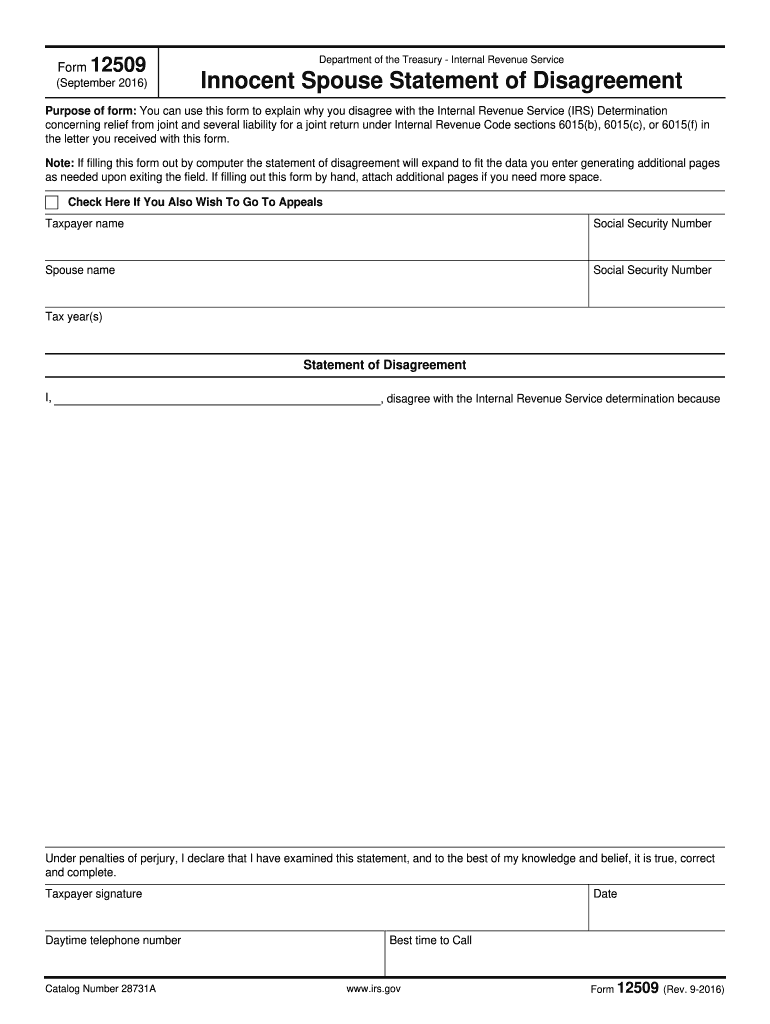

12509 Irs Form 2016

What is the 12509 IRS Form

The 12509 IRS Form, also known as the "Notice of Claim Disallowance," is an important document used by taxpayers in the United States. This form is issued by the Internal Revenue Service (IRS) to notify individuals or businesses that their claim for a tax refund has been denied. It serves as an official communication detailing the reasons for the disallowance, which may include issues related to eligibility, documentation, or compliance with tax laws. Understanding the contents and implications of this form is essential for taxpayers who wish to address any discrepancies with the IRS.

How to use the 12509 IRS Form

Using the 12509 IRS Form involves a few critical steps. First, review the notice carefully to understand the reasons for the disallowance of your claim. Next, gather any supporting documentation that may address the issues raised by the IRS. If you believe the disallowance is incorrect, you can respond to the IRS by submitting additional information or documentation that supports your claim. It is crucial to follow the instructions provided in the notice and to respond within the specified timeframe to avoid further complications.

Steps to complete the 12509 IRS Form

Completing the 12509 IRS Form requires attention to detail. Here are the steps to follow:

- Review the notice to understand the disallowed claim.

- Gather all relevant documents, such as receipts, tax returns, and correspondence.

- Prepare a written response that addresses the IRS's concerns, including any additional evidence.

- Complete the form accurately, ensuring that all required fields are filled.

- Submit the form and any supporting documents by the deadline indicated in the notice.

Legal use of the 12509 IRS Form

The legal use of the 12509 IRS Form is governed by IRS regulations. This form must be used in accordance with the guidelines provided by the IRS to ensure that taxpayers can effectively dispute a claim disallowance. It is essential to comply with all legal requirements, including deadlines for submission and the provision of accurate information. Failure to adhere to these regulations may result in further complications or additional penalties.

Filing Deadlines / Important Dates

Filing deadlines related to the 12509 IRS Form are crucial for taxpayers. The IRS typically specifies a timeframe within which you must respond to the notice. This period can vary based on the nature of the claim and the specific circumstances of the disallowance. It is important to check the notice for exact dates and to ensure that all responses are submitted on time to avoid losing the right to appeal the decision.

Required Documents

When responding to the 12509 IRS Form, certain documents are typically required to support your case. These may include:

- Copies of tax returns related to the disallowed claim.

- Receipts or invoices that substantiate your deductions or credits.

- Any correspondence with the IRS regarding the claim.

- Documentation that demonstrates compliance with tax laws.

Providing comprehensive and accurate documentation can significantly strengthen your response to the IRS.

Quick guide on how to complete 12509 irs 2016 form

Complete 12509 Irs Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents swiftly without delays. Handle 12509 Irs Form on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign 12509 Irs Form without any hassle

- Locate 12509 Irs Form and click Get Form to initiate the process.

- Employ the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your updates.

- Select your preferred method to submit your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign 12509 Irs Form and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 12509 irs 2016 form

Create this form in 5 minutes!

How to create an eSignature for the 12509 irs 2016 form

How to generate an eSignature for your 12509 Irs 2016 Form online

How to generate an electronic signature for the 12509 Irs 2016 Form in Chrome

How to make an electronic signature for putting it on the 12509 Irs 2016 Form in Gmail

How to make an electronic signature for the 12509 Irs 2016 Form straight from your smart phone

How to make an electronic signature for the 12509 Irs 2016 Form on iOS

How to create an electronic signature for the 12509 Irs 2016 Form on Android devices

People also ask

-

What is the 12509 IRS Form and why do I need it?

The 12509 IRS Form is used by taxpayers to request a refund for overpaid taxes. Understanding how to fill out the 12509 IRS Form is crucial for ensuring you receive any eligible refunds efficiently. With airSlate SignNow, you can easily eSign and submit this form, streamlining your tax process.

-

How can airSlate SignNow help me with the 12509 IRS Form?

airSlate SignNow offers a user-friendly platform that simplifies the process of filling out and eSigning the 12509 IRS Form. With our solution, you can quickly upload your documents, complete the required fields, and send them for signature, saving you valuable time and effort during tax season.

-

Is there a cost associated with using airSlate SignNow for the 12509 IRS Form?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, ensuring you can choose one that fits your budget. Our plans provide unlimited access to features that allow you to efficiently manage documents like the 12509 IRS Form without breaking the bank.

-

What are the key features of airSlate SignNow for handling the 12509 IRS Form?

Key features of airSlate SignNow include easy document uploading, customizable templates, and secure eSignature capabilities. These tools make it simple to prepare and submit the 12509 IRS Form while ensuring your information remains protected and compliant with IRS regulations.

-

Can I integrate airSlate SignNow with other applications to manage the 12509 IRS Form?

Absolutely! airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and CRM systems. This means you can easily manage and access your documents, including the 12509 IRS Form, across different platforms without any hassle.

-

How secure is my information when using airSlate SignNow for the 12509 IRS Form?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and compliance with industry standards to protect your data when preparing and submitting the 12509 IRS Form. You can trust that your sensitive information is safe with us.

-

What are the benefits of using airSlate SignNow for the 12509 IRS Form compared to traditional methods?

Using airSlate SignNow for the 12509 IRS Form offers numerous benefits, including increased efficiency, reduced paper waste, and faster turnaround times. Our platform allows you to eSign documents quickly and track the signing process, making the entire experience much smoother than traditional methods.

Get more for 12509 Irs Form

- Progress energy interconnect request form

- Cheshire bridge highrise atlanta housing authority form

- Vehicle schedule for commercial auto insurance business insurance services forms

- Ca application certification form

- Application for electrician examination and certification form

- Osse dc residency verification form

- Abortion online filling forms

- Pasadena city college consortium agreement form

Find out other 12509 Irs Form

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile