9 3 Impuesto Sobre La Renta De Las Personas Fsicas 2024-2026

What is the 9 3 Impuesto Sobre La Renta De Las Personas Físicas

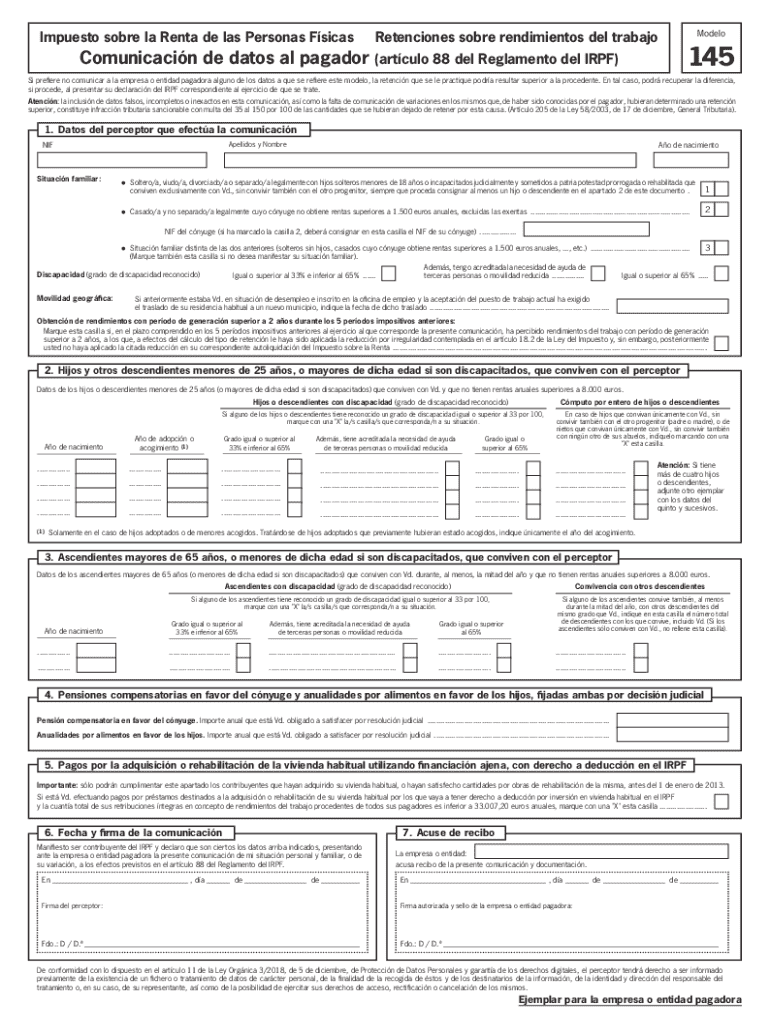

The 9 3 Impuesto Sobre La Renta De Las Personas Físicas is a tax form used for reporting individual income tax in certain jurisdictions. This form is specifically designed for individuals to declare their income, deductions, and tax liabilities. It is essential for ensuring compliance with local tax laws and regulations. The form collects information regarding various income sources, including wages, interest, dividends, and other earnings. Understanding this form is crucial for individuals to accurately report their financial activities and fulfill their tax obligations.

How to use the 9 3 Impuesto Sobre La Renta De Las Personas Físicas

Using the 9 3 Impuesto Sobre La Renta De Las Personas Físicas involves several steps. First, gather all necessary financial documents, such as W-2s, 1099s, and any records of deductions. Next, fill out the form by entering your personal information, including your name, address, and Social Security number. Report your total income from all sources and apply any eligible deductions. After completing the form, review it for accuracy and ensure all required fields are filled. Finally, submit the form by the designated deadline to avoid penalties.

Steps to complete the 9 3 Impuesto Sobre La Renta De Las Personas Físicas

Completing the 9 3 Impuesto Sobre La Renta De Las Personas Físicas requires a systematic approach:

- Gather all necessary documents, including income statements and deduction records.

- Fill in your personal information accurately at the top of the form.

- List all sources of income, ensuring to include wages, dividends, and any freelance earnings.

- Apply any deductions you qualify for, such as student loan interest or mortgage interest.

- Calculate your total tax liability based on the provided tax tables.

- Review the completed form for any errors or omissions.

- Submit the form by the specified deadline, either electronically or via mail.

Required Documents

To effectively complete the 9 3 Impuesto Sobre La Renta De Las Personas Físicas, you will need several key documents:

- W-2 forms from employers, detailing your annual earnings and tax withholdings.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or investment earnings.

- Documentation for deductions, including receipts for medical expenses, charitable contributions, and mortgage interest statements.

Filing Deadlines / Important Dates

Filing deadlines for the 9 3 Impuesto Sobre La Renta De Las Personas Físicas are critical to avoid penalties. Typically, the deadline for submission is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to the filing schedule, especially in light of any tax law changes or special circumstances that may arise.

Penalties for Non-Compliance

Failing to file the 9 3 Impuesto Sobre La Renta De Las Personas Físicas on time can result in significant penalties. The IRS may impose a failure-to-file penalty, which is typically a percentage of the unpaid tax for each month the return is late. Additionally, if taxes owed are not paid, interest will accrue on the unpaid balance. It is important to adhere to filing deadlines and ensure accurate reporting to avoid these financial repercussions.

Handy tips for filling out 9 3 Impuesto Sobre La Renta De Las Personas Fsicas online

Quick steps to complete and e-sign 9 3 Impuesto Sobre La Renta De Las Personas Fsicas online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Obtain access to a GDPR and HIPAA compliant platform for maximum simplicity. Use signNow to e-sign and send out 9 3 Impuesto Sobre La Renta De Las Personas Fsicas for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct 9 3 impuesto sobre la renta de las personas fsicas

Create this form in 5 minutes!

How to create an eSignature for the 9 3 impuesto sobre la renta de las personas fsicas

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas?

The 9 3 Impuesto Sobre La Renta De Las Personas Fsicas refers to the income tax for individuals in certain jurisdictions. Understanding this tax is crucial for compliance and financial planning. airSlate SignNow can help streamline document management related to tax filings.

-

How can airSlate SignNow assist with the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas?

airSlate SignNow provides an efficient platform for eSigning and sending documents related to the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas. This ensures that all necessary forms are completed and submitted on time, reducing the risk of penalties.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business needs. Each plan includes features that can assist with managing documents related to the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas, ensuring you find a solution that fits your budget.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools are particularly useful for managing documents associated with the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas, making the process more efficient.

-

Can airSlate SignNow integrate with other software for tax purposes?

Yes, airSlate SignNow integrates seamlessly with various accounting and tax software. This integration can simplify the management of documents related to the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas, allowing for a more streamlined workflow.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents offers numerous benefits, including enhanced security, ease of use, and time savings. These advantages are particularly relevant when dealing with the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas, as they help ensure compliance and accuracy.

-

Is airSlate SignNow suitable for individuals filing the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas?

Absolutely! airSlate SignNow is designed for both individuals and businesses, making it a great choice for anyone needing to file the 9 3 Impuesto Sobre La Renta De Las Personas Fsicas. Its user-friendly interface simplifies the eSigning process for personal tax documents.

Get more for 9 3 Impuesto Sobre La Renta De Las Personas Fsicas

- Condominium sale prohibition covenant washington form

- Abc thought log form

- Permit preventwildfireca org form

- Form ct 222 underpayment of estimated tax by a corporation tax year 772083723

- Academy admission form

- Financial contract template form

- Financial loan contract template form

- Finders fee contract template form

Find out other 9 3 Impuesto Sobre La Renta De Las Personas Fsicas

- Can I eSign Mississippi Car Dealer Resignation Letter

- eSign Missouri Car Dealer Lease Termination Letter Fast

- Help Me With eSign Kentucky Business Operations Quitclaim Deed

- eSign Nevada Car Dealer Warranty Deed Myself

- How To eSign New Hampshire Car Dealer Purchase Order Template

- eSign New Jersey Car Dealer Arbitration Agreement Myself

- eSign North Carolina Car Dealer Arbitration Agreement Now

- eSign Ohio Car Dealer Business Plan Template Online

- eSign Ohio Car Dealer Bill Of Lading Free

- How To eSign North Dakota Car Dealer Residential Lease Agreement

- How Do I eSign Ohio Car Dealer Last Will And Testament

- Sign North Dakota Courts Lease Agreement Form Free

- eSign Oregon Car Dealer Job Description Template Online

- Sign Ohio Courts LLC Operating Agreement Secure

- Can I eSign Michigan Business Operations POA

- eSign Car Dealer PDF South Dakota Computer

- eSign Car Dealer PDF South Dakota Later

- eSign Rhode Island Car Dealer Moving Checklist Simple

- eSign Tennessee Car Dealer Lease Agreement Form Now

- Sign Pennsylvania Courts Quitclaim Deed Mobile