Irs Form 12509 1999

What is the IRS Form 12509

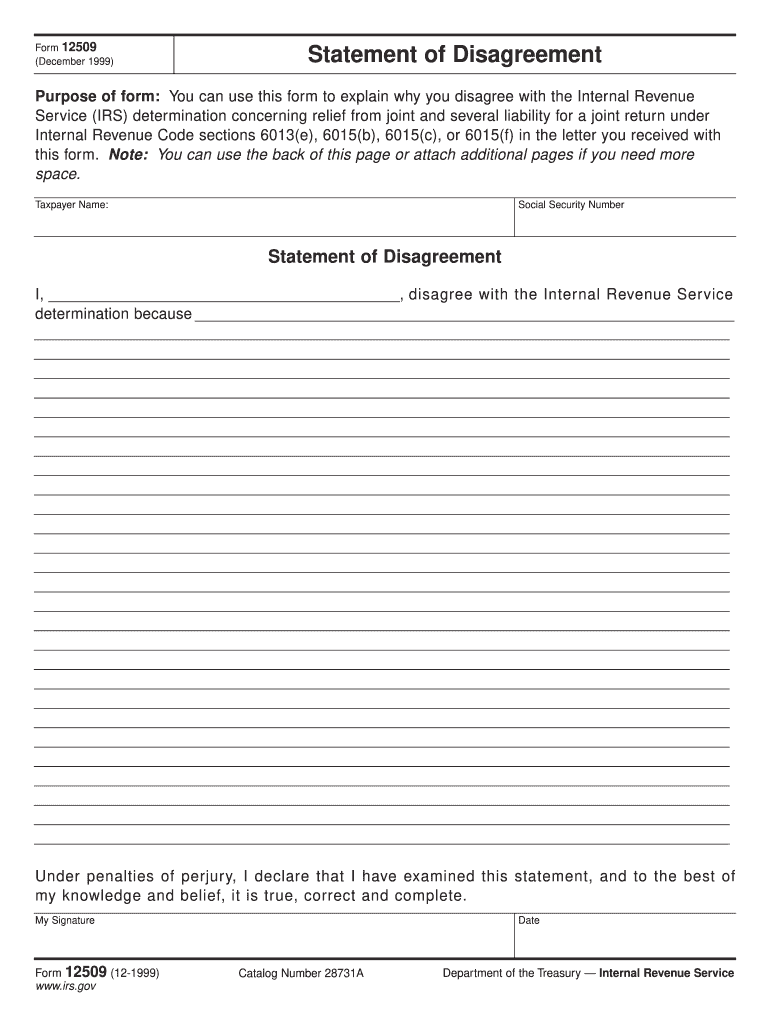

The IRS Form 12509 is a document used by taxpayers to appeal a proposed adjustment to their tax return. This form is specifically designed for individuals who disagree with the IRS's findings during an audit or examination of their tax filings. It serves as a formal request for reconsideration of the IRS's decision, allowing taxpayers to present their case and provide additional information or documentation that may support their position.

How to use the IRS Form 12509

To effectively use the IRS Form 12509, taxpayers should first ensure they have received a notice from the IRS outlining the proposed adjustments. After reviewing the notice, they can fill out the form, clearly stating the reasons for their disagreement. It is essential to include any supporting documentation that may strengthen their appeal. Once completed, the form should be submitted to the appropriate IRS address as indicated in the notice.

Steps to complete the IRS Form 12509

Completing the IRS Form 12509 involves several key steps:

- Review the IRS notice carefully to understand the proposed changes.

- Gather any relevant documentation that supports your position.

- Fill out the form accurately, providing clear explanations for your disagreement.

- Attach any supporting documents to the completed form.

- Submit the form to the IRS by the specified deadline.

Legal use of the IRS Form 12509

The IRS Form 12509 is legally recognized as a means for taxpayers to contest IRS findings. To ensure its legal validity, it is important that the form is filled out completely and accurately. Additionally, all supporting documentation must be relevant and submitted within the time frame specified by the IRS. Compliance with these guidelines helps protect the taxpayer's rights and ensures that their appeal is considered seriously.

Filing Deadlines / Important Dates

Timeliness is crucial when submitting the IRS Form 12509. Taxpayers typically have thirty days from the date of the IRS notice to file their appeal. It is important to mark this deadline clearly and ensure that the form is submitted on time to avoid any complications. Late submissions may result in the IRS not considering the appeal.

Required Documents

When completing the IRS Form 12509, taxpayers should include several key documents:

- A copy of the IRS notice detailing the proposed adjustments.

- Any relevant tax returns or schedules that support your case.

- Documentation that substantiates your claims, such as receipts or bank statements.

Who Issues the Form

The IRS Form 12509 is issued by the Internal Revenue Service, the U.S. government agency responsible for tax collection and enforcement. Taxpayers receive this form in response to an IRS audit or examination when they need to formally contest the findings. It is important for taxpayers to understand that this form is part of the IRS's process for ensuring fair tax practices and compliance.

Quick guide on how to complete irs form 12509 1999

Effortlessly prepare Irs Form 12509 on any device

Digital document management has become favored among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Handle Irs Form 12509 on any device using airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign Irs Form 12509 seamlessly

- Locate Irs Form 12509 and click on Get Form to begin.

- Utilize the tools provided to fill in your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that function.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred delivery method for your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Form 12509 and ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct irs form 12509 1999

Create this form in 5 minutes!

How to create an eSignature for the irs form 12509 1999

The best way to create an electronic signature for your PDF online

The best way to create an electronic signature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is IRS Form 12509?

IRS Form 12509 is a document that allows taxpayers to respond to a notice of proposed adjustment. Understanding and completing IRS Form 12509 accurately is crucial to ensure that your tax records are correctly reflected with the IRS.

-

How can airSlate SignNow help with IRS Form 12509?

airSlate SignNow streamlines the signing and submission process for IRS Form 12509. With our easy-to-use platform, you can create, eSign, and manage your documents without the hassles of printing and scanning, ensuring a quick response to the IRS.

-

Is there a cost associated with using airSlate SignNow for IRS Form 12509?

Yes, airSlate SignNow offers a subscription-based pricing model, providing a cost-effective solution for eSigning documents like IRS Form 12509. You can choose a plan that best fits your needs, which includes various features that enhance your document workflow.

-

What features does airSlate SignNow offer for handling IRS Form 12509?

airSlate SignNow provides advanced features such as templates, in-person signing, and secure storage specifically for IRS Form 12509. These capabilities help simplify the process and ensure that you can easily access and manage your tax documents.

-

Can I integrate airSlate SignNow with my accounting software for IRS Form 12509?

Yes, airSlate SignNow integrates seamlessly with various accounting software, making it easier to manage IRS Form 12509 and other tax documents. This integration ensures that your financial data is aligned and simplifies the entire tax filing process.

-

How secure is my information when using airSlate SignNow for IRS Form 12509?

Security is a top priority at airSlate SignNow. When handling IRS Form 12509, all documents are encrypted, and we adhere to strict security practices to ensure your sensitive information remains safe throughout the signing and submission process.

-

What are the benefits of using airSlate SignNow to eSign IRS Form 12509?

Using airSlate SignNow to eSign IRS Form 12509 offers multiple benefits, including time efficiency, reduced paper usage, and enhanced tracking of document status. Our platform also provides a legally binding signature, adding to the legitimacy of your IRS communications.

Get more for Irs Form 12509

Find out other Irs Form 12509

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online