Form No 10g 2011

What is the Form No 10g

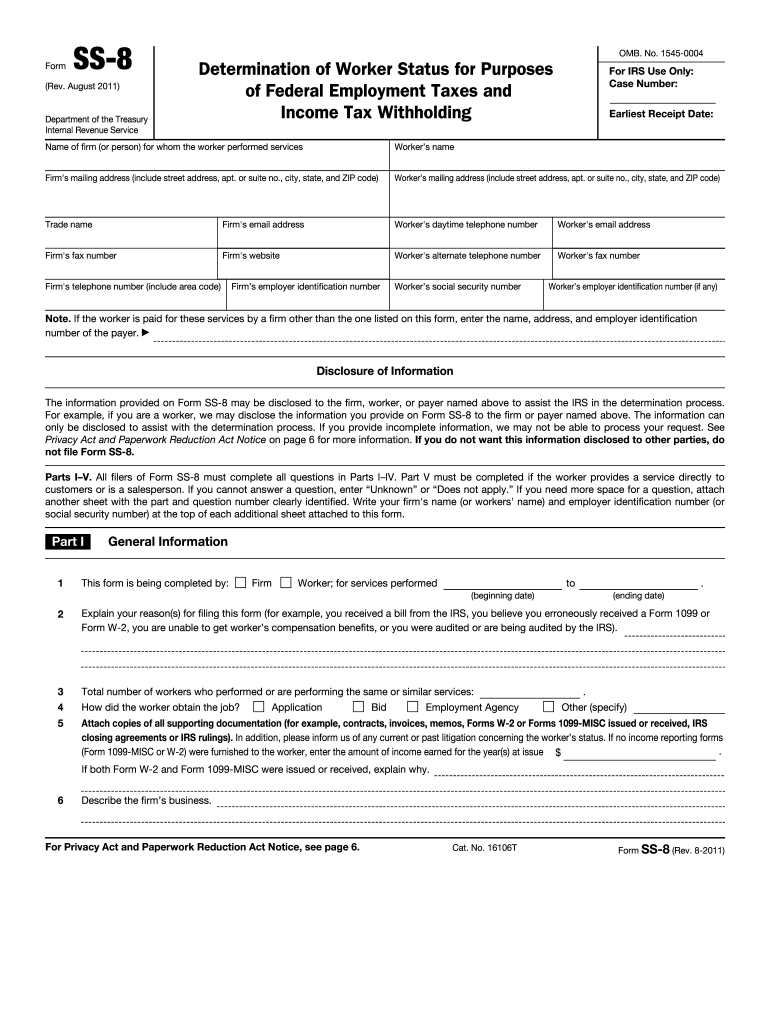

The Form No 10g is a specific document used primarily for tax purposes in the United States. It serves as a declaration for individuals or entities to provide necessary information regarding their tax status. This form is essential for ensuring compliance with federal tax regulations and is often required when applying for certain tax benefits or exemptions. Understanding the purpose and requirements of Form No 10g is crucial for taxpayers to avoid potential issues with the Internal Revenue Service (IRS).

How to use the Form No 10g

Using the Form No 10g involves several key steps to ensure accurate completion and submission. Initially, gather all relevant information, including personal identification details and financial data. Carefully read the instructions provided with the form to understand each section's requirements. Fill out the form completely and accurately, ensuring that all information is current and truthful. Once completed, review the form for any errors before submission to avoid delays or penalties.

Steps to complete the Form No 10g

Completing the Form No 10g requires attention to detail. Follow these steps for successful completion:

- Obtain the latest version of the form from the IRS or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide any necessary financial information relevant to your tax situation.

- Review the form for accuracy, ensuring all required fields are completed.

- Sign and date the form where indicated.

- Submit the form according to the instructions, either electronically or by mail.

Legal use of the Form No 10g

The legal use of Form No 10g is governed by IRS regulations, which outline its necessity for specific tax-related processes. This form must be filled out truthfully, as providing false information can lead to penalties, including fines or audits. It is essential to maintain compliance with all applicable tax laws when using this form, as improper use can result in legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for Form No 10g vary depending on the specific tax situation and the individual's filing status. Generally, forms must be submitted by the annual tax deadline, which is typically April fifteenth for most taxpayers. It is crucial to be aware of any extensions or specific deadlines that may apply to your situation to avoid late penalties.

Required Documents

When preparing to complete Form No 10g, certain documents may be required to support the information provided. These documents can include:

- Previous tax returns

- W-2 forms or 1099 forms

- Proof of income

- Identification documents, such as a driver's license or Social Security card

Having these documents ready can streamline the completion process and ensure accuracy.

Quick guide on how to complete form no 10g 2011

Prepare Form No 10g effortlessly on any device

Online document management has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage Form No 10g on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Form No 10g effortlessly

- Find Form No 10g and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of the documents or conceal sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information carefully and click on the Done button to save your changes.

- Choose how you wish to deliver your form, either via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Form No 10g and ensure outstanding communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form no 10g 2011

Create this form in 5 minutes!

How to create an eSignature for the form no 10g 2011

The best way to make an eSignature for a PDF document in the online mode

The best way to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is Form No 10g and how is it used?

Form No 10g is a document used in various administrative processes that typically requires eSigning for authentication. With airSlate SignNow, you can easily upload and send Form No 10g for electronic signatures, streamlining the workflow and ensuring that your documents are securely signed.

-

How does airSlate SignNow ensure the security of Form No 10g during the signing process?

airSlate SignNow employs industry-standard encryption and security protocols to protect Form No 10g during transmission and storage. This ensures that your sensitive information remains confidential and secure, giving you peace of mind when signing important documents.

-

What are the main features of airSlate SignNow for handling Form No 10g?

airSlate SignNow offers various features to efficiently manage Form No 10g, including easy document uploads, customizable templates, and real-time tracking of signatures. Additionally, the platform allows for seamless integrations with other tools you may already be using, enhancing your document management experience.

-

How can I integrate airSlate SignNow with other applications when using Form No 10g?

Integrating airSlate SignNow with your existing applications is straightforward, allowing you to optimize processes associated with Form No 10g. Whether you use CRM software or project management tools, our platform supports various integrations to ensure your workflow remains efficient.

-

What are the pricing options for using airSlate SignNow for Form No 10g?

airSlate SignNow offers flexible pricing plans depending on your needs, whether you require basic functionality for Form No 10g or advanced features. You can explore our pricing page to find a plan that fits your budget while providing the features necessary for effective document management.

-

Can I customize Form No 10g using airSlate SignNow?

Yes, airSlate SignNow allows you to customize Form No 10g easily. You can add fields, change formatting, and include company branding to create a document that meets your specific requirements, ensuring that it aligns with your business needs.

-

Is it easy to track the status of Form No 10g signatures with airSlate SignNow?

Absolutely! airSlate SignNow provides real-time tracking features that enable you to monitor the status of your Form No 10g signatures. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay informed throughout the process.

Get more for Form No 10g

- Subcontractors agreement indiana form

- Option to purchase addendum to residential lease lease or rent to own indiana form

- Indiana prenuptial premarital agreement uniform premarital agreement act with financial statements indiana

- Prenuptial agreement financial form

- Amendment to prenuptial or premarital agreement indiana form

- Financial statements only in connection with prenuptial premarital agreement indiana form

- In prenuptial contract form

- No fault agreed uncontested divorce package for dissolution of marriage for people with minor children indiana form

Find out other Form No 10g

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast