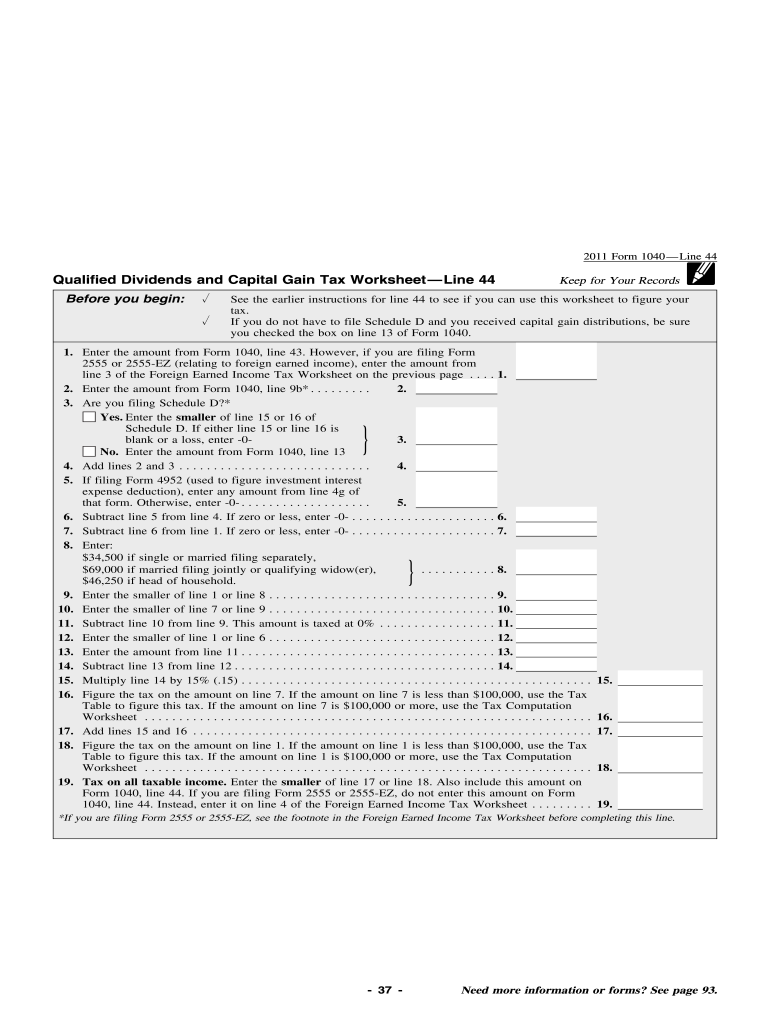

Irs Capital Gains Worksheet Form 2011

What is the Irs Capital Gains Worksheet Form

The Irs Capital Gains Worksheet Form is a tax document used by individuals and businesses to calculate capital gains or losses from the sale of assets. This form helps taxpayers report their gains or losses accurately, ensuring compliance with IRS regulations. It is essential for determining the taxable amount when selling properties, stocks, or other investments. Understanding this form is crucial for proper tax filing and financial planning.

How to use the Irs Capital Gains Worksheet Form

Using the Irs Capital Gains Worksheet Form involves several steps. First, gather all relevant information regarding the assets sold, including purchase price, selling price, and any associated costs. Next, fill in the required sections of the form, detailing each transaction clearly. Be sure to calculate the total gains or losses accurately, as this will affect your overall tax liability. Once completed, the form should be submitted along with your tax return.

Steps to complete the Irs Capital Gains Worksheet Form

Completing the Irs Capital Gains Worksheet Form requires careful attention to detail. Here are the steps to follow:

- Gather documentation for each asset sold, including purchase and sale records.

- Calculate the adjusted basis for each asset, which includes the purchase price plus any improvements.

- Determine the selling price for each asset, subtracting any selling expenses.

- Calculate the gain or loss for each transaction by subtracting the adjusted basis from the selling price.

- Transfer the totals to the appropriate sections of the worksheet.

- Review the completed form for accuracy before submission.

Legal use of the Irs Capital Gains Worksheet Form

The Irs Capital Gains Worksheet Form is legally binding when completed accurately and submitted according to IRS guidelines. It is essential to ensure that all information provided is truthful and reflects actual financial transactions. Failure to comply with IRS regulations can lead to penalties or audits. Therefore, maintaining accurate records and understanding the legal implications of the form is crucial for taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Irs Capital Gains Worksheet Form align with the general tax filing deadlines set by the IRS. Typically, individual taxpayers must submit their tax returns by April 15 each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is important to check for any updates or changes in deadlines each tax year to avoid late filing penalties.

Examples of using the Irs Capital Gains Worksheet Form

Examples of using the Irs Capital Gains Worksheet Form include scenarios such as selling a home, stocks, or business assets. For instance, if an individual sells a property for $300,000 that was purchased for $200,000, they would report the $100,000 gain on the worksheet. Similarly, if stocks were bought for $5,000 and sold for $8,000, the $3,000 gain would be documented. Each example highlights the importance of accurately reporting gains or losses for tax purposes.

Quick guide on how to complete irs capital gains worksheet 2011 form

Effortlessly Prepare Irs Capital Gains Worksheet Form on Any Device

The management of online documents has gained traction among businesses and individuals alike. It serves as an ideal environmentally-friendly substitute for conventional printed and signed paperwork, as you can easily locate the necessary form and securely archive it online. airSlate SignNow provides all the tools necessary for you to create, modify, and eSign your documents swiftly without delays. Manage Irs Capital Gains Worksheet Form on any device using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to Alter and eSign Irs Capital Gains Worksheet Form with Ease

- Find Irs Capital Gains Worksheet Form and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark relevant sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, and errors that require new document copies. airSlate SignNow fulfills your document management needs with just a few clicks from any device of your choice. Modify and eSign Irs Capital Gains Worksheet Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs capital gains worksheet 2011 form

Create this form in 5 minutes!

How to create an eSignature for the irs capital gains worksheet 2011 form

The way to generate an eSignature for a PDF in the online mode

The way to generate an eSignature for a PDF in Chrome

How to create an eSignature for putting it on PDFs in Gmail

How to generate an eSignature right from your smart phone

The way to create an eSignature for a PDF on iOS devices

How to generate an eSignature for a PDF on Android OS

People also ask

-

What is the Irs Capital Gains Worksheet Form, and why do I need it?

The Irs Capital Gains Worksheet Form is a crucial document for calculating capital gains or losses on the sale of assets. It helps you accurately report your financial gains when filing your taxes, ensuring compliance with IRS guidelines. By using this form, you can simplify your tax filing process and potentially reduce your taxable income.

-

How can airSlate SignNow help in filling out the Irs Capital Gains Worksheet Form?

airSlate SignNow offers an intuitive platform that allows you to easily complete the Irs Capital Gains Worksheet Form digitally. With features like document templates and eSigning, you can streamline the process of preparing and submitting your tax forms. This efficiency can save you time and minimize errors in data entry.

-

Is there a cost associated with using airSlate SignNow for the Irs Capital Gains Worksheet Form?

Yes, airSlate SignNow operates on a subscription-based model, which varies based on the features you choose. However, the cost is competitive and includes access to tools for eSigning, document management, and template creation. This investment can be worthwhile for ensuring your Irs Capital Gains Worksheet Form is completed accurately and efficiently.

-

What are the key features of airSlate SignNow that benefit users preparing the Irs Capital Gains Worksheet Form?

Key features of airSlate SignNow include customizable document templates, electronic signatures, and secure cloud storage. These tools simplify the process of preparing and signing the Irs Capital Gains Worksheet Form, making it easier to gather necessary information and collaborate with your tax advisor. You'll benefit from enhanced accuracy and efficiency.

-

Can I integrate airSlate SignNow with other software for managing the Irs Capital Gains Worksheet Form?

Yes, airSlate SignNow offers multiple integrations with popular software such as CRM systems, cloud storage services, and accounting tools. This allows for seamless data transfer and better management of your documents related to the Irs Capital Gains Worksheet Form. These integrations help ensure you keep comprehensive records for your tax reporting.

-

How does using airSlate SignNow enhance the security of my Irs Capital Gains Worksheet Form?

airSlate SignNow is committed to security, incorporating advanced encryption and secure data storage protocols. By using this platform for your Irs Capital Gains Worksheet Form, you can rest assured that your sensitive financial information is protected from unauthorized access. Additionally, the audit trail feature allows you to track all interactions with your documents for added peace of mind.

-

Is there customer support available if I have questions about the Irs Capital Gains Worksheet Form?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any questions or concerns regarding the Irs Capital Gains Worksheet Form. You can signNow out via multiple channels, ensuring you get the help you need promptly. This support aims to empower you in making the most of your document management.

Get more for Irs Capital Gains Worksheet Form

- Legal last will and testament form for a widow or widower with adult and minor children district of columbia

- Legal last will and testament form for divorced and remarried person with mine yours and ours children district of columbia

- Dc will form

- Written revocation of will district of columbia form

- Last will and testament for other persons district of columbia form

- Notice to beneficiaries of being named in will district of columbia form

- Estate planning questionnaire and worksheets district of columbia form

- Document locator and personal information package including burial information form district of columbia

Find out other Irs Capital Gains Worksheet Form

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple