Form 1120 Schedule G 2010

What is the Form 1120 Schedule G

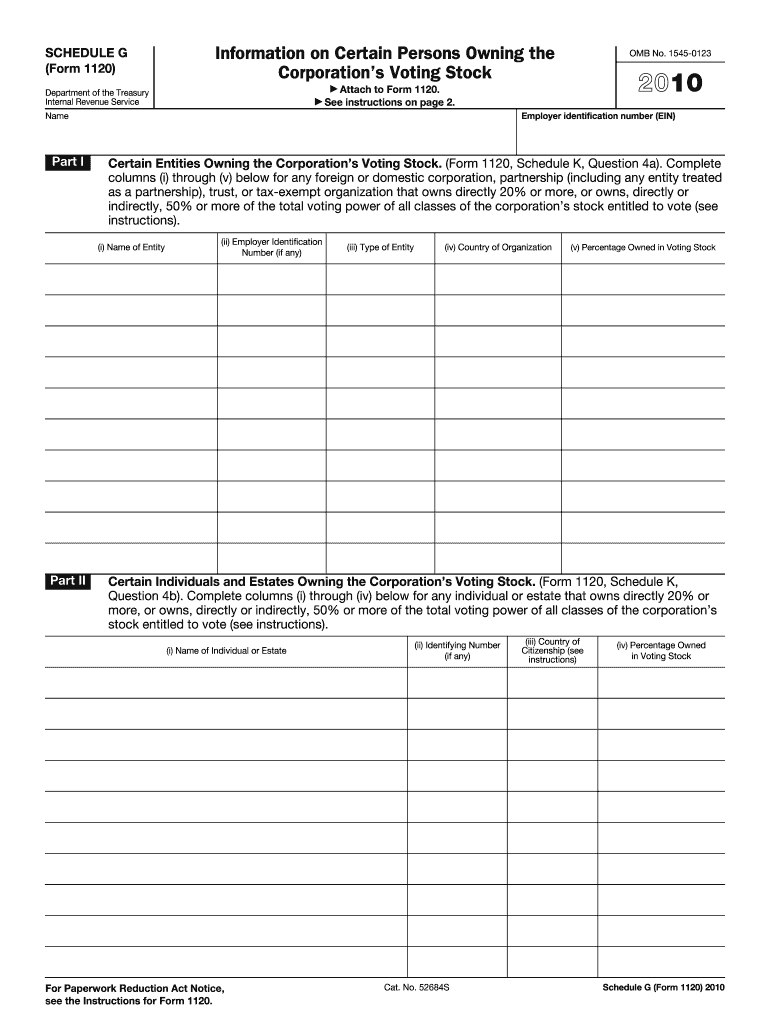

The Form 1120 Schedule G is a supplementary form used by corporations to report information regarding their activities, including details on their shareholders and stock ownership. This form is essential for ensuring compliance with the Internal Revenue Service (IRS) regulations, particularly for corporations that have made certain elections or have specific reporting requirements. It helps the IRS understand the structure and ownership of the corporation, which is crucial for tax purposes.

How to use the Form 1120 Schedule G

To effectively use the Form 1120 Schedule G, corporations must accurately fill out the required sections, which include information about shareholders, stock classes, and any changes in stock ownership during the tax year. It is important to ensure that all information is current and reflects the corporation's status as of the end of the tax year. This form must be attached to the corporation's main Form 1120 when filed, ensuring that the IRS has a complete picture of the corporation's financial and ownership structure.

Steps to complete the Form 1120 Schedule G

Completing the Form 1120 Schedule G involves several key steps:

- Gather necessary information about the corporation's shareholders, including names, addresses, and ownership percentages.

- Identify the different classes of stock issued by the corporation and their respective rights.

- Document any changes in stock ownership that occurred during the tax year.

- Complete the form by entering the gathered information into the appropriate fields.

- Review the form for accuracy and completeness before submission.

Legal use of the Form 1120 Schedule G

The legal use of the Form 1120 Schedule G is governed by IRS regulations. It must be filed accurately to avoid penalties and ensure compliance with tax laws. The information provided on this form is used by the IRS to verify the corporation's tax obligations and shareholder structure. Filing this form is not only a legal requirement but also a crucial aspect of maintaining transparency and accountability in corporate governance.

Filing Deadlines / Important Dates

The filing deadline for the Form 1120 Schedule G coincides with the due date for the corporation's main Form 1120, which is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April fifteenth. If the corporation requires an extension, it is essential to file Form 7004 to obtain additional time, ensuring that the Schedule G is also submitted within the extended timeframe.

Form Submission Methods (Online / Mail / In-Person)

Corporations can submit the Form 1120 Schedule G through various methods. The preferred method is electronic filing, which can be done through authorized e-file providers. This method is secure and allows for quicker processing. Alternatively, corporations may choose to mail the completed form to the appropriate IRS address based on their location. In-person submissions are generally not accepted for tax forms, making electronic and mail submissions the primary options.

Quick guide on how to complete 2010 form 1120 schedule g

Accomplish Form 1120 Schedule G effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents swiftly and seamlessly. Control Form 1120 Schedule G on any device with airSlate SignNow apps for Android or iOS, and enhance any document-focused task today.

Ways to modify and electronically sign Form 1120 Schedule G easily

- Locate Form 1120 Schedule G and click on Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or mislaid documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from any device of your choice. Edit and electronically sign Form 1120 Schedule G to guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 form 1120 schedule g

Create this form in 5 minutes!

How to create an eSignature for the 2010 form 1120 schedule g

How to generate an eSignature for your PDF file online

How to generate an eSignature for your PDF file in Google Chrome

How to make an eSignature for signing PDFs in Gmail

The best way to make an eSignature straight from your mobile device

The best way to create an electronic signature for a PDF file on iOS

The best way to make an eSignature for a PDF document on Android devices

People also ask

-

What is Form 1120 Schedule G?

Form 1120 Schedule G is an essential document that corporations must file with their annual tax return to disclose information about their corporate officers and directors. It helps the IRS understand the corporate structure and governance, ensuring compliance with federal regulations. Properly completing Form 1120 Schedule G is crucial for businesses to avoid penalties.

-

How can airSlate SignNow help with completing Form 1120 Schedule G?

airSlate SignNow provides an intuitive platform for businesses to create, send, and eSign documents like Form 1120 Schedule G. With its user-friendly interface, you can easily fill out the form electronically and ensure all necessary details are included. This streamlines the filing process and minimizes the risk of errors.

-

Is there a cost associated with using airSlate SignNow for Form 1120 Schedule G?

Yes, airSlate SignNow offers a variety of pricing plans tailored to different business needs, including features for completing Form 1120 Schedule G. Whether you're a small business or a large corporation, you’ll find a cost-effective solution that fits your budget. Pricing typically depends on the number of users and volume of documents.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers robust features for document management, including customizable templates, secure eSigning, and real-time tracking of document status. These features are particularly beneficial when handling important forms like Form 1120 Schedule G, allowing you to manage your documents efficiently and securely. Additionally, the platform ensures compliance with industry standards.

-

Can I integrate airSlate SignNow with other software for Form 1120 Schedule G?

Yes, airSlate SignNow allows seamless integration with a variety of software systems, enhancing your workflow for completing Form 1120 Schedule G. Whether you’re using accounting software or CRM systems, these integrations enable easy access to relevant data, streamlining the entire process. This flexibility enhances productivity for your business.

-

What are the benefits of eSigning Form 1120 Schedule G using airSlate SignNow?

ESigning Form 1120 Schedule G through airSlate SignNow offers numerous advantages, such as increased speed, enhanced security, and reduced paperwork. Electronic signatures are legally binding and recognized by the IRS, making it a reliable choice for businesses. This method also facilitates quick updates and adjustments to the form without the hassle of printing and scanning.

-

How does airSlate SignNow ensure the security of my documents, including Form 1120 Schedule G?

airSlate SignNow prioritizes document security by implementing advanced encryption and secure data storage protocols. Your Form 1120 Schedule G and other sensitive documents are safeguarded against unauthorized access. Furthermore, the platform complies with privacy regulations to ensure your data remains protected throughout the eSigning process.

Get more for Form 1120 Schedule G

- Idaho assets form

- Essential documents for the organized traveler package idaho form

- Essential documents for the organized traveler package with personal organizer idaho form

- Postnuptial agreements package idaho form

- Letters of recommendation package idaho form

- Idaho mechanics lien form

- Id corporation 497305864 form

- Storage business package idaho form

Find out other Form 1120 Schedule G

- Sign Maryland Non-Profit Business Plan Template Fast

- How To Sign Nevada Life Sciences LLC Operating Agreement

- Sign Montana Non-Profit Warranty Deed Mobile

- Sign Nebraska Non-Profit Residential Lease Agreement Easy

- Sign Nevada Non-Profit LLC Operating Agreement Free

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast