W9 R092004 Form 2004

What is the W-9 R092004 Form

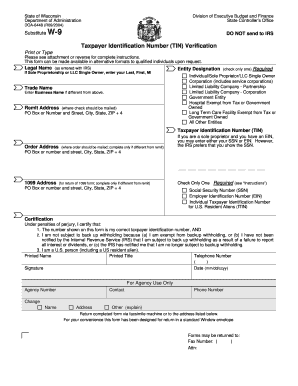

The W-9 R092004 Form is an official document used by the Internal Revenue Service (IRS) in the United States. It is primarily utilized by individuals and businesses to provide their taxpayer identification information, which may include a Social Security Number (SSN) or Employer Identification Number (EIN). This form is essential for reporting income paid to independent contractors, freelancers, and other non-employees. By completing the W-9, the requester can accurately report payments to the IRS, ensuring compliance with tax regulations.

How to use the W-9 R092004 Form

To use the W-9 R092004 Form, individuals or entities must first obtain the form, which can typically be downloaded from the IRS website or through various tax preparation software. Once in possession of the form, the user should fill in their name, business name (if applicable), address, and taxpayer identification number. After completing the form, it should be submitted to the requester, not the IRS. It is crucial to ensure that the information provided is accurate to avoid potential tax issues.

Steps to complete the W-9 R092004 Form

Completing the W-9 R092004 Form involves several straightforward steps:

- Download the form from the IRS website or access it through tax software.

- Fill in your name as it appears on your tax return.

- If applicable, provide your business name.

- Enter your address, including city, state, and ZIP code.

- Input your taxpayer identification number, either SSN or EIN.

- Sign and date the form to certify that the information is correct.

Once completed, send the form to the requester rather than the IRS.

Legal use of the W-9 R092004 Form

The legal use of the W-9 R092004 Form is vital for compliance with IRS regulations. This form serves as a means for businesses to collect taxpayer information necessary for reporting payments made to contractors and freelancers. By providing accurate information on the W-9, individuals help ensure that the payments are reported correctly, which is essential for tax purposes. Failure to provide a completed W-9 may result in backup withholding on payments made to the individual or entity.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and use of the W-9 R092004 Form. It is important to ensure that the form is filled out completely and accurately to avoid any issues with tax reporting. The IRS requires that the form be updated whenever there is a change in taxpayer information, such as a name change or change of address. Additionally, the IRS advises individuals to keep a copy of the completed W-9 for their records, as it may be needed for future reference.

Form Submission Methods

The W-9 R092004 Form can be submitted in several ways, depending on the requester's preferences. Common submission methods include:

- Emailing a scanned copy of the completed form.

- Mailing the physical form to the requester.

- Submitting the form through a secure online portal, if available.

It is essential to follow the requester's instructions for submission to ensure timely processing.

Quick guide on how to complete w9 r092004 form

Prepare W9 R092004 Form effortlessly on any device

Digital document management has become widely embraced by companies and individuals alike. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can access the correct form and securely save it online. airSlate SignNow provides all the essential tools needed to develop, revise, and eSign your documents swiftly without delays. Manage W9 R092004 Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to modify and eSign W9 R092004 Form with ease

- Find W9 R092004 Form and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Revise and eSign W9 R092004 Form and ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct w9 r092004 form

Create this form in 5 minutes!

How to create an eSignature for the w9 r092004 form

The way to generate an electronic signature for a PDF file online

The way to generate an electronic signature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to create an eSignature straight from your mobile device

The best way to make an eSignature for a PDF file on iOS

The way to create an eSignature for a PDF document on Android devices

People also ask

-

What is the W9 R092004 Form?

The W9 R092004 Form is a tax form used by individuals and businesses in the United States to provide their taxpayer identification information. This form is essential for anyone needing to report income, including independent contractors and freelancers. Understanding the W9 R092004 Form is crucial for compliance with IRS regulations.

-

How can airSlate SignNow assist with the W9 R092004 Form?

airSlate SignNow simplifies the process of managing the W9 R092004 Form by allowing users to easily send, receive, and eSign the document electronically. Our platform enhances efficiency, ensuring that the form is filled out accurately and submitted on time. Experience the convenience of handling the W9 R092004 Form with a user-friendly interface.

-

Is there a cost associated with using airSlate SignNow for the W9 R092004 Form?

Yes, there is a pricing structure for using airSlate SignNow services, which varies based on your business needs. We offer various plans that accommodate different volumes of document handling, including the W9 R092004 Form. For specific pricing details, please visit our website to choose the best plan for you.

-

What features does airSlate SignNow provide for the W9 R092004 Form?

airSlate SignNow offers a range of features for handling the W9 R092004 Form, including customizable templates, secure electronic signatures, and real-time tracking of document status. These features ensure that users can easily manage their compliance needs with minimal hassle. Our platform is designed to streamline the entire process for your convenience.

-

Can I integrate airSlate SignNow with other tools to manage the W9 R092004 Form?

Yes, airSlate SignNow integrates seamlessly with various applications, allowing for enhanced workflow management when handling the W9 R092004 Form. This includes integrations with popular CRMs and accounting software, making it easier to automate processes. Discover how our integrations can simplify your documentation needs today.

-

What are the benefits of using airSlate SignNow for the W9 R092004 Form?

Using airSlate SignNow for the W9 R092004 Form provides numerous benefits, including improved efficiency, cost savings, and a better user experience. Our platform minimizes errors associated with manual handling of documents, ensuring smooth compliance with IRS guidelines. Overall, you can expect a streamlined process when managing your W9 R092004 Form.

-

Is airSlate SignNow secure for managing the W9 R092004 Form?

Absolutely, airSlate SignNow prioritizes security when it comes to handling sensitive documents like the W9 R092004 Form. Our platform employs advanced encryption and security protocols to protect your information. You can trust us to keep your documents safe while using our eSignature services.

Get more for W9 R092004 Form

Find out other W9 R092004 Form

- eSignature California Letter of Intent Free

- Can I eSign Louisiana General Power of Attorney Template

- eSign Mississippi General Power of Attorney Template Free

- How Can I eSignature New Mexico Letter of Intent

- Can I eSign Colorado Startup Business Plan Template

- eSign Massachusetts Startup Business Plan Template Online

- eSign New Hampshire Startup Business Plan Template Online

- How To eSign New Jersey Startup Business Plan Template

- eSign New York Startup Business Plan Template Online

- eSign Colorado Income Statement Quarterly Mobile

- eSignature Nebraska Photo Licensing Agreement Online

- How To eSign Arizona Profit and Loss Statement

- How To eSign Hawaii Profit and Loss Statement

- How To eSign Illinois Profit and Loss Statement

- How To eSign New York Profit and Loss Statement

- How To eSign Ohio Profit and Loss Statement

- How Do I eSign Ohio Non-Compete Agreement

- eSign Utah Non-Compete Agreement Online

- eSign Tennessee General Partnership Agreement Mobile

- eSign Alaska LLC Operating Agreement Fast