Form Clgs 32 1 2014

What is the Form CLGS 32 1?

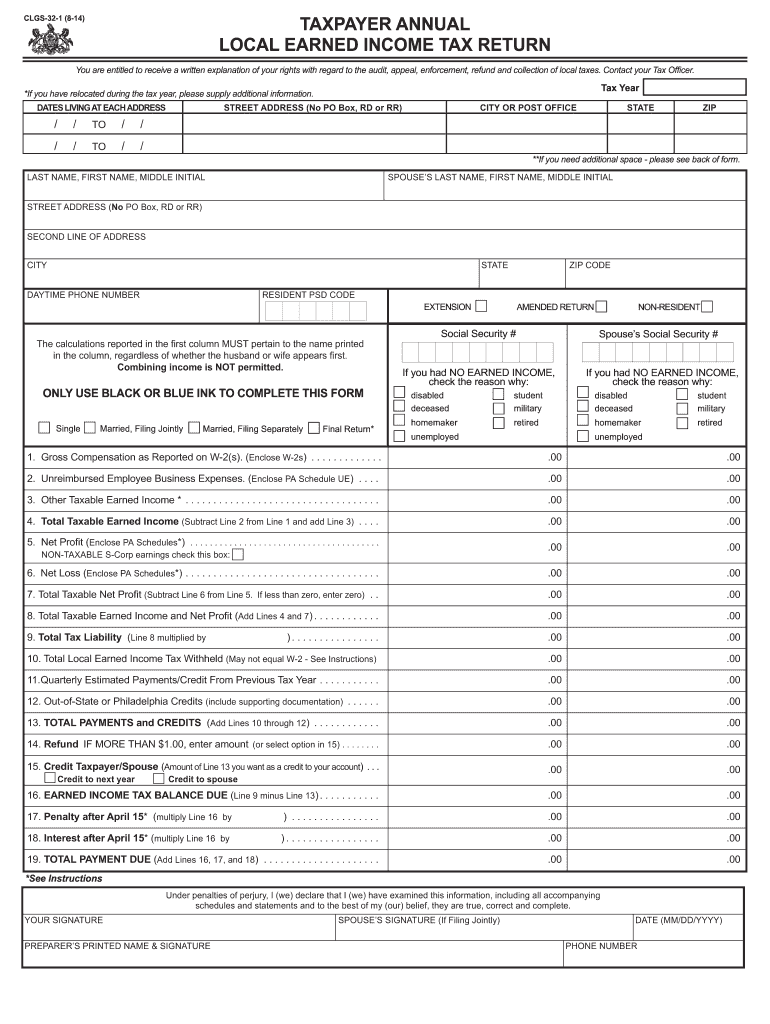

The Form CLGS 32 1 is a Pennsylvania local income tax form used by residents to report their earned income and pay local taxes. This form is essential for individuals who earn income within Pennsylvania, as it helps local authorities assess and collect the appropriate local earned income tax. Understanding the purpose of this form is crucial for compliance and ensuring that all local tax obligations are met.

Steps to Complete the Form CLGS 32 1

Completing the Form CLGS 32 1 requires careful attention to detail. Here are the key steps:

- Gather necessary documentation, including your W-2 forms and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total earned income from all sources, ensuring accuracy to avoid penalties.

- Calculate the local tax due based on the income reported, using the appropriate local tax rate.

- Sign and date the form to validate your submission.

How to Obtain the Form CLGS 32 1

The Form CLGS 32 1 can be obtained through various channels. Residents can visit their local tax collector's office or municipal website to download a copy. Additionally, many local government offices provide printed forms upon request. It is advisable to ensure you have the most current version of the form to avoid any compliance issues.

Legal Use of the Form CLGS 32 1

The legal use of the Form CLGS 32 1 is governed by Pennsylvania state tax laws. This form must be completed accurately and submitted by the designated deadline to avoid penalties. It serves as a legal document that confirms the taxpayer's income and tax liability to local authorities. Compliance with the regulations surrounding this form is essential to avoid legal repercussions.

Filing Deadlines / Important Dates

Timely filing of the Form CLGS 32 1 is crucial for compliance. The typical deadline for submitting this form is April 15 of the following tax year. However, if the deadline falls on a weekend or holiday, it may be extended to the next business day. It is important to stay informed about any changes to these deadlines to ensure timely submission.

Penalties for Non-Compliance

Failure to file the Form CLGS 32 1 on time can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action by local tax authorities. Understanding the consequences of non-compliance emphasizes the importance of completing and submitting the form accurately and on time.

Quick guide on how to complete form local earned income 2014 2019

Complete Form Clgs 32 1 seamlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to acquire the correct form and securely preserve it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Form Clgs 32 1 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Form Clgs 32 1 effortlessly

- Locate Form Clgs 32 1 and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional ink signature.

- Review all the details and click the Done button to finalize your changes.

- Select how you want to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign Form Clgs 32 1 to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form local earned income 2014 2019

Create this form in 5 minutes!

How to create an eSignature for the form local earned income 2014 2019

How to generate an eSignature for your Form Local Earned Income 2014 2019 in the online mode

How to create an electronic signature for the Form Local Earned Income 2014 2019 in Google Chrome

How to make an electronic signature for signing the Form Local Earned Income 2014 2019 in Gmail

How to make an electronic signature for the Form Local Earned Income 2014 2019 from your mobile device

How to generate an electronic signature for the Form Local Earned Income 2014 2019 on iOS devices

How to create an eSignature for the Form Local Earned Income 2014 2019 on Android devices

People also ask

-

What is PA local income tax and how does it affect my business?

PA local income tax is a tax levied by local municipalities in Pennsylvania on earned income. For businesses, understanding local income tax obligations is crucial for ensuring compliance and proper tax reporting. Utilizing airSlate SignNow can streamline the signing of tax-related documents, making it easier to manage these obligations.

-

How can airSlate SignNow help with PA local income tax documents?

airSlate SignNow offers an efficient platform for sending and signing essential PA local income tax documents electronically. This not only speeds up the process but also ensures that all parties can access and complete what they need in a secure manner. Simplifying document management related to PA local income tax can signNowly reduce delays.

-

What features does airSlate SignNow offer for handling PA local income tax forms?

With airSlate SignNow, you can easily create, edit, and eSign PA local income tax forms. Key features include template creation for consistent document preparation, in-app notifications for document status updates, and secure storage for all signed documents. This makes tracking your PA local income tax documents straightforward and efficient.

-

Is airSlate SignNow cost-effective for managing PA local income tax documents?

Yes, airSlate SignNow provides a cost-effective solution for businesses needing to manage PA local income tax documents. Its pricing plan offers features that cater to various business sizes without compromising on functionality. Investing in airSlate SignNow can ultimately save time and resources associated with document management.

-

Can I integrate airSlate SignNow with other accounting software for PA local income tax?

Absolutely! airSlate SignNow seamlessly integrates with a variety of accounting software, allowing for streamlined handling of PA local income tax requirements. Integration helps maintain accurate financial data while simplifying the document signing process, leading to enhanced operational efficiency.

-

What are the benefits of using airSlate SignNow for PA local income tax compliance?

Using airSlate SignNow for PA local income tax compliance helps ensure that your business meets all necessary regulations in a timely manner. The platform enhances document security, reduces potential errors, and allows for easy tracking of signed documents. This peace of mind lets you focus on your core business activities.

-

How do I get started with airSlate SignNow for my PA local income tax needs?

Getting started with airSlate SignNow is simple! You can sign up for a free trial, which allows you to explore its features specifically for PA local income tax-related tasks. Once you experience the user-friendly interface, you can easily craft and manage your tax documents efficiently.

Get more for Form Clgs 32 1

Find out other Form Clgs 32 1

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney

- How Do I Electronic signature South Carolina Unlimited Power of Attorney

- How Can I Electronic signature Alaska Limited Power of Attorney

- How To Electronic signature Massachusetts Retainer Agreement Template

- Electronic signature California Limited Power of Attorney Now

- Electronic signature Colorado Limited Power of Attorney Now

- Electronic signature Georgia Limited Power of Attorney Simple

- Electronic signature Nevada Retainer Agreement Template Myself

- Electronic signature Alabama Limited Partnership Agreement Online

- Can I Electronic signature Wisconsin Retainer Agreement Template

- Can I Electronic signature Michigan Trademark License Agreement