Form 4782 1992-2026

What is the Form 4782

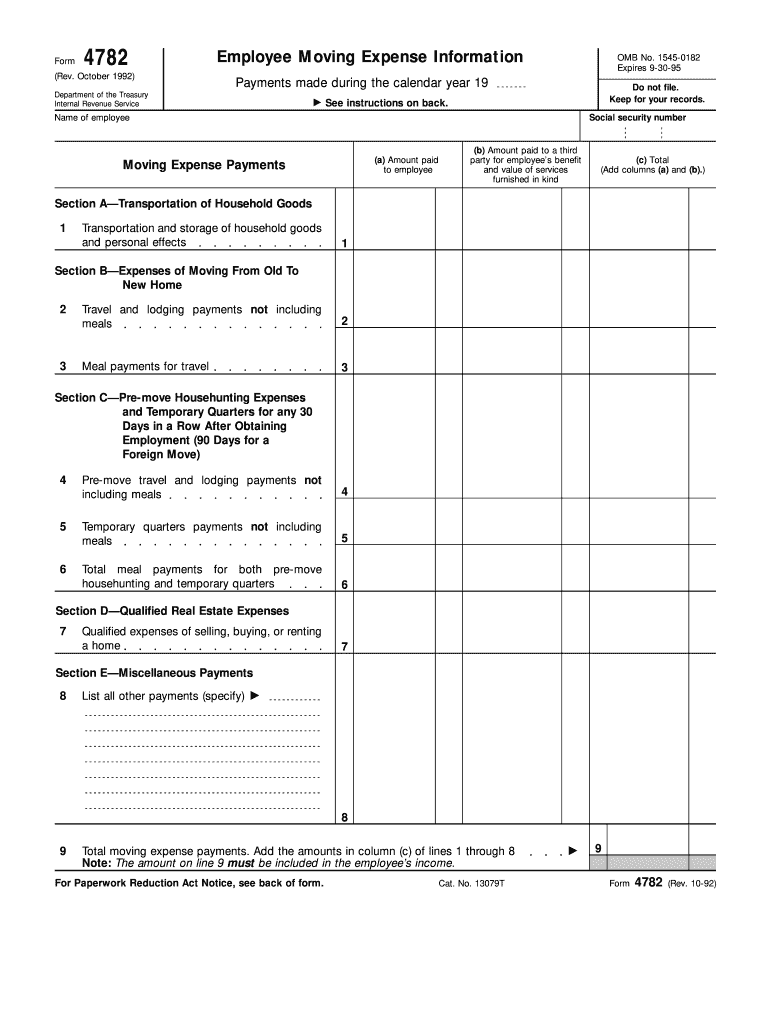

The IRS Form 4782 is a specific document used for reporting certain tax-related information. This form is part of the compliance requirements set by the Internal Revenue Service (IRS) for various tax obligations. Understanding the purpose of Form 4782 is essential for individuals and businesses to ensure they meet their tax responsibilities accurately and on time.

How to obtain the Form 4782

To obtain IRS Form 4782, individuals can visit the official IRS website, where forms are available for download in PDF format. Additionally, taxpayers can request a physical copy by contacting the IRS directly or visiting a local IRS office. It is important to ensure that you are accessing the most current version of the form to avoid any compliance issues.

Steps to complete the Form 4782

Completing IRS Form 4782 involves several key steps:

- Download the form from the IRS website or obtain a physical copy.

- Read the instructions carefully to understand the information required.

- Fill out the form with accurate details, ensuring all sections are completed.

- Review the information for accuracy and completeness.

- Sign and date the form as required.

Following these steps will help ensure that the form is filled out correctly, reducing the risk of delays or penalties.

Legal use of the Form 4782

The legal use of IRS Form 4782 hinges on its compliance with federal tax laws. Properly completed forms serve as official documentation for tax reporting purposes. It is crucial to adhere to the guidelines provided by the IRS to ensure the form is accepted and recognized as valid. Failure to comply with these regulations can lead to penalties or legal repercussions.

Filing Deadlines / Important Dates

Filing deadlines for IRS Form 4782 can vary depending on the specific tax year and the taxpayer's circumstances. Generally, forms must be submitted by the annual tax filing deadline, which is typically April 15 for individual taxpayers. It is essential to stay informed about any changes to deadlines, as late submissions can result in penalties.

Form Submission Methods (Online / Mail / In-Person)

IRS Form 4782 can be submitted through various methods to accommodate different preferences. Taxpayers can file the form online using the IRS e-file system, which offers a secure and efficient way to submit documents. Alternatively, forms can be mailed to the appropriate IRS address or delivered in person at a local IRS office. Each submission method has its own guidelines, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete form 4782

Complete Form 4782 effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers a perfect environmentally-friendly alternative to conventional printed and signed papers, allowing you to access the suitable form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Form 4782 on any gadget with airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to modify and electronically sign Form 4782 effortlessly

- Locate Form 4782 and click Get Form to commence.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or hide sensitive data using tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal value as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in a few clicks from any device of your choosing. Edit and electronically sign Form 4782 and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 4782

The way to make an eSignature for your PDF document in the online mode

The way to make an eSignature for your PDF document in Chrome

The way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature straight from your mobile device

The way to make an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF document on Android devices

People also ask

-

What is IRS Form 4782?

IRS Form 4782 is used for specific tax reporting purposes. It enables businesses to streamline their documentation processes, particularly for tax-related submissions. Understanding its requirements can help ensure compliance and efficiency in filing.

-

How can airSlate SignNow help with IRS Form 4782?

airSlate SignNow simplifies the process of completing and submitting IRS Form 4782 by allowing users to easily eSign and manage documents. With our platform, you can securely send the form, ensuring it is signed and submitted on time. This reduces the risk of errors and delays in tax reporting.

-

What features does airSlate SignNow offer for handling IRS Form 4782?

Our platform includes features such as customizable templates, secure eSignatures, and real-time tracking. These tools not only simplify the completion of IRS Form 4782 but also enhance document management and workflow efficiency. Users can collaborate seamlessly, reducing turnaround times.

-

Is airSlate SignNow affordable for small businesses needing IRS Form 4782?

Yes, airSlate SignNow offers competitive pricing plans tailored for small businesses, making it an accessible solution for managing IRS Form 4782. With our cost-effective plans, you can enhance your documentation process without breaking the budget. Try our services to see how we can add value to your tax filing operations.

-

What benefits does airSlate SignNow provide for IRS Form 4782 submissions?

Using airSlate SignNow for IRS Form 4782 submissions streamlines your workflow and reduces paper usage. The ability to eSign documents ensures swift processing and minimizes the chances of lost paperwork. Additionally, all documents are securely stored for easy access and retrieval.

-

Can I integrate airSlate SignNow with other software for IRS Form 4782?

Absolutely! airSlate SignNow integrates smoothly with various software systems, allowing you to easily import and manage IRS Form 4782 data. Whether you're using accounting software or customer relationship management (CRM) tools, our integrations facilitate a seamless workflow to boost productivity.

-

How secure is the storage of IRS Form 4782 in airSlate SignNow?

Security is a top priority at airSlate SignNow. We implement advanced encryption protocols and secure servers to protect your IRS Form 4782 and other sensitive documents. Our compliance with industry standards ensures your data is safe from unauthorized access.

Get more for Form 4782

- Letter from tenant to landlord containing request for permission to sublease kansas form

- Letter tenant damages form

- Kansas landlord tenant 497307479 form

- Ks tenant landlord 497307480 form

- Letter from landlord to tenant with 30 day notice of expiration of lease and nonrenewal by landlord vacate by expiration kansas form

- Letter from tenant to landlord for 30 day notice to landlord that tenant will vacate premises on or prior to expiration of 497307482 form

- Letter from tenant to landlord about insufficient notice to terminate rental agreement kansas form

- Letter from tenant to landlord about insufficient notice of change in rental agreement for other than rent increase kansas form

Find out other Form 4782

- Can I eSignature Nevada Non-disclosure agreement PDF

- eSignature New Mexico Non-disclosure agreement PDF Online

- Can I eSignature Utah Non-disclosure agreement PDF

- eSignature Rhode Island Rental agreement lease Easy

- eSignature New Hampshire Rental lease agreement Simple

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online