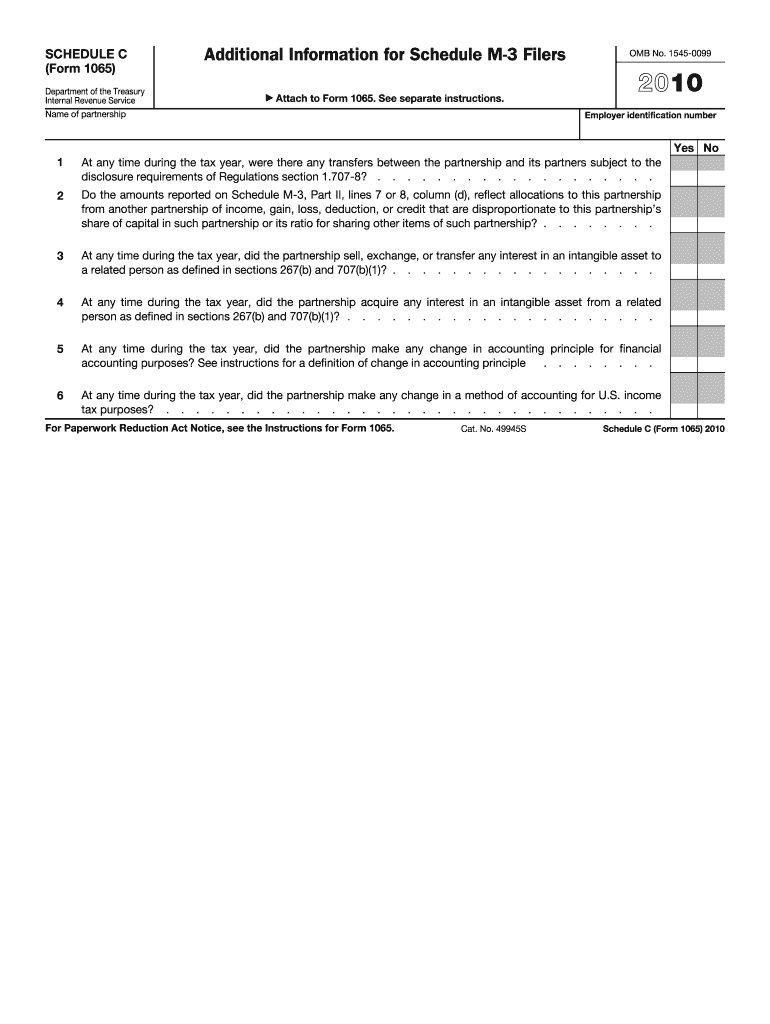

Schedule C Form 1065 Internal Revenue Service Irs 2010

What is the Schedule C Form 1065 Internal Revenue Service Irs

The Schedule C Form 1065 is a tax document used by partnerships to report income, deductions, and credits. It is filed with the Internal Revenue Service (IRS) as part of the partnership's annual tax return. This form provides essential information about the partnership's financial activities, including revenue generated and expenses incurred during the tax year. It is crucial for ensuring accurate tax reporting and compliance with federal regulations.

Steps to complete the Schedule C Form 1065 Internal Revenue Service Irs

Completing the Schedule C Form 1065 involves several important steps:

- Gather all necessary financial records, including income statements and receipts for expenses.

- Begin by entering the partnership's name, address, and Employer Identification Number (EIN) at the top of the form.

- Report total income earned during the year in the appropriate section.

- List all deductible expenses, categorized by type, such as rent, utilities, and salaries.

- Calculate the net profit or loss by subtracting total expenses from total income.

- Review the completed form for accuracy before submission.

Legal use of the Schedule C Form 1065 Internal Revenue Service Irs

The Schedule C Form 1065 is legally binding when properly completed and submitted to the IRS. It must be signed by an authorized partner or member of the partnership. The form must adhere to IRS guidelines to ensure its validity. Electronic signatures are acceptable, provided they comply with federal eSignature laws, such as the ESIGN Act and UETA. Using a reliable platform for eSigning can enhance the legal standing of the document.

Filing Deadlines / Important Dates

Partnerships must file the Schedule C Form 1065 by the 15th day of the third month following the end of their tax year. For most partnerships operating on a calendar year, this means the deadline is March 15. If additional time is needed, partnerships can request a six-month extension by filing Form 7004, but this does not extend the time to pay any taxes owed.

Key elements of the Schedule C Form 1065 Internal Revenue Service Irs

Key elements of the Schedule C Form 1065 include:

- Income Section: Total income earned by the partnership.

- Expense Section: Detailed listing of all deductible expenses.

- Net Profit or Loss: Calculation of the partnership's financial result for the year.

- Partner Information: Details about each partner's share of income and deductions.

How to obtain the Schedule C Form 1065 Internal Revenue Service Irs

The Schedule C Form 1065 can be obtained directly from the IRS website or through tax preparation software. It is available in a printable format for those who prefer to fill it out by hand. Additionally, many tax professionals can provide the form and assist in its completion, ensuring compliance with all relevant tax laws.

Quick guide on how to complete 2010 schedule c form 1065 internal revenue service irs

Effortlessly Prepare Schedule C Form 1065 Internal Revenue Service Irs on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally-friendly alternative to traditional printed and signed papers, as you can acquire the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you require to create, modify, and electronically sign your documents swiftly and without interruptions. Handle Schedule C Form 1065 Internal Revenue Service Irs across any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and electronically sign Schedule C Form 1065 Internal Revenue Service Irs effortlessly

- Locate Schedule C Form 1065 Internal Revenue Service Irs and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and holds the same legal validity as a traditional ink signature.

- Review the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form hunting, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Schedule C Form 1065 Internal Revenue Service Irs to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2010 schedule c form 1065 internal revenue service irs

Create this form in 5 minutes!

How to create an eSignature for the 2010 schedule c form 1065 internal revenue service irs

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The best way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The best way to create an electronic signature for a PDF file on Android

People also ask

-

What is the Schedule C Form 1065 Internal Revenue Service Irs?

The Schedule C Form 1065 Internal Revenue Service Irs is used by businesses to report income or loss from a sole proprietorship. It's essential for tax reporting and helps in determining taxable income. Understanding this form is crucial for accurate bookkeeping and compliance with IRS regulations.

-

How can airSlate SignNow help me with the Schedule C Form 1065 Internal Revenue Service Irs?

airSlate SignNow offers an easy-to-use platform that allows you to eSign and send your Schedule C Form 1065 Internal Revenue Service Irs documents securely. You can streamline the document signing process, ensuring that your forms are completed and submitted in a timely manner for tax purposes.

-

What are the pricing options for using airSlate SignNow to manage Schedule C Form 1065 Internal Revenue Service Irs?

airSlate SignNow provides various pricing plans to suit businesses of all sizes. Our plans are designed to be cost-effective, ensuring you can efficiently manage your Schedule C Form 1065 Internal Revenue Service Irs without breaking the bank. You can choose from monthly or annual subscriptions based on your needs.

-

Are there any integrations available with airSlate SignNow for managing tax documents?

Yes, airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage your Schedule C Form 1065 Internal Revenue Service Irs alongside other tools. This integration capability enhances your productivity by enabling smooth data transfers between platforms, making document management easier.

-

What features does airSlate SignNow offer for handling the Schedule C Form 1065 Internal Revenue Service Irs?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all designed to aid in managing your Schedule C Form 1065 Internal Revenue Service Irs. These tools simplify the process, ensuring that you can focus on growing your business while staying compliant with tax obligations.

-

Is airSlate SignNow secure for handling sensitive tax documents like the Schedule C Form 1065 Internal Revenue Service Irs?

Absolutely! airSlate SignNow prioritizes security, using encryption and robust security protocols to protect your Schedule C Form 1065 Internal Revenue Service Irs. You can have peace of mind knowing that your sensitive tax documents are stored and transmitted securely.

-

Can I access airSlate SignNow on mobile devices for my Schedule C Form 1065 Internal Revenue Service Irs?

Yes, airSlate SignNow is accessible on mobile devices, allowing you to manage your Schedule C Form 1065 Internal Revenue Service Irs on-the-go. This flexibility empowers you to eSign and send your documents whenever you need, from wherever you are, enhancing your efficiency.

Get more for Schedule C Form 1065 Internal Revenue Service Irs

- Revocation of life prolonging procedures declaration indiana form

- Revised uniform anatomical gift act donation indiana

- Employment hiring process package indiana form

- Indiana anatomical form

- Employment or job termination package indiana form

- Newly widowed individuals package indiana form

- Employment interview package indiana form

- Employment employee personnel file package indiana form

Find out other Schedule C Form 1065 Internal Revenue Service Irs

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure