Doa 6448 Form 2012-2026

What is the W-9 Form in Wisconsin?

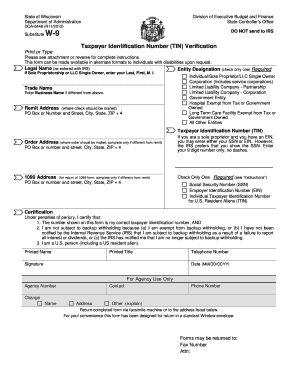

The W-9 form, officially known as the Request for Taxpayer Identification Number and Certification, is a crucial document used in the United States, including Wisconsin. It is primarily utilized by businesses to collect information from independent contractors, freelancers, and other vendors. This form requests the taxpayer's name, address, and taxpayer identification number (TIN), which can be a Social Security number or an Employer Identification Number. The information provided on the W-9 is essential for the business to accurately report payments made to the IRS.

Steps to Complete the W-9 Form in Wisconsin

Completing the W-9 form involves several straightforward steps:

- Download the Form: Obtain the latest version of the W-9 form from a reliable source, such as the IRS website.

- Provide Personal Information: Fill in your name, business name (if applicable), and address in the designated fields.

- Enter Taxpayer Identification Number: Include your Social Security number or Employer Identification Number as required.

- Certification: Sign and date the form, certifying that the information provided is accurate.

Once completed, the form should be submitted to the requester, typically the business or individual that requires your services.

Legal Use of the W-9 Form in Wisconsin

The W-9 form holds legal significance as it certifies the taxpayer's identification information. It is essential for compliance with IRS regulations, ensuring that businesses report payments accurately. Failure to provide a W-9 when requested can result in backup withholding, where the payer is required to withhold a percentage of payments for tax purposes. Therefore, understanding the legal implications of the W-9 form is crucial for both the taxpayer and the requesting entity.

IRS Guidelines for the W-9 Form

The IRS provides specific guidelines for completing and submitting the W-9 form. It is important to ensure that the information is current and accurate to avoid any issues with tax reporting. The IRS may also require the form to be updated if there are changes in your name, address, or taxpayer identification number. Keeping abreast of IRS guidelines helps ensure compliance and minimizes the risk of penalties.

Filing Deadlines and Important Dates for the W-9 Form

While the W-9 form itself does not have a specific filing deadline, it is crucial to provide it promptly when requested by a business or individual. The information on the W-9 is used for various tax reporting purposes, including the issuance of Form 1099 at the end of the tax year. Timely submission of the W-9 ensures that the requester can meet their reporting deadlines without complications.

Required Documents for the W-9 Form

When filling out the W-9 form, no additional documents are required to be submitted with it. However, it is advisable to have your Social Security card or Employer Identification Number documentation on hand for accurate reporting. Maintaining accurate records can facilitate a smoother process when completing the form.

Who Issues the W-9 Form?

The W-9 form is not issued by any specific organization; instead, it is a standard form provided by the IRS. Any business or individual requiring your taxpayer identification information can request that you complete a W-9. It is essential to provide this form to ensure compliance with tax reporting requirements.

Quick guide on how to complete doa 6448 form

Effortlessly Complete Doa 6448 Form on Any Device

Managing documents online has become increasingly popular among companies and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the right form and securely store it online. airSlate SignNow offers you all the resources necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Doa 6448 Form on any device using the airSlate SignNow apps for Android or iOS and enhance any document-based task today.

Steps to Modify and eSign Doa 6448 Form Effortlessly

- Find Doa 6448 Form and click Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the information thoroughly and click on the Done button to finalize your edits.

- Choose your preferred method to send your form—via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Doa 6448 Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct doa 6448 form

Create this form in 5 minutes!

How to create an eSignature for the doa 6448 form

The best way to create an electronic signature for your PDF file in the online mode

The best way to create an electronic signature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is a Wisconsin W-9 form?

The Wisconsin W-9 form is a document used to provide taxpayer identification information to an entity that requires it. This form is essential for freelancers and contractors in Wisconsin who need to report their income accurately. Using airSlate SignNow, you can easily complete and eSign the Wisconsin W-9 form securely online.

-

How does airSlate SignNow simplify the W-9 signing process?

AirSlate SignNow streamlines the W-9 signing process by allowing you to fill out and eSign the Wisconsin W-9 form digitally. This eliminates the hassle of printing, scanning, or mailing documents. With its user-friendly interface, you can complete the form and send it to clients swiftly and securely.

-

Is there a cost associated with using airSlate SignNow for the Wisconsin W-9?

AirSlate SignNow offers a range of pricing plans that cater to different business needs. You can start with a free trial, and if you find the service valuable for managing documents like the Wisconsin W-9, you can choose from various subscription options to access enhanced features. The overall cost is designed to be cost-effective for businesses of all sizes.

-

What features are available for managing the Wisconsin W-9 in airSlate SignNow?

AirSlate SignNow provides several features for managing the Wisconsin W-9, including customizable templates, document tracking, and secure storage. These features ensure that your documents are organized and accessible whenever needed. Furthermore, you can set reminders for renewal or updates, ensuring compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for handling the Wisconsin W-9?

Yes, airSlate SignNow offers seamless integrations with various business tools like CRM systems and accounting software. This makes it easier to manage your documents, including the Wisconsin W-9, alongside your existing workflows. Integrations enhance productivity by automating data entry and document management tasks.

-

How can I ensure the security of my Wisconsin W-9 documents in airSlate SignNow?

AirSlate SignNow prioritizes the security of your documents, including the Wisconsin W-9. It uses industry-standard encryption and secure cloud storage to protect your sensitive information. Additionally, the platform complies with legal and regulatory requirements, giving you peace of mind when handling important documents.

-

What benefits does airSlate SignNow offer for users completing a Wisconsin W-9?

The benefits of using airSlate SignNow for your Wisconsin W-9 include increased efficiency, reduced processing time, and improved accuracy. By digitizing the signing process, you can complete and send the form in moments rather than days. This enhances your professional image and ensures timely compliance with tax obligations.

Get more for Doa 6448 Form

Find out other Doa 6448 Form

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer