Form 8109 2000

What is the Form 8109

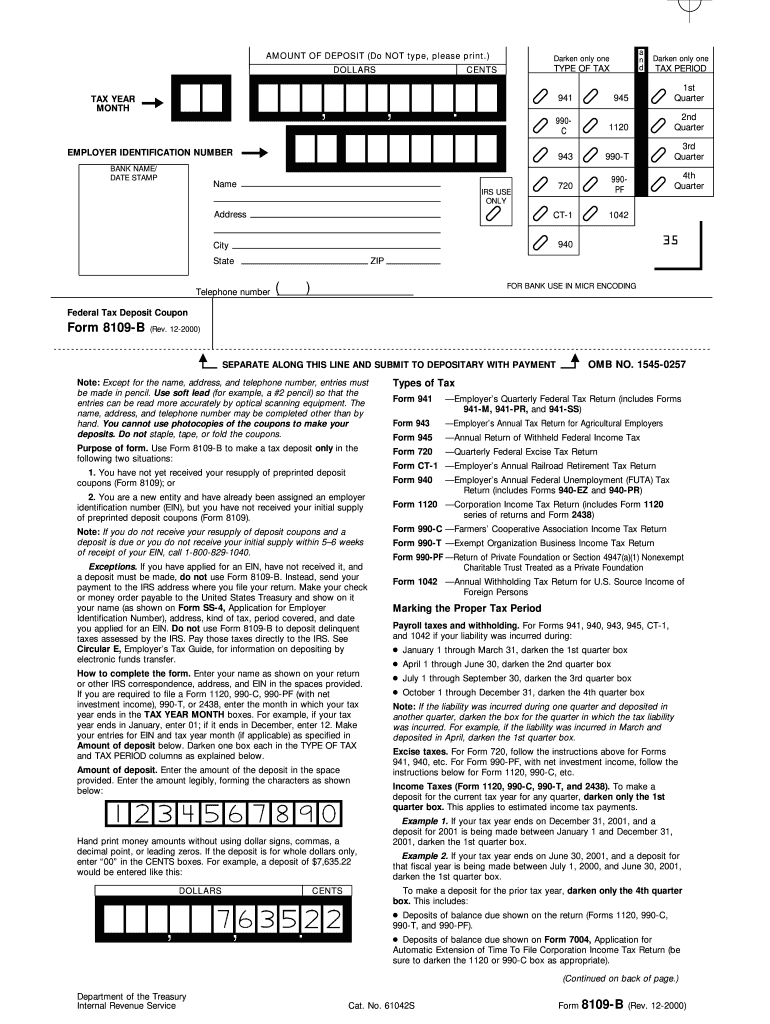

The Form 8109 is a crucial document used by businesses and individuals for various tax-related purposes in the United States. Specifically, it serves as a payment voucher for federal taxes, allowing taxpayers to submit payments directly to the Internal Revenue Service (IRS). This form is essential for ensuring that tax payments are accurately recorded and credited to the appropriate tax accounts.

How to use the Form 8109

Using the Form 8109 involves several straightforward steps. First, taxpayers need to fill out the form with accurate information, including the taxpayer's identification number and the payment amount. Next, the completed form must be submitted along with the payment, either by mail or electronically, depending on the specific instructions provided by the IRS. It is important to ensure that the form is filled out correctly to avoid any delays or issues with processing the payment.

Steps to complete the Form 8109

Completing the Form 8109 requires careful attention to detail. Here are the main steps:

- Gather necessary information, including your taxpayer identification number and payment details.

- Download the Form 8109 from the IRS website or obtain a physical copy.

- Fill out the form, ensuring all fields are completed accurately.

- Double-check the form for any errors or omissions.

- Submit the form along with your payment using the appropriate method.

Legal use of the Form 8109

The legal use of the Form 8109 is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted in accordance with the IRS guidelines. This includes adhering to deadlines and ensuring that all required information is provided. Failure to comply with these regulations may result in penalties or delays in processing payments.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8109 can vary based on the type of payment being made. It is essential to be aware of these dates to avoid penalties. Generally, payments are due on specific dates throughout the tax year, and taxpayers should consult the IRS calendar for the most accurate and up-to-date information regarding deadlines.

Who Issues the Form

The Form 8109 is issued by the Internal Revenue Service (IRS), the federal agency responsible for tax collection and enforcement in the United States. The IRS provides guidelines on how to obtain the form, complete it, and submit it for payment processing. It is crucial for taxpayers to refer to the IRS for the most current version of the form and any updates regarding its use.

Quick guide on how to complete form 8109 2000

Effortlessly Prepare Form 8109 on Any Device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal environmentally friendly option to traditional printed and signed paperwork, as you can easily locate the correct form and securely store it online. airSlate SignNow equips you with all the essentials to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8109 on any device using the airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to Edit and Electronically Sign Form 8109 with Ease

- Locate Form 8109 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or redact sensitive information using the tools specifically offered by airSlate SignNow for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click the Done button to save your modifications.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 8109 and ensure seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8109 2000

Create this form in 5 minutes!

How to create an eSignature for the form 8109 2000

How to make an electronic signature for your PDF file in the online mode

How to make an electronic signature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

The best way to create an eSignature from your smartphone

The best way to generate an electronic signature for a PDF file on iOS devices

The best way to create an eSignature for a PDF file on Android

People also ask

-

What is Form 8109 and how can airSlate SignNow help with it?

Form 8109 is a tax form used by businesses to remit payroll taxes to the IRS. airSlate SignNow simplifies the process of signing and sending Form 8109 electronically, ensuring fast delivery and secure signatures, which streamlines your tax preparation.

-

Is there a cost associated with using airSlate SignNow for Form 8109?

Yes, airSlate SignNow offers a range of pricing plans that cater to different business sizes and needs. You can choose a plan that fits your budget while ensuring easy handling of Form 8109 and other document transactions.

-

What features does airSlate SignNow offer for managing Form 8109?

airSlate SignNow provides features such as customizable templates, electronic signatures, and document tracking specifically optimized for Form 8109. This helps businesses to manage and complete their documents quickly and efficiently.

-

Can airSlate SignNow integrate with other software for better management of Form 8109?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and payroll software to streamline the handling of Form 8109. Integration simplifies the workflow, allowing you to send and track your forms without switching platforms.

-

How does airSlate SignNow ensure the security of Form 8109?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and secure cloud storage to protect your Form 8109 and other sensitive documents, ensuring your data remains confidential and compliant.

-

What are the benefits of using airSlate SignNow for Form 8109 over traditional methods?

Using airSlate SignNow for Form 8109 eliminates paper usage, reduces the risk of errors, and speeds up the submission process. Unlike traditional methods, airSlate SignNow offers convenience and improved workflow efficiency.

-

How easy is it to sign Form 8109 electronically with airSlate SignNow?

Signing Form 8109 electronically with airSlate SignNow is user-friendly and straightforward. The platform allows users to click, type, or draw their signatures, making it accessible for everyone, regardless of technical expertise.

Get more for Form 8109

- Fencing contractor package georgia form

- Hvac contractor package georgia form

- Landscaping contractor package georgia form

- Commercial contractor package georgia form

- Excavation contractor package georgia form

- Renovation contractor package georgia form

- Concrete mason contractor package georgia form

- Demolition contractor package georgia form

Find out other Form 8109

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online