Form 730 Rev January Monthly Tax Return for Wagers 2008

What is the Form 730 Rev January Monthly Tax Return For Wagers

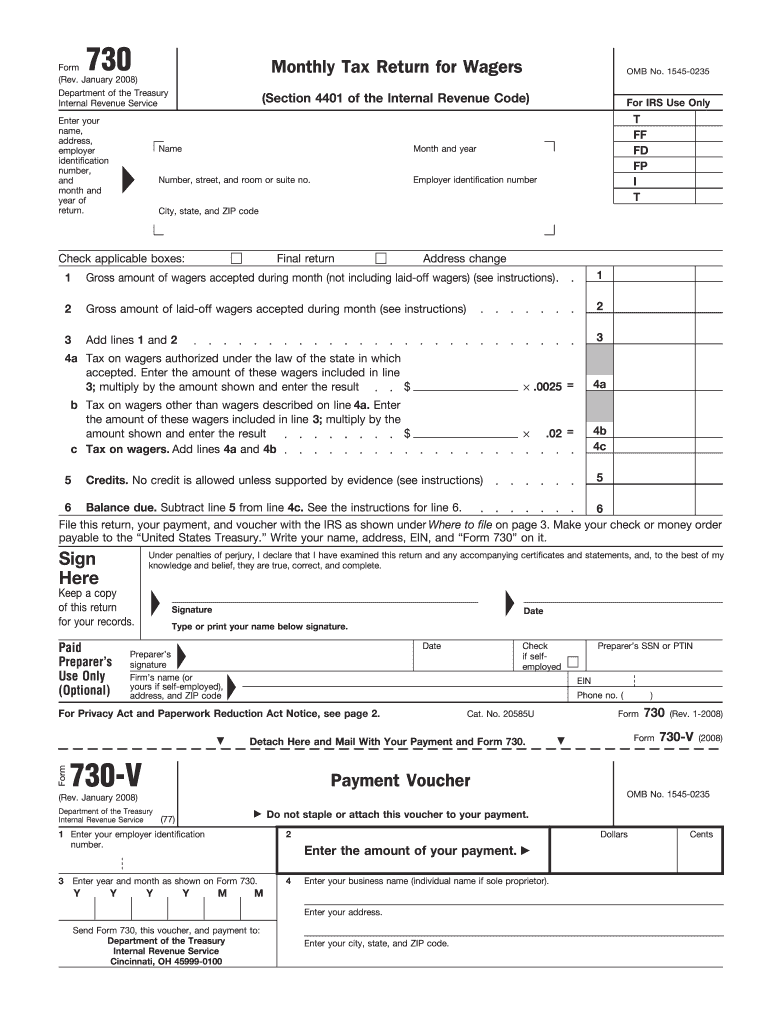

The Form 730 Rev January Monthly Tax Return For Wagers is a tax document used by businesses and individuals to report and pay federal excise taxes on wagers. This form is specifically designed for those engaged in wagering activities, such as casinos and sports betting establishments. It helps ensure compliance with the Internal Revenue Service (IRS) regulations regarding gambling activities. The form must be submitted monthly, reflecting the total amount of wagers made during the reporting period.

How to use the Form 730 Rev January Monthly Tax Return For Wagers

Using the Form 730 Rev January Monthly Tax Return For Wagers involves several steps. First, gather all relevant financial information related to wagers for the month. This includes total wagers, winnings, and any applicable deductions. Next, accurately fill out the form, ensuring that all figures are correct and correspond to the reporting period. Once completed, the form can be submitted electronically or via mail, depending on your preference and compliance requirements.

Steps to complete the Form 730 Rev January Monthly Tax Return For Wagers

Completing the Form 730 Rev January Monthly Tax Return For Wagers involves a series of clear steps:

- Gather all necessary financial records related to wagers for the month.

- Fill in your business information, including name, address, and Employer Identification Number (EIN).

- Calculate the total wagers made during the reporting period.

- Determine the total amount of excise tax owed based on the wagers reported.

- Review the form for accuracy before submission.

- Submit the completed form either electronically or by mail to the IRS.

Legal use of the Form 730 Rev January Monthly Tax Return For Wagers

The legal use of the Form 730 Rev January Monthly Tax Return For Wagers is crucial for compliance with federal tax laws. This form must be filed accurately and on time to avoid penalties. It serves as an official record of wagering activities and the associated taxes owed. Businesses must retain copies of submitted forms and supporting documents for their records, as they may be required for audits or other legal inquiries.

Filing Deadlines / Important Dates

Filing deadlines for the Form 730 Rev January Monthly Tax Return For Wagers are typically set by the IRS. The form must be submitted by the last day of the month following the reporting period. For example, the January return is due by the end of February. It is essential to stay informed about any changes to deadlines or requirements to ensure timely compliance and avoid potential penalties.

Penalties for Non-Compliance

Failure to file the Form 730 Rev January Monthly Tax Return For Wagers on time can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the duration of the delay. Additionally, non-compliance can lead to increased scrutiny during audits and potential legal repercussions. It is vital for businesses to understand these risks and prioritize timely and accurate filing to maintain compliance with federal regulations.

Quick guide on how to complete form 730 rev january 2008 monthly tax return for wagers

Effortlessly Manage Form 730 Rev January Monthly Tax Return For Wagers on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly and without interruptions. Handle Form 730 Rev January Monthly Tax Return For Wagers on any device using airSlate SignNow's Android or iOS applications and enhance your document workflow today.

How to Edit and Electronically Sign Form 730 Rev January Monthly Tax Return For Wagers with Ease

- Obtain Form 730 Rev January Monthly Tax Return For Wagers and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Select pertinent sections of the documents or redact sensitive information using the features that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Decide how you want to send your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or inaccuracies that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Form 730 Rev January Monthly Tax Return For Wagers and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 730 rev january 2008 monthly tax return for wagers

Create this form in 5 minutes!

How to create an eSignature for the form 730 rev january 2008 monthly tax return for wagers

How to generate an eSignature for your PDF in the online mode

How to generate an eSignature for your PDF in Chrome

How to generate an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature straight from your smart phone

The best way to create an electronic signature for a PDF on iOS devices

The best way to make an eSignature for a PDF document on Android OS

People also ask

-

What is Form 730 Rev January Monthly Tax Return For Wagers?

Form 730 Rev January Monthly Tax Return For Wagers is a necessary form for businesses involved in wagering to report and pay their federal excise tax. This form must be filed monthly to remain compliant with IRS regulations, ensuring that your business stays in good standing.

-

How does airSlate SignNow facilitate the completion of Form 730 Rev January Monthly Tax Return For Wagers?

airSlate SignNow provides a streamlined platform that simplifies the process of filling out and submitting Form 730 Rev January Monthly Tax Return For Wagers. With customizable templates and easy access to e-signature capabilities, you can complete your tax returns efficiently and securely.

-

What are the pricing options for using airSlate SignNow to file Form 730 Rev January Monthly Tax Return For Wagers?

airSlate SignNow offers flexible pricing plans tailored to businesses of various sizes, allowing you to choose the best option for your needs. From individual plans to team solutions, you can find an affordable strategy that includes features for efficiently managing Form 730 Rev January Monthly Tax Return For Wagers.

-

Can I integrate airSlate SignNow with other software for filing Form 730 Rev January Monthly Tax Return For Wagers?

Yes, airSlate SignNow seamlessly integrates with various software solutions, enhancing your ability to manage financial documentation, including Form 730 Rev January Monthly Tax Return For Wagers. This integration capability ensures a smooth workflow, allowing you to connect your existing tools effortlessly.

-

What benefits does airSlate SignNow provide for businesses submitting Form 730 Rev January Monthly Tax Return For Wagers?

One of the primary benefits of using airSlate SignNow for Form 730 Rev January Monthly Tax Return For Wagers is the ease of use and time savings. The platform offers features that simplify document management, allowing you to focus more on your business operations rather than paperwork.

-

Is airSlate SignNow secure for submitting sensitive tax documents like Form 730 Rev January Monthly Tax Return For Wagers?

Absolutely. airSlate SignNow employs advanced security measures, including encryption and secure servers, to protect sensitive documents such as Form 730 Rev January Monthly Tax Return For Wagers. You can trust that your data is safe while using our platform.

-

How can I track the status of my Form 730 Rev January Monthly Tax Return For Wagers submitted through airSlate SignNow?

With airSlate SignNow, you can easily track the status of your submitted Form 730 Rev January Monthly Tax Return For Wagers directly through the platform. You'll receive notifications and updates regarding any changes, ensuring you are always informed about your submission.

Get more for Form 730 Rev January Monthly Tax Return For Wagers

Find out other Form 730 Rev January Monthly Tax Return For Wagers

- Sign South Carolina Letter of Intent Later

- Sign Texas Hold Harmless (Indemnity) Agreement Computer

- Sign Connecticut Quitclaim Deed Free

- Help Me With Sign Delaware Quitclaim Deed

- How To Sign Arkansas Warranty Deed

- How Can I Sign Delaware Warranty Deed

- Sign California Supply Agreement Checklist Online

- How Can I Sign Georgia Warranty Deed

- Sign Maine Supply Agreement Checklist Computer

- Sign North Dakota Quitclaim Deed Free

- Sign Oregon Quitclaim Deed Simple

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple