SignNow assist with Form 8854?

airSlate SignNow provides a streamlined platform for eSigning and sending documents, including Form 8854. Our easy-to-use features allow you to ensure that your Form 8854 is completed and signed efficiently, maintaining compliance with IRS requirements.

-

Is there a cost to use airSlate SignNow for signing Form 8854?

Yes, airSlate SignNow offers various pricing plans to suit different needs, including options for individuals and businesses. Prices are designed to be cost-effective, ensuring that you can manage and sign important documents like Form 8854 without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 8854?

With airSlate SignNow, you can easily upload, edit, and eSign Form 8854. Our platform includes features such as templates, document tracking, and secure cloud storage, making it simple to manage your Form 8854 and other important documents.

-

Can I integrate airSlate SignNow with other software for Form 8854 management?

Absolutely! airSlate SignNow integrates seamlessly with various software applications, allowing you to streamline your workflow when managing Form 8854. This integration helps in organizing your documents and enhances productivity across different platforms.

-

Are there any security measures in place for signing Form 8854 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security and uses advanced encryption methods to protect your data when signing Form 8854. Our platform adheres to strict compliance standards, ensuring that your information remains confidential and secure.

-

How do I get started with airSlate SignNow for my Form 8854?

Getting started with airSlate SignNow is easy! Simply sign up for an account, upload your Form 8854, and you can begin sending and eSigning documents immediately. Our user-friendly interface makes it simple to navigate and complete your forms.

Get more for Form 8854

- Itemized receipt template form

- Voya trust certification form

- New vendor form

- Credit application and agreement principalamp39s marjam form

- Check log template form

- Alliance spine and pain centers with locations all over form

- Separation from employment withdrawal request empower form

- Payday loan plus riverland federal credit union form

Find out other Form 8854

- How To Sign Missouri Banking Form

- Help Me With Sign New Jersey Banking PDF

- How Can I Sign New Jersey Banking Document

- Help Me With Sign New Mexico Banking Word

- Help Me With Sign New Mexico Banking Document

- How Do I Sign New Mexico Banking Form

- How To Sign New Mexico Banking Presentation

- How Do I Sign New York Banking PPT

- Help Me With Sign Ohio Banking Document

- How To Sign Oregon Banking PDF

- Help Me With Sign Oregon Banking Presentation

- Can I Sign Pennsylvania Banking Form

- How To Sign Arizona Business Operations PDF

- Help Me With Sign Nebraska Business Operations Presentation

- How To Sign Arizona Car Dealer Form

- How To Sign Arkansas Car Dealer Document

- How Do I Sign Colorado Car Dealer PPT

- Can I Sign Florida Car Dealer PPT

- Help Me With Sign Illinois Car Dealer Presentation

- How Can I Sign Alabama Charity Form