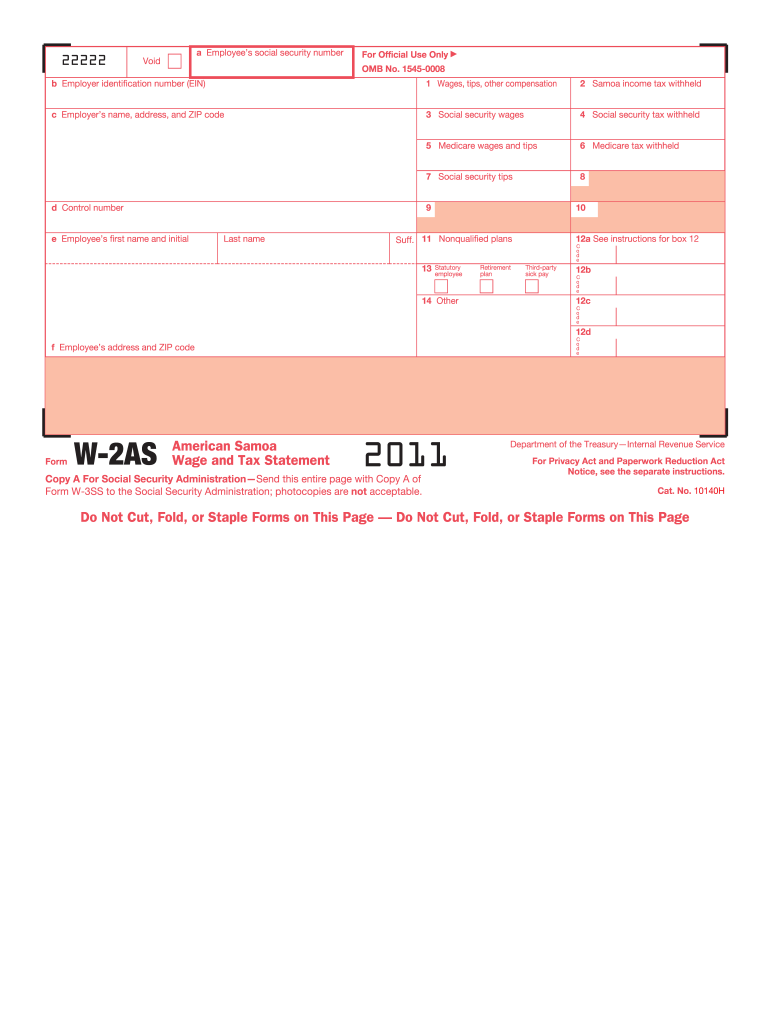

W 2as Form 2011

What is the W-2AS Form

The W-2AS Form is a tax document used in the United States, specifically for reporting income earned by employees working in American Samoa. This form is essential for both employers and employees, as it provides a summary of wages paid and taxes withheld during the year. The W-2AS Form is similar to the standard W-2 form but includes specific information pertinent to the unique tax situation in American Samoa, such as local tax rates and deductions.

How to use the W-2AS Form

To use the W-2AS Form effectively, employers must complete it accurately at the end of the tax year. This involves entering the employee's total earnings, the amount of federal and local taxes withheld, and other relevant information. Employees should then use the completed form to file their federal and local tax returns. It is crucial for both parties to ensure that the information is correct to avoid issues with the Internal Revenue Service (IRS) or local tax authorities.

Steps to complete the W-2AS Form

Completing the W-2AS Form involves several key steps:

- Gather necessary information, including employee details and payroll records.

- Fill in the employee's name, address, and Social Security number.

- Report total wages paid in the appropriate box.

- Indicate the amount of federal income tax withheld.

- Include any local taxes withheld specific to American Samoa.

- Distribute copies of the completed form to the employee and the IRS.

Legal use of the W-2AS Form

The W-2AS Form is legally binding and must be used in accordance with IRS regulations. Employers are required to provide this form to their employees by January thirty-first of each year. Failure to comply with these regulations can result in penalties, including fines for both employers and employees. It is essential to ensure that the form is filled out correctly to maintain compliance with federal and local tax laws.

Key elements of the W-2AS Form

The W-2AS Form includes several key elements that are crucial for accurate reporting:

- Employee information: Name, address, and Social Security number.

- Employer information: Name and Employer Identification Number (EIN).

- Wages: Total earnings for the year.

- Federal tax withheld: Amount deducted for federal income tax.

- Local tax withheld: Specific amounts withheld for local taxes in American Samoa.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the W-2AS Form. Employers must provide the completed form to employees by January thirty-first. Additionally, the form must be submitted to the IRS by the end of February if filing by paper, or by March thirty-first if filing electronically. Being aware of these deadlines helps ensure compliance and avoids potential penalties.

Quick guide on how to complete 2011 w 2as form

Effortlessly Prepare W 2as Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers a fantastic environmentally friendly alternative to conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Manage W 2as Form on any device using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and eSign W 2as Form Effortlessly

- Obtain W 2as Form and click Get Form to begin.

- Employ the tools we provide to fill out your form.

- Mark relevant sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Edit and eSign W 2as Form while ensuring outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2011 w 2as form

Create this form in 5 minutes!

How to create an eSignature for the 2011 w 2as form

The way to generate an electronic signature for your PDF in the online mode

The way to generate an electronic signature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

How to create an electronic signature from your smart phone

The best way to make an electronic signature for a PDF on iOS devices

How to create an electronic signature for a PDF file on Android OS

People also ask

-

What is a W 2as Form and why is it important?

The W 2as Form is a crucial tax document that reports an employee's annual wages and the amount of taxes withheld. It's important for both employers and employees as it provides necessary information for tax filing. Using airSlate SignNow, businesses can easily create, send, and eSign W 2as Forms to ensure compliance and accuracy.

-

How can airSlate SignNow help with W 2as Forms?

airSlate SignNow simplifies the process of managing W 2as Forms by allowing users to send, receive, and eSign documents securely and efficiently. This platform ensures that all documents are stored safely and can be accessed anytime. With its user-friendly interface, you can streamline your payroll processes related to W 2as Forms.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans tailored to different business needs, including options for small businesses and larger enterprises. Each plan includes features that enhance document management and eSigning, including for W 2as Forms. Visit our pricing page to find the plan that best suits your requirements.

-

Can I integrate airSlate SignNow with other software?

Yes, airSlate SignNow offers seamless integrations with popular software applications. This allows you to automate workflows involving W 2as Forms and other documents. By integrating with your existing systems, you can enhance efficiency and reduce manual errors while managing important tax documents.

-

Is airSlate SignNow secure for handling sensitive documents like W 2as Forms?

Absolutely! airSlate SignNow prioritizes security within its platform. We implement robust encryption methods and compliance measures to safeguard sensitive documents, including W 2as Forms. You can have peace of mind knowing that your data is securely protected while using our services.

-

What features does airSlate SignNow offer for managing W 2as Forms?

With airSlate SignNow, you can benefit from features such as document templates, automated workflows, and advanced tracking options specifically for W 2as Forms. These features streamline the eSignature process and help ensure that all necessary fields are filled correctly. It greatly minimizes the chances of errors or delays in processing.

-

Can I use airSlate SignNow for sending multiple W 2as Forms at once?

Yes, airSlate SignNow supports the bulk sending of W 2as Forms, making it easy for employers to distribute these critical tax documents to their employees. This bulk feature saves time by allowing you to send multiple documents simultaneously while ensuring each one is properly eSigned. It’s particularly useful during tax season.

Get more for W 2as Form

- District of columbia property management package district of columbia form

- Sample operating agreement for professional limited liability company pllc district of columbia form

- Pllc notices and resolutions district of columbia form

- Sample transmittal letter document form

- New resident guide district of columbia form

- Satisfaction release or cancellation of deed of trust by corporation district of columbia form

- Satisfaction release or cancellation of deed of trust by individual district of columbia form

- Partial release of property from deed of trust for corporation district of columbia form

Find out other W 2as Form

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document