Credit Report Authorization Form

What is the credit report authorization?

The credit report authorization form is a document that allows an individual or organization to request access to a person's credit report. This authorization is essential for lenders, employers, and other entities that need to evaluate an individual's creditworthiness. By signing this form, the individual grants permission for their credit information to be accessed and reviewed, which is crucial in processes such as loan applications or employment screenings.

Key elements of the credit report authorization

A comprehensive credit report authorization form typically includes several key elements to ensure clarity and legality:

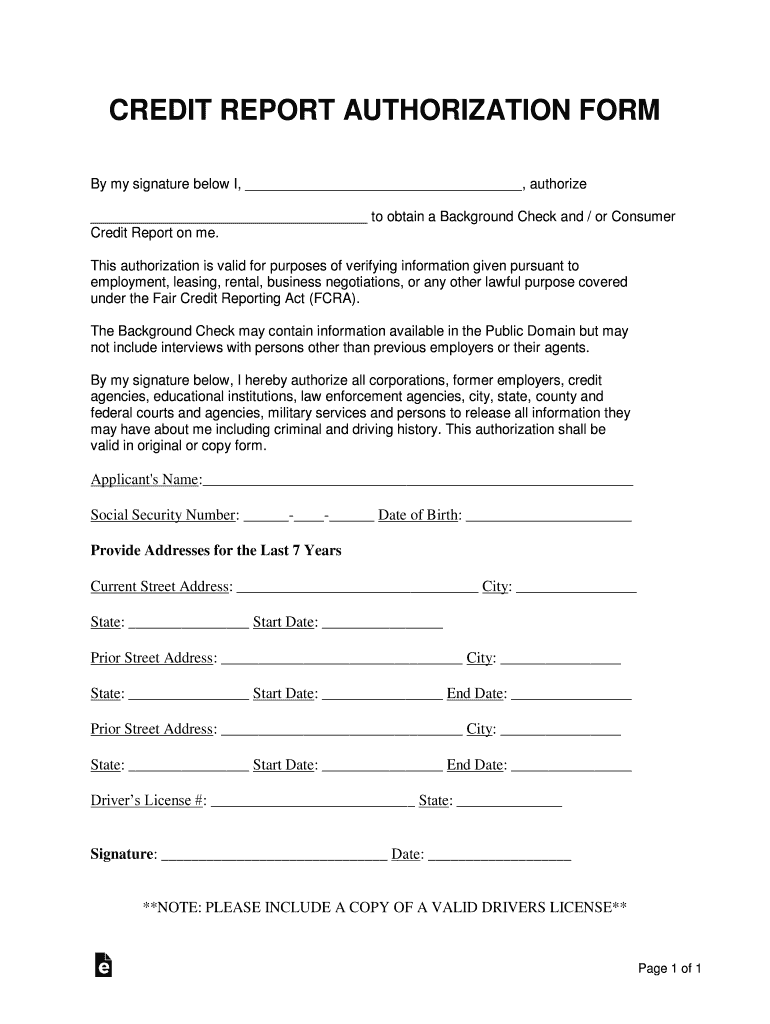

- Personal Information: This section requires the individual's full name, address, Social Security number, and date of birth to accurately identify the credit report.

- Purpose of Authorization: The form should specify the reason for the credit check, such as loan approval or employment screening.

- Consent Statement: A clear statement indicating that the individual consents to the release of their credit report.

- Signature and Date: The individual must sign and date the form to validate the authorization.

Steps to complete the credit report authorization

Completing the credit report authorization form involves several straightforward steps:

- Obtain the Form: Access the credit report authorization form template from a reliable source.

- Fill in Personal Information: Provide accurate personal details as required on the form.

- Specify the Purpose: Clearly state why the credit report is being requested.

- Review the Consent Statement: Ensure that you understand the implications of granting access to your credit report.

- Sign and Date: Complete the form by signing and dating it to confirm your authorization.

Legal use of the credit report authorization

The credit report authorization form must comply with federal and state laws to be legally valid. Under the Fair Credit Reporting Act (FCRA), individuals have the right to know when their credit report is being accessed and for what purpose. It is essential for organizations to obtain explicit consent before pulling a credit report. Failure to adhere to these legal requirements can lead to penalties and legal repercussions.

How to use the credit report authorization

To use the credit report authorization form effectively, follow these guidelines:

- Provide the Form to Requesters: Once completed, submit the form to the entity requesting your credit report, such as a bank or employer.

- Keep a Copy: Retain a copy of the signed authorization for your records.

- Monitor Your Credit: After granting access, consider monitoring your credit report for any unauthorized activity.

Examples of using the credit report authorization

There are several scenarios in which a credit report authorization form is commonly used:

- Loan Applications: Lenders require authorization to assess an applicant's creditworthiness before approving loans.

- Employment Background Checks: Employers may request access to a candidate's credit report as part of the hiring process.

- Rental Applications: Landlords often require a credit report authorization to evaluate potential tenants.

Quick guide on how to complete credit report authorization

Effortlessly Prepare Credit Report Authorization on Any Device

Digital document management has become popular among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to easily locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and efficiently. Manage Credit Report Authorization across any platform using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

How to Modify and eSign Credit Report Authorization with Ease

- Obtain Credit Report Authorization and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure sensitive information with the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements within a few clicks from the device of your choice. Edit and eSign Credit Report Authorization and ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the credit report authorization

The best way to generate an eSignature for your PDF file online

The best way to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

How to create an eSignature straight from your mobile device

How to create an electronic signature for a PDF file on iOS

How to create an eSignature for a PDF document on Android devices

People also ask

-

What is a credit report authorization form?

A credit report authorization form is a document that allows a third party to access your credit report. This form is commonly used by lenders and employers to evaluate an individual's creditworthiness and background. By utilizing airSlate SignNow, you can easily create, send, and eSign your credit report authorization form securely and efficiently.

-

How does airSlate SignNow streamline the creation of a credit report authorization form?

airSlate SignNow offers a simple drag-and-drop interface for creating customizable credit report authorization forms. You can add your branding, specify the necessary fields, and ensure compliance with relevant regulations. This makes it easy for businesses to tailor their forms to meet specific needs without extensive paperwork.

-

Is there a cost associated with using airSlate SignNow for a credit report authorization form?

Yes, there is a cost associated with using airSlate SignNow, but it’s designed to be cost-effective. The pricing plans cater to various business sizes and requirements, providing excellent value for the features included, such as unlimited eSigning and access to customizable templates like the credit report authorization form.

-

What features does airSlate SignNow offer for managing credit report authorization forms?

airSlate SignNow offers a range of features for managing credit report authorization forms, including secure eSigning, real-time notifications, and document tracking. These features enhance the efficiency of the signing process, allowing you to manage all your authorization forms from one centralized platform.

-

Can I integrate airSlate SignNow with other applications for my credit report authorization form?

Yes, airSlate SignNow provides integration capabilities with various applications and tools. This means you can seamlessly link your credit report authorization form with CRM systems, document storage services, and more, making it easier to manage your workflows and document processes.

-

How does airSlate SignNow ensure the security of my credit report authorization forms?

airSlate SignNow prioritizes the security of its users’ documents, including credit report authorization forms. With encryption, secure cloud storage, and compliance with legal standards like GDPR and HIPAA, you can trust that your sensitive information is well protected when using the platform.

-

What benefits do I gain from using airSlate SignNow for credit report authorization forms?

Using airSlate SignNow for your credit report authorization forms brings numerous benefits, including faster turnaround times, reduced paperwork, and a more efficient workflow. With the ability to eSign documents from anywhere, you can enhance productivity and improve the overall experience for both clients and staff.

Get more for Credit Report Authorization

Find out other Credit Report Authorization

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later

- eSign Texas Insurance Affidavit Of Heirship Myself

- Help Me With eSign Kentucky Legal Quitclaim Deed

- eSign Louisiana Legal Limited Power Of Attorney Online

- How Can I eSign Maine Legal NDA

- eSign Maryland Legal LLC Operating Agreement Safe

- Can I eSign Virginia Life Sciences Job Description Template

- eSign Massachusetts Legal Promissory Note Template Safe

- eSign West Virginia Life Sciences Agreement Later

- How To eSign Michigan Legal Living Will

- eSign Alabama Non-Profit Business Plan Template Easy

- eSign Mississippi Legal Last Will And Testament Secure

- eSign California Non-Profit Month To Month Lease Myself

- eSign Colorado Non-Profit POA Mobile

- How Can I eSign Missouri Legal RFP