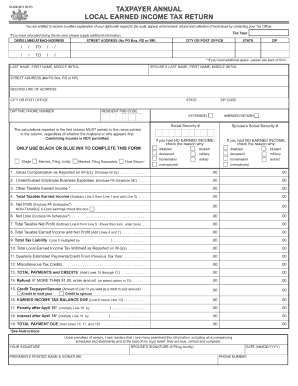

Taxpayer Annual Local Earned Income Tax Return Form 2011

What is the Taxpayer Annual Local Earned Income Tax Return Form

The Taxpayer Annual Local Earned Income Tax Return Form is a crucial document for individuals who earn income within a specific locality. This form is used to report local earned income to the appropriate local tax authorities. It helps ensure compliance with local tax regulations and allows for accurate assessment of local tax obligations. Understanding this form is essential for taxpayers to fulfill their civic duties and avoid potential penalties.

How to use the Taxpayer Annual Local Earned Income Tax Return Form

Using the Taxpayer Annual Local Earned Income Tax Return Form involves several steps to ensure accurate reporting of income. First, gather all necessary financial documents, including W-2s and 1099s, which detail your earnings. Next, fill out the form with your personal information, including your name, address, and Social Security number. Report your total earned income for the year and any applicable deductions. Finally, review the form for accuracy before submitting it to your local tax authority.

Steps to complete the Taxpayer Annual Local Earned Income Tax Return Form

Completing the Taxpayer Annual Local Earned Income Tax Return Form can be straightforward if you follow these steps:

- Collect all relevant income documents, such as pay stubs and tax forms.

- Fill in your personal details accurately on the form.

- Report your total local earned income, ensuring to include all sources.

- Apply any local deductions or credits you may qualify for.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Taxpayer Annual Local Earned Income Tax Return Form

The legal use of the Taxpayer Annual Local Earned Income Tax Return Form is governed by local tax laws. This form must be completed and submitted by the designated deadline to avoid penalties. It serves as a formal declaration of income and is essential for local tax assessment. Failure to file or inaccuracies in the form can result in legal repercussions, including fines or audits by local tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the Taxpayer Annual Local Earned Income Tax Return Form vary by locality. Generally, most localities require the form to be submitted by April fifteenth of the following tax year. It is important to check with your local tax authority for specific deadlines and any extensions that may apply. Staying informed about these dates helps ensure timely compliance and avoids unnecessary penalties.

Form Submission Methods (Online / Mail / In-Person)

The Taxpayer Annual Local Earned Income Tax Return Form can typically be submitted through various methods, depending on local regulations. Common submission methods include:

- Online submission through the local tax authority's website.

- Mailing the completed form to the designated local tax office.

- In-person submission at local tax offices or designated locations.

Choosing the right method can enhance the efficiency of your filing process.

Quick guide on how to complete taxpayer annual local earned income tax return form

Effortlessly complete Taxpayer Annual Local Earned Income Tax Return Form on any device

Digital document management has become increasingly popular among companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and eSign your documents rapidly without interruptions. Handle Taxpayer Annual Local Earned Income Tax Return Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign Taxpayer Annual Local Earned Income Tax Return Form with ease

- Locate Taxpayer Annual Local Earned Income Tax Return Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of the documents or obscure sensitive information with tools specifically offered by airSlate SignNow for this purpose.

- Create your signature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to conserve your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you select. Edit and eSign Taxpayer Annual Local Earned Income Tax Return Form and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct taxpayer annual local earned income tax return form

Create this form in 5 minutes!

How to create an eSignature for the taxpayer annual local earned income tax return form

The way to create an electronic signature for a PDF file in the online mode

The way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The way to make an eSignature for a PDF file on Android

People also ask

-

What is the Taxpayer Annual Local Earned Income Tax Return Form?

The Taxpayer Annual Local Earned Income Tax Return Form is a necessary document for individuals to report their local earned income. Completing this form accurately ensures compliance with local tax regulations and helps determine any tax obligations. airSlate SignNow simplifies the process of filling out and submitting this form electronically.

-

How does airSlate SignNow help with the Taxpayer Annual Local Earned Income Tax Return Form?

airSlate SignNow provides an intuitive platform for users to create, complete, and eSign the Taxpayer Annual Local Earned Income Tax Return Form. With our easy-to-use interface, you can streamline your tax filing process and enhance your overall productivity. This makes it easier to keep track of your documents and stay organized.

-

What pricing plans does airSlate SignNow offer for tax documents like the Taxpayer Annual Local Earned Income Tax Return Form?

airSlate SignNow offers flexible pricing plans to cater to a variety of needs, including individual and business users. Each plan provides access to tools necessary for efficiently managing your Taxpayer Annual Local Earned Income Tax Return Form and other documents. Check our website for the latest pricing details and features included in each plan.

-

Can I integrate airSlate SignNow with other accounting software when filing the Taxpayer Annual Local Earned Income Tax Return Form?

Yes, airSlate SignNow offers integrations with various accounting and tax software, making it easier to manage your Taxpayer Annual Local Earned Income Tax Return Form alongside other important documents. This functionality allows for seamless data transfer and enhances operational efficiency for your tax filing needs.

-

What features does airSlate SignNow provide for managing tax forms like the Taxpayer Annual Local Earned Income Tax Return Form?

airSlate SignNow includes robust features such as eSignature capabilities, document templates, real-time tracking, and secure cloud storage, all tailored for managing forms like the Taxpayer Annual Local Earned Income Tax Return Form. These features simplify the tax filing process while ensuring data security and compliance.

-

Is it safe to use airSlate SignNow for submitting the Taxpayer Annual Local Earned Income Tax Return Form?

Absolutely! airSlate SignNow employs advanced security measures, such as encryption and secure access, to protect your sensitive information while submitting the Taxpayer Annual Local Earned Income Tax Return Form. Our commitment to data protection ensures that your personal and financial details remain confidential.

-

Can airSlate SignNow help me track the status of my Taxpayer Annual Local Earned Income Tax Return Form?

Yes, airSlate SignNow allows you to track the status of your submitted Taxpayer Annual Local Earned Income Tax Return Form in real-time. This feature helps you stay informed about your filing process and ensures you meet any deadlines effectively. You can easily monitor progress and receive notifications once your form is processed.

Get more for Taxpayer Annual Local Earned Income Tax Return Form

- Maryland contractor 497310546 form

- Concrete mason contractor package maryland form

- Demolition contractor package maryland form

- Security contractor package maryland form

- Insulation contractor package maryland form

- Paving contractor package maryland form

- Site work contractor package maryland form

- Siding contractor package maryland form

Find out other Taxpayer Annual Local Earned Income Tax Return Form

- eSignature Arkansas Legal Affidavit Of Heirship Fast

- Help Me With eSignature Colorado Legal Cease And Desist Letter

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney