Modelo 145 Word Form

What is the Modelo 145 Word

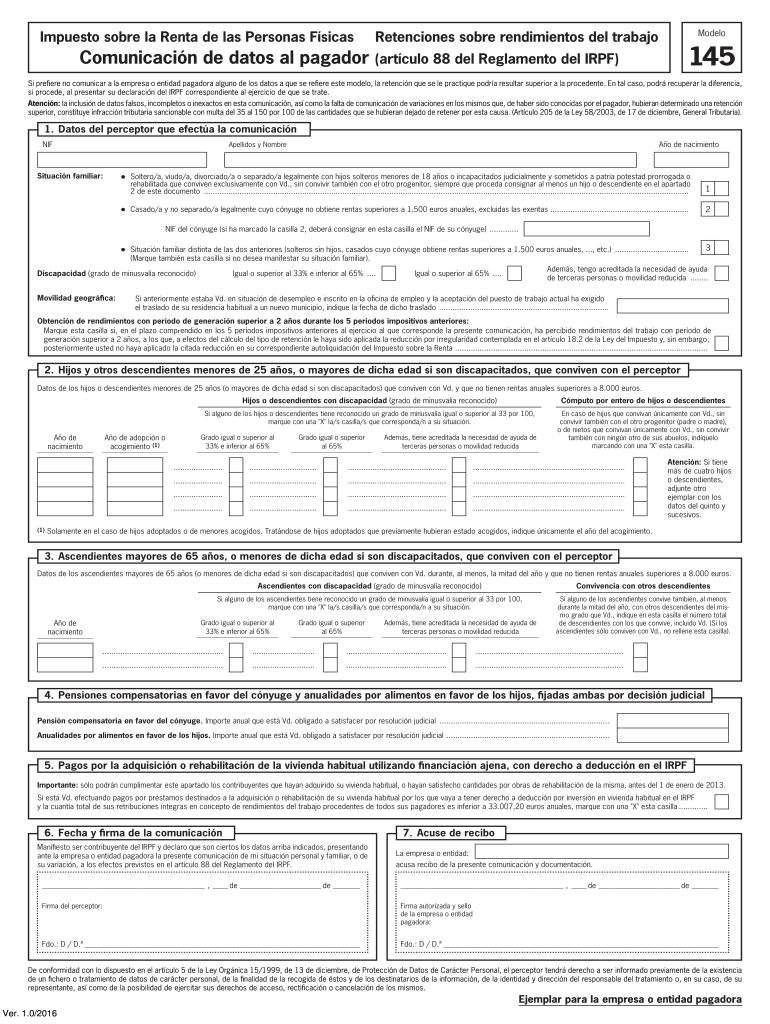

The Modelo 145 Word is a specific form used for reporting income tax withholdings in the United States. It is essential for employees and employers to accurately complete this document to ensure compliance with tax regulations. The form captures vital information regarding the taxpayer's income, deductions, and exemptions, which ultimately influences the amount of tax withheld from an employee's paycheck. Understanding the purpose of this form is crucial for both parties involved in the employment relationship.

Steps to complete the Modelo 145 Word

Completing the Modelo 145 Word involves several key steps to ensure accuracy and compliance. First, gather all necessary personal information, including your Social Security number, address, and details about your employment. Next, fill in the sections that detail your income, any applicable deductions, and exemptions. Be sure to double-check all entries for accuracy before finalizing the form. Once completed, the form should be submitted to the appropriate tax authority or your employer, as required.

Legal use of the Modelo 145 Word

The legal use of the Modelo 145 Word is governed by federal tax laws, which mandate that employers withhold a certain percentage of an employee's wages for tax purposes. This form serves as a declaration of the employee's tax situation and ensures that the correct amount is withheld. Failure to complete or submit this form accurately can result in penalties for both the employee and employer, highlighting the importance of understanding its legal implications.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines regarding the completion and submission of the Modelo 145 Word. These guidelines outline the necessary information required on the form, the deadlines for submission, and the consequences of non-compliance. It is essential for taxpayers to familiarize themselves with these guidelines to avoid potential issues with their tax filings.

Required Documents

To complete the Modelo 145 Word, several documents may be required. These typically include proof of income, such as pay stubs or W-2 forms, as well as any documentation related to deductions or exemptions claimed. Having these documents ready can streamline the process of filling out the form and ensure that all information provided is accurate and verifiable.

Filing Deadlines / Important Dates

Filing deadlines for the Modelo 145 Word are critical to ensure compliance with tax regulations. Generally, the form must be submitted by specific dates set by the IRS, often coinciding with the end of the tax year or the beginning of the tax filing season. Missing these deadlines can lead to penalties, so it is important to stay informed about the relevant dates each tax year.

Form Submission Methods (Online / Mail / In-Person)

The Modelo 145 Word can be submitted through various methods, depending on the requirements of your employer or the tax authority. Options typically include online submission through secure portals, mailing a physical copy of the form, or delivering it in person to the appropriate office. Each method has its own advantages and timelines, so it is important to choose the one that best fits your situation.

Quick guide on how to complete modelo 145 word

Effortlessly Prepare Modelo 145 Word on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary forms and securely store them online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly and without hassle. Handle Modelo 145 Word on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Modelo 145 Word with Ease

- Find Modelo 145 Word and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign function, which takes only seconds and carries the same legal validity as a conventional wet-ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, frustrating form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Edit and eSign Modelo 145 Word and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct modelo 145 word

Create this form in 5 minutes!

How to create an eSignature for the modelo 145 word

The way to make an eSignature for your PDF online

The way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your smartphone

The way to make an electronic signature for a PDF on iOS

How to make an electronic signature for a PDF file on Android

People also ask

-

What are retenciones trabajo and how do they impact my business?

Retenciones trabajo refers to the deductions applicable to employee income and can affect payroll calculations. Understanding these deductions is crucial for businesses to ensure compliance and avoid penalties. Using airSlate SignNow can streamline document signing for payroll processes, making it easier to manage retenciones trabajo effectively.

-

How can airSlate SignNow help manage retenciones trabajo in my business?

With airSlate SignNow, you can send, receive, and eSign essential documents related to retenciones trabajo quickly and securely. The platform allows for automated workflows that can help in tracking and managing employee deductions efficiently. This optimization can save time and reduce errors in payroll management.

-

What is the pricing structure for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans tailored to different business needs, including options for managing documents related to retenciones trabajo. You can choose a plan based on your organizational size and required features. This ensures that you pay only for the functionalities that your business truly needs.

-

Are there any features specifically designed for handling retenciones trabajo?

Yes, airSlate SignNow includes features that support the handling of documents associated with retenciones trabajo, such as customizable templates and document storage. These tools allow businesses to easily create, manage, and retrieve necessary documentation, ensuring compliance and accuracy in payroll processing.

-

Can airSlate SignNow integrate with my existing payroll system?

Absolutely! AirSlate SignNow can seamlessly integrate with various payroll systems and software, allowing for efficient handling of retenciones trabajo. This integration ensures that all signed documents and necessary deductions are aligned with your existing payroll processes.

-

What benefits can I expect from using airSlate SignNow for retenciones trabajo management?

By using airSlate SignNow for managing retenciones trabajo, businesses can expect improved efficiency, reduced paperwork, and enhanced compliance with tax regulations. The intuitive platform helps simplify the signing process and ensures that all documents are securely stored and easily accessible.

-

Is airSlate SignNow secure for handling sensitive documents like those related to retenciones trabajo?

Yes, airSlate SignNow employs advanced security measures to protect sensitive documents, including those related to retenciones trabajo. With features like document encryption and secure access controls, you can trust that your payroll-related information remains confidential and safe.

Get more for Modelo 145 Word

- Marital domestic separation and property settlement agreement minor children no joint property or debts where divorce action 497310939 form

- Dependent minor child form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts where 497310941 form

- Marital domestic separation and property settlement agreement minor children parties may have joint property or debts effective 497310942 form

- Marital domestic separation and property settlement agreement for persons with no children no joint property or debts effective 497310943 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts where 497310944 form

- Marital domestic separation and property settlement agreement no children parties may have joint property or debts effective 497310945 form

- Marital domestic separation and property settlement agreement adult children parties may have joint property or debts where 497310946 form

Find out other Modelo 145 Word

- eSignature Missouri Car Dealer Purchase Order Template Easy

- eSignature Indiana Charity Residential Lease Agreement Simple

- How Can I eSignature Maine Charity Quitclaim Deed

- How Do I eSignature Michigan Charity LLC Operating Agreement

- eSignature North Carolina Car Dealer NDA Now

- eSignature Missouri Charity Living Will Mobile

- eSignature New Jersey Business Operations Memorandum Of Understanding Computer

- eSignature North Dakota Car Dealer Lease Agreement Safe

- eSignature Oklahoma Car Dealer Warranty Deed Easy

- eSignature Oregon Car Dealer Rental Lease Agreement Safe

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy