Canada Uniform Sale Use Tax Certification

What is the Canada Uniform Sale Use Tax Certification

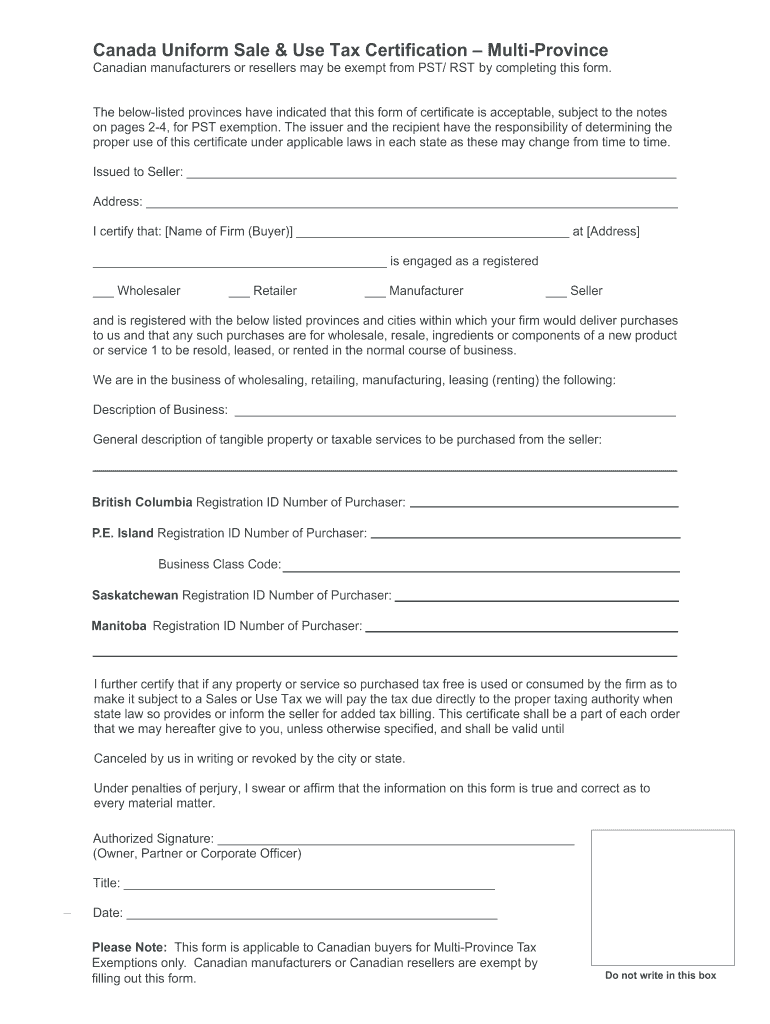

The Canada Uniform Sale Use Tax Certification is a vital document for businesses engaged in selling goods or services across multiple provinces in Canada. This certification allows sellers to exempt certain sales from sales tax, provided that the buyer intends to resell the purchased items. It serves as proof that the buyer is eligible for a tax exemption, preventing the seller from charging sales tax on the transaction. Understanding the nuances of this certification is crucial for businesses to ensure compliance with tax regulations and to avoid unnecessary tax liabilities.

How to use the Canada Uniform Sale Use Tax Certification

Using the Canada Uniform Sale Use Tax Certification involves several steps to ensure that the document is correctly filled out and submitted. First, the buyer must complete the certification form, providing necessary details such as their business name, address, and tax registration number. Once completed, the buyer presents this certification to the seller at the time of purchase. The seller retains this document for their records, which can be crucial in case of audits or inquiries from tax authorities. Proper usage of this certification not only facilitates tax exemptions but also supports transparent business practices.

Steps to complete the Canada Uniform Sale Use Tax Certification

Completing the Canada Uniform Sale Use Tax Certification requires careful attention to detail. Here are the essential steps:

- Obtain the certification form, which can typically be found on provincial tax authority websites.

- Fill in the buyer's information, including the business name, address, and tax registration number.

- Specify the type of goods or services being purchased and indicate that these items are intended for resale.

- Sign and date the form to validate the certification.

- Provide the completed form to the seller at the time of purchase.

Following these steps ensures that the certification is valid and can be used effectively to claim tax exemptions.

Legal use of the Canada Uniform Sale Use Tax Certification

The legal use of the Canada Uniform Sale Use Tax Certification is governed by specific tax regulations in each province. This certification must be used in accordance with the laws that dictate when and how sales tax exemptions can be applied. It is essential for businesses to understand the legal implications of using this certification, as improper use can lead to penalties or audits. Sellers are advised to verify the authenticity of the certification and maintain proper records to demonstrate compliance with tax laws.

Key elements of the Canada Uniform Sale Use Tax Certification

Several key elements must be included in the Canada Uniform Sale Use Tax Certification to ensure its validity:

- Business Information: The name and address of the buyer's business.

- Tax Registration Number: The buyer's tax identification number, which verifies their eligibility for the exemption.

- Description of Goods/Services: A clear description of the items being purchased for resale.

- Signature: The buyer's signature, confirming the accuracy of the information provided.

- Date: The date of completion, which is important for record-keeping.

Including these elements ensures that the certification is complete and compliant with legal requirements.

Examples of using the Canada Uniform Sale Use Tax Certification

Examples of using the Canada Uniform Sale Use Tax Certification can help clarify its application in real-world scenarios. For instance, a retail store purchasing inventory from a wholesaler would present the certification to avoid paying sales tax on those items. Similarly, an online business that resells products may use the certification when buying goods from suppliers. These examples illustrate how the certification facilitates tax exemptions, promoting smoother transactions between buyers and sellers.

Quick guide on how to complete canada uniform sale use tax certification

Easily Prepare Canada Uniform Sale Use Tax Certification on Any Device

Digital document management has become popular among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and electronically sign your documents swiftly and without delays. Manage Canada Uniform Sale Use Tax Certification on any device using the airSlate SignNow Android or iOS applications and enhance any document-related operation today.

How to Edit and eSign Canada Uniform Sale Use Tax Certification with Ease

- Locate Canada Uniform Sale Use Tax Certification and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Canada Uniform Sale Use Tax Certification while ensuring exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the canada uniform sale use tax certification

How to create an electronic signature for your PDF document online

How to create an electronic signature for your PDF document in Google Chrome

How to make an electronic signature for signing PDFs in Gmail

How to create an electronic signature right from your smart phone

How to create an electronic signature for a PDF document on iOS

How to create an electronic signature for a PDF on Android OS

People also ask

-

What is airSlate SignNow's pricing for handling canada tax multi province documents?

airSlate SignNow offers competitive pricing plans tailored for businesses dealing with canada tax multi province documents. Our pricing scales based on the number of users and volume of transactions, ensuring you only pay for what you need. Sign up for a free trial to explore features without any initial commitment.

-

How does airSlate SignNow simplify the canada tax multi province document signing process?

With airSlate SignNow, you can easily prepare, send, and eSign canada tax multi province documents in a few clicks. Our intuitive interface allows users to manage multiple signers and track document statuses seamlessly. This streamlines the entire process, saving time and reducing errors.

-

What features does airSlate SignNow offer for canada tax multi province compliance?

airSlate SignNow is equipped with unique features designed for compliance with canada tax multi province regulations. This includes secure storage, audit trails, and customizable templates that ensure documents meet legal requirements. You can rest assured that your electronic signatures are legally binding and compliant.

-

Can airSlate SignNow integrate with accounting software for canada tax multi province?

Yes, airSlate SignNow integrates seamlessly with popular accounting software, making it easier to manage canada tax multi province documents alongside your financial records. This integration allows for smoother workflows, automating data entry and ensuring accuracy in filing your taxes.

-

What are the benefits of using airSlate SignNow for canada tax multi province documentation?

The main benefits of using airSlate SignNow for canada tax multi province documentation include increased efficiency, enhanced security, and improved accuracy. By eSigning and managing documents online, you can reduce paper usage and save time on traditional methods, giving you more time to focus on your business.

-

Is support available for users managing canada tax multi province documents?

Absolutely! airSlate SignNow provides comprehensive support for all users, including those navigating canada tax multi province documents. Our support team is available via chat, email, and phone to assist with any questions you have, ensuring you get the help you need when you need it.

-

How does airSlate SignNow ensure the security of canada tax multi province documents?

airSlate SignNow prioritizes security for all canada tax multi province documents with advanced encryption protocols and secure data storage. We follow industry best practices to protect your sensitive information and provide an audit trail for added accountability. You can trust that your documents are safe with us.

Get more for Canada Uniform Sale Use Tax Certification

- Motion for temporary order allowing move form

- Temporary order about moving with form

- Final order and findings on objection form

- How to notify the other parent you want to move with the form

- Home detention order form

- State appellate courtsthe researching paralegal form

- Felony judgment and sentence doc templatepdffiller form

- Felony judgment and sentence jail one year or less cr form

Find out other Canada Uniform Sale Use Tax Certification

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney