Form 8109 B 1994

What is the Form 8109 B

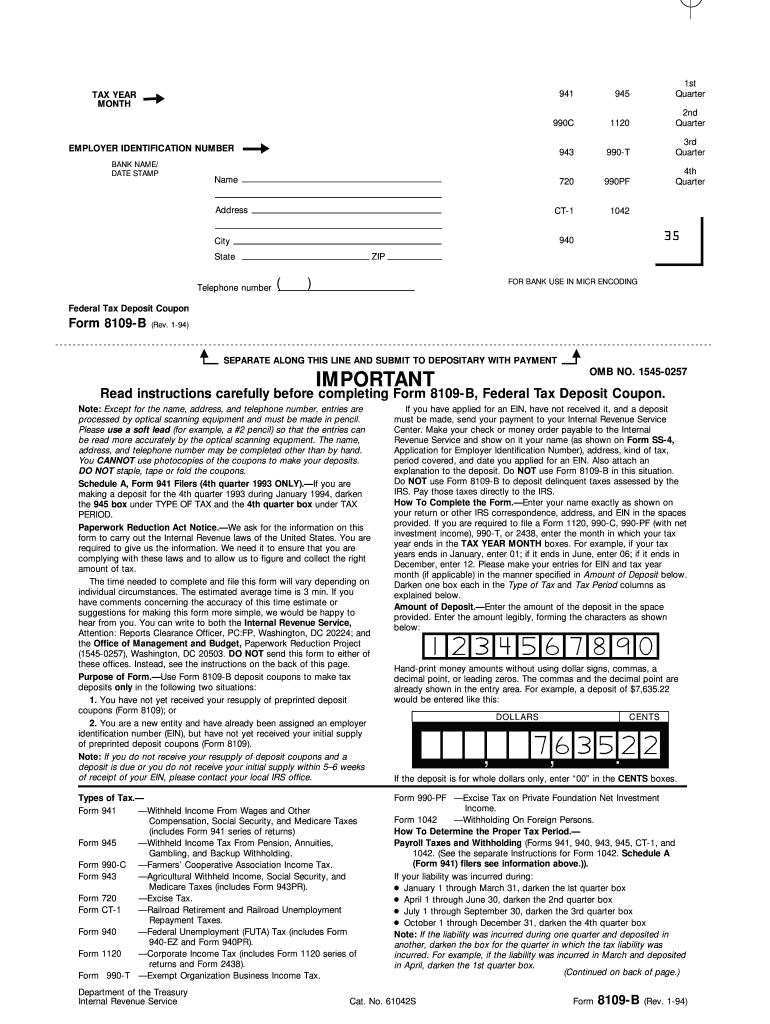

The Form 8109 B, also known as the Federal Tax Deposit Coupon, is a document used by businesses to remit federal payroll taxes. This form is essential for employers who need to make tax payments to the Internal Revenue Service (IRS). The form provides a structured way to report and pay various federal taxes, including income tax withholding, Social Security tax, and Medicare tax. Understanding the purpose of this form is crucial for maintaining compliance with federal tax regulations.

How to use the Form 8109 B

Using the Form 8109 B involves a few straightforward steps. First, ensure that you have the correct version of the form, as there may be updates or changes. Next, fill out the required information accurately, including your Employer Identification Number (EIN) and the payment amount. Once completed, the form can be submitted along with your payment to the IRS. It is advisable to keep a copy for your records as proof of payment.

Steps to complete the Form 8109 B

Completing the Form 8109 B requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website.

- Enter your EIN in the designated field.

- Indicate the payment amount clearly.

- Fill in the date of the payment.

- Review all information for accuracy before submission.

After filling out the form, ensure that it is submitted along with your payment to the IRS by the appropriate deadline.

Legal use of the Form 8109 B

The legal validity of the Form 8109 B hinges on its proper completion and timely submission. This form must be used in accordance with IRS guidelines to ensure that payments are recognized and processed correctly. Failure to comply with the requirements may result in penalties or interest charges. Therefore, it is essential to understand the legal implications of using this form and to adhere to all relevant regulations.

Form Submission Methods

The Form 8109 B can be submitted through various methods, including:

- Mail: Send the completed form along with your payment to the address specified by the IRS.

- In-Person: Deliver the form directly to an IRS office, if necessary.

Each method has its own processing times, so consider your deadlines when choosing how to submit the form.

Penalties for Non-Compliance

Non-compliance with the requirements associated with the Form 8109 B can lead to significant penalties. These may include fines for late payments, interest on unpaid amounts, and potential legal action for failure to report taxes accurately. It is important to stay informed about your obligations to avoid these consequences and ensure that your business remains in good standing with the IRS.

Quick guide on how to complete form 8109 b

Complete Form 8109 B effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, edit, and eSign your documents swiftly without delays. Manage Form 8109 B on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Form 8109 B with ease

- Obtain Form 8109 B and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive details with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Edit and eSign Form 8109 B and ensure exceptional communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 8109 b

Create this form in 5 minutes!

How to create an eSignature for the form 8109 b

How to make an eSignature for a PDF file online

How to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is Form 8109 B and how can it be used with airSlate SignNow?

Form 8109 B is a form utilized by businesses to ensure compliance with federal tax obligations. With airSlate SignNow, you can easily upload, edit, and electronically sign the Form 8109 B, streamlining the filing process and ensuring that your documents are properly managed and securely stored.

-

What features does airSlate SignNow offer for handling Form 8109 B?

airSlate SignNow provides robust features tailored for Form 8109 B, including customizable templates, secure eSigning, and a user-friendly interface. These features help you automate workflows, ensuring that you can complete and submit your Form 8109 B efficiently without the hassle of manual paperwork.

-

Is there a cost associated with using airSlate SignNow for Form 8109 B?

Yes, airSlate SignNow offers various subscription plans tailored for businesses needing to manage documents like Form 8109 B. Pricing is competitive and provides access to a comprehensive suite of features, making it a cost-effective solution for managing your documentation needs.

-

How does airSlate SignNow ensure the security of my Form 8109 B?

airSlate SignNow employs advanced encryption and security measures to protect your documents, including Form 8109 B. With features like audit trails and secure cloud storage, you can rest assured that your sensitive information is kept safe from unauthorized access.

-

Can I integrate airSlate SignNow with other applications to streamline Form 8109 B processing?

Absolutely! airSlate SignNow seamlessly integrates with popular business applications, making it easier to manage your Form 8109 B alongside other important documents. Integrating with the tools your team already uses enhances productivity and keeps your workflow efficient.

-

What are the benefits of using airSlate SignNow for Form 8109 B?

Using airSlate SignNow for Form 8109 B offers numerous benefits, including increased efficiency, reduced paperwork, and improved accuracy in handling tax documents. The easy eSigning process allows for faster approvals, helping your business stay compliant without the stress of traditional methods.

-

How do I get started with airSlate SignNow for Form 8109 B?

Getting started with airSlate SignNow for Form 8109 B is quick and easy. Simply create an account, upload your template for Form 8109 B, and begin customizing your document for eSigning. The intuitive platform guides you through each step, making the process seamless.

Get more for Form 8109 B

- Quitclaim deed from corporation to husband and wife illinois form

- Warranty deed from corporation to husband and wife illinois form

- Il release form

- Illinois lien mechanic form

- Quitclaim deed from corporation to individual illinois form

- Illinois warranty deed form

- Illinois partial form

- Quitclaim deed from corporation to llc illinois form

Find out other Form 8109 B

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now

- eSignature North Carolina Police Claim Secure

- eSignature New York Police Notice To Quit Free

- eSignature North Dakota Real Estate Quitclaim Deed Later

- eSignature Minnesota Sports Rental Lease Agreement Free

- eSignature Minnesota Sports Promissory Note Template Fast

- eSignature Minnesota Sports Forbearance Agreement Online

- eSignature Oklahoma Real Estate Business Plan Template Free

- eSignature South Dakota Police Limited Power Of Attorney Online

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement