This Application Must Be Signed by at Least One Individual Who is an Owner Andor Officer of the 2019-2026

Eligibility Criteria for the BBVA Secured Business Credit Card

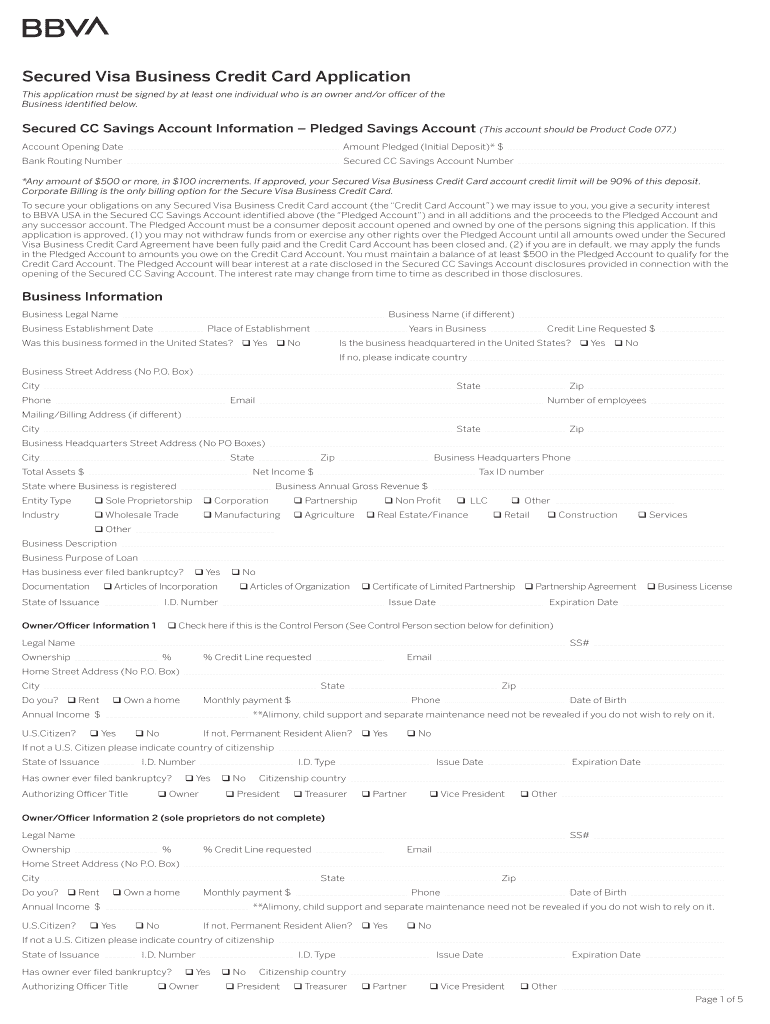

To qualify for the BBVA secured business credit card, applicants must meet specific eligibility criteria. Generally, the applicant should be a business owner or an authorized officer of the business entity applying for the card. Additionally, the business must have a valid Employer Identification Number (EIN) or Social Security Number (SSN) for sole proprietors. Creditworthiness is also assessed, which may include a review of personal credit history, particularly since this is a secured card. It is important to ensure that all information provided during the application process is accurate and up-to-date to avoid delays.

Steps to Complete the Application for the BBVA Secured Business Credit Card

Completing the application for the BBVA secured business credit card involves several key steps. First, gather all necessary documents, including your business's financial statements and identification information. Next, visit the BBVA website or your local branch to access the application form. Fill out the form carefully, ensuring that all required fields are completed accurately. After submitting the application, you may need to provide additional documentation or information as requested by BBVA. Once your application is processed, you will be notified of the approval status, which may take several days.

Required Documents for the BBVA Secured Business Credit Card Application

When applying for the BBVA secured business credit card, specific documents are required to support your application. These typically include:

- Proof of business ownership, such as incorporation documents or a business license.

- Financial statements, including profit and loss statements and balance sheets.

- Identification documents for the business owner or authorized officer, such as a driver's license or passport.

- Tax identification number, either an EIN or SSN for sole proprietors.

Having these documents ready can streamline the application process and help ensure a smooth experience.

Legal Use of the BBVA Secured Business Credit Card

The BBVA secured business credit card can be used for various business-related expenses, including purchasing supplies, paying for services, and managing cash flow. However, it is essential to use the card in compliance with the terms and conditions set forth by BBVA. Misuse of the card, such as using it for personal expenses or failing to make timely payments, can result in penalties or damage to your credit profile. Understanding the legal implications of using the card responsibly is crucial for maintaining a healthy business financial standing.

Application Process & Approval Time for the BBVA Secured Business Credit Card

The application process for the BBVA secured business credit card is designed to be straightforward. After submitting your application along with the required documents, BBVA typically processes applications within a few business days. The approval time may vary based on the completeness of your application and the need for additional information. Once approved, you will receive your card in the mail, which can then be activated for use. It's important to monitor your application status and respond promptly to any requests from BBVA to expedite the process.

Quick guide on how to complete this application must be signed by at least one individual who is an owner andor officer of the

Complete This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to modify and eSign This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The with ease

- Find This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The and click Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the this application must be signed by at least one individual who is an owner andor officer of the

The way to generate an electronic signature for your PDF document in the online mode

The way to generate an electronic signature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to create an electronic signature straight from your mobile device

The best way to make an electronic signature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF document on Android devices

People also ask

-

What is a BBVA secured business credit card?

A BBVA secured business credit card is a credit card that requires a cash deposit as collateral, making it easier for businesses to build their credit. This type of card can help you establish or improve your credit score while offering convenient purchasing power for business expenses.

-

What are the benefits of using a BBVA secured business credit card?

The BBVA secured business credit card provides various benefits including the ability to earn rewards on purchases, detailed spending tracking, and improved cash flow management. Additionally, it helps businesses build credit over time, which can lead to better financing opportunities in the future.

-

What is the pricing structure for the BBVA secured business credit card?

The pricing structure for the BBVA secured business credit card typically includes an annual fee and competitive interest rates. While fees may vary based on the specific card terms, there are no hidden costs, making it a transparent option for business owners looking to enhance their credit profile.

-

How does the BBVA secured business credit card differ from a standard business credit card?

Unlike standard business credit cards, the BBVA secured business credit card requires an upfront cash deposit that establishes your credit limit. This requirement makes it an excellent choice for businesses just starting out or those looking to rebuild their credit history.

-

Can the BBVA secured business credit card be integrated with accounting software?

Yes, the BBVA secured business credit card can be integrated with popular accounting software, simplifying expense tracking and reporting for your business. This seamless integration enhances financial management and helps maintain organized records for tax purposes.

-

Are there any rewards associated with the BBVA secured business credit card?

Yes, the BBVA secured business credit card often comes with reward programs that allow you to earn points on every purchase. These rewards can be redeemed for discounts, travel, or other business-related expenses, adding signNow value to your spending.

-

What documentation is needed to apply for a BBVA secured business credit card?

To apply for a BBVA secured business credit card, you'll typically need to provide proof of business ownership, a federal tax identification number, and personal identification. This documentation helps BBVA assess your eligibility and facilitates a smooth application process.

Get more for This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The

- Employment interview package alaska form

- Employment employee personnel file package alaska form

- Assignment of mortgage package alaska form

- Assignment of lease package alaska form

- Alaska purchase form

- Satisfaction cancellation or release of mortgage package alaska form

- Premarital agreements package alaska form

- Painting contractor package alaska form

Find out other This Application Must Be Signed By At Least One Individual Who Is An Owner Andor Officer Of The

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple

- eSign Oklahoma Sports Rental Application Easy

- eSign Missouri Courts Lease Agreement Template Mobile

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe