Form 8825 1120s 2000

What is the Form 8s

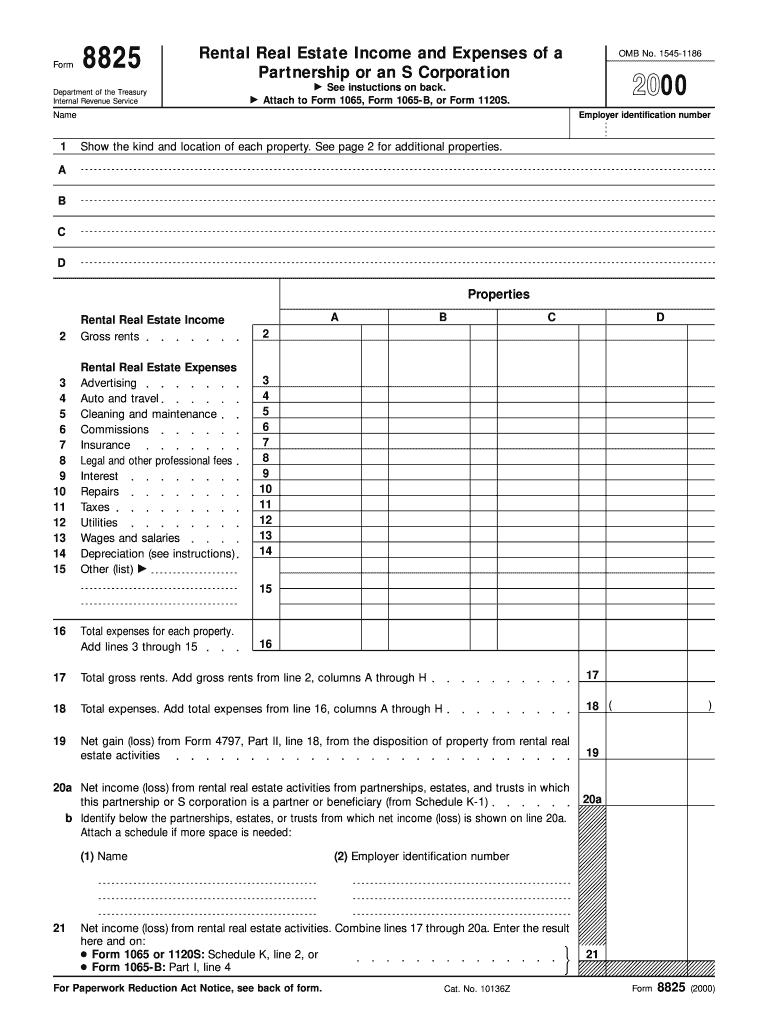

The Form 8825 is a tax document used by S corporations to report income and expenses from rental real estate activities. This form is essential for S corporations that own rental properties, as it allows them to detail their income, deductions, and expenses related to these properties. The information reported on Form 8825 is then used to calculate the corporation's taxable income and is ultimately included in the shareholders' individual tax returns. Understanding this form is crucial for compliance with IRS regulations and for optimizing tax liabilities.

How to use the Form 8s

To effectively use Form 8825, S corporations must first gather all relevant financial information regarding their rental properties. This includes income received from tenants, operating expenses, depreciation, and any other costs associated with property management. Once the data is collected, it can be entered into the appropriate sections of the form. Each rental property should be reported separately, allowing for a clear breakdown of income and expenses. After completing the form, it should be reviewed for accuracy before submission, ensuring all information aligns with supporting documentation.

Steps to complete the Form 8s

Completing Form 8825 involves several key steps:

- Gather financial records related to rental properties, including income statements and expense receipts.

- Fill out the identification section with the S corporation's name, address, and Employer Identification Number (EIN).

- List each rental property separately, detailing income received and expenses incurred for each property.

- Calculate the total income and total expenses for all properties, and determine the net income or loss.

- Review the completed form for accuracy and completeness.

- File the form with the S corporation's tax return, ensuring it is submitted by the appropriate deadline.

Legal use of the Form 8s

Form 8825 must be used in accordance with IRS regulations to ensure its legal validity. The form serves as an official record of the S corporation's rental income and expenses, which can be subject to audits by the IRS. To maintain compliance, it is essential that all information reported is accurate and supported by appropriate documentation. Additionally, the form must be filed timely to avoid penalties. Understanding the legal implications of this form can help S corporations manage their tax obligations effectively.

Key elements of the Form 8s

Form 8825 contains several key elements that are important for accurate reporting:

- Property Identification: Each rental property must be clearly identified, including its address.

- Income Reporting: All rental income received must be reported, including any advance payments.

- Expense Categories: Expenses must be categorized appropriately, including repairs, maintenance, and management fees.

- Depreciation: Any depreciation taken on the properties must be calculated and reported.

- Net Income Calculation: The form culminates in a calculation of net income or loss from the rental activities.

Filing Deadlines / Important Dates

Form 8825 must be filed in conjunction with the S corporation's tax return, typically due on March 15 for calendar-year filers. If an extension is filed, the deadline may be extended to September 15. It is important for S corporations to be aware of these deadlines to avoid late filing penalties. Additionally, any changes in tax laws or IRS regulations may impact filing requirements, so staying informed is essential.

Quick guide on how to complete 2000 form 8825 1120s

Effortlessly Prepare Form 8825 1120s on Any Device

Digital document management has become increasingly favored by companies and individuals. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and safely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly and without hassle. Manage Form 8825 1120s on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The Easiest Method to Edit and Electronically Sign Form 8825 1120s with Ease

- Obtain Form 8825 1120s and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Decide how you want to send your form, whether via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 8825 1120s and ensure efficient communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2000 form 8825 1120s

Create this form in 5 minutes!

How to create an eSignature for the 2000 form 8825 1120s

How to create an eSignature for your PDF document online

How to create an eSignature for your PDF document in Google Chrome

The best way to make an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature from your smart phone

How to generate an electronic signature for a PDF document on iOS

The best way to generate an eSignature for a PDF file on Android OS

People also ask

-

What is Form 8825 1120s and why is it important?

Form 8825 1120s is a tax form used by partnerships and S Corporations to report income, deductions, and credits related to rental real estate activities. Understanding and filing Form 8825 1120s accurately is crucial for tax compliance and can aid in maximizing potential tax benefits related to real estate investments.

-

How can airSlate SignNow help with completing Form 8825 1120s?

airSlate SignNow provides tools that simplify the process of preparing and eSigning documents like Form 8825 1120s. With its user-friendly interface, you can easily fill out, sign, and manage your documents, ensuring you stay compliant and organized during tax season.

-

What features does airSlate SignNow offer for managing Form 8825 1120s?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and eSigning capabilities tailored for Form 8825 1120s. These features not only streamline the process but also enhance document security and collaboration among partners or stakeholders.

-

Is airSlate SignNow a cost-effective solution for preparing Form 8825 1120s?

Yes, airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. By using our platform to manage Form 8825 1120s, you'll reduce paperwork costs and save time, leading to a more efficient tax filing process.

-

What integrations does airSlate SignNow offer for Form 8825 1120s?

airSlate SignNow integrates seamlessly with various accounting and productivity tools, enhancing your workflow when preparing Form 8825 1120s. These integrations allow for easy import of necessary financial data, reducing errors and ensuring accuracy in your tax filings.

-

Can I store my completed Form 8825 1120s securely with airSlate SignNow?

Absolutely! airSlate SignNow ensures your completed Form 8825 1120s are stored securely in encrypted cloud storage. This not only protects sensitive information but also allows for easy access whenever you need to review or share your documents.

-

How does airSlate SignNow enhance collaboration for Form 8825 1120s?

With airSlate SignNow, multiple users can collaborate in real-time on Form 8825 1120s. This feature enables stakeholders to review and sign documents quickly, ensuring that everyone involved stays informed and aligned throughout the process.

Get more for Form 8825 1120s

Find out other Form 8825 1120s

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself