Mastering Depreciation Final Exam Answers Form

Understanding the Mastering Depreciation Final Exam Answers

The Mastering Depreciation Final Exam Answers serve as a comprehensive resource for individuals preparing for assessments related to depreciation concepts. This exam typically covers essential topics such as the methods of depreciation, the impact of depreciation on financial statements, and compliance with both GAAP and tax regulations. Understanding these answers can enhance your grasp of how depreciation affects asset valuation and financial reporting.

Steps to Complete the Mastering Depreciation Final Exam Answers

Completing the Mastering Depreciation Final Exam requires a structured approach. Begin by reviewing the key concepts of depreciation, including straight-line and declining balance methods. Next, practice answering sample questions to familiarize yourself with the exam format. Ensure you understand the legal implications of depreciation under both GAAP and tax regulations. Finally, allocate sufficient time for review and practice to reinforce your knowledge before taking the exam.

Legal Use of the Mastering Depreciation Final Exam Answers

Utilizing the Mastering Depreciation Final Exam Answers is legal as long as you adhere to academic integrity guidelines. These answers are intended for educational purposes and should be used to enhance understanding rather than as a means to bypass learning. Institutions may have specific policies regarding the use of such resources, so it is essential to consult your school’s guidelines to ensure compliance.

Key Elements of the Mastering Depreciation Final Exam Answers

Key elements of the Mastering Depreciation Final Exam Answers include an overview of depreciation methods, calculations for various asset types, and examples illustrating the application of these methods. Additionally, the answers often highlight common pitfalls and misconceptions related to depreciation, providing valuable insights that can aid in successful exam completion.

Examples of Using the Mastering Depreciation Final Exam Answers

Examples of using the Mastering Depreciation Final Exam Answers can include case studies where students apply depreciation methods to real-world scenarios. For instance, a student might analyze how a company calculates depreciation for its fleet of vehicles, comparing straight-line versus declining balance methods. These practical examples can help solidify theoretical knowledge and prepare students for similar questions on the exam.

IRS Guidelines on Depreciation

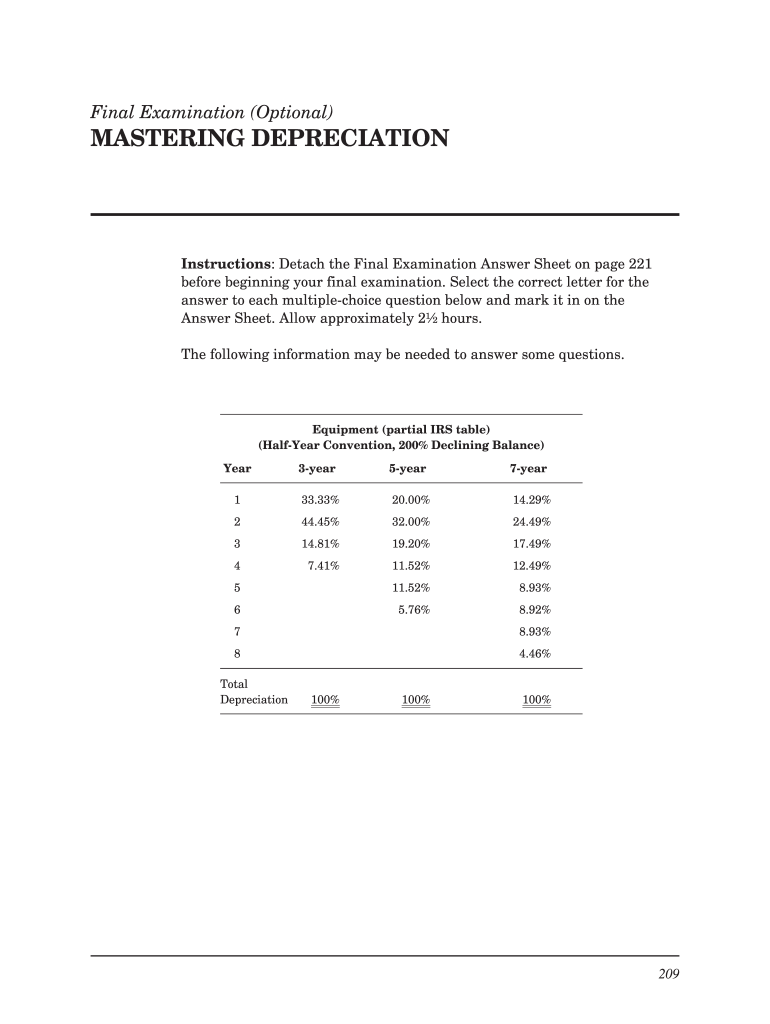

The IRS provides specific guidelines on depreciation, outlining acceptable methods and the treatment of various asset types. Understanding these guidelines is crucial for accurate financial reporting and tax compliance. Familiarizing yourself with IRS publications related to depreciation can enhance your ability to answer exam questions accurately and apply this knowledge in real-world situations.

Quick guide on how to complete mastering depreciation final exam answers

Effortlessly Prepare Mastering Depreciation Final Exam Answers on Any Device

The online management of documents has become increasingly favored by organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing easy access to the correct form and secure online storage. airSlate SignNow provides all the necessary tools for you to create, modify, and electronically sign your documents quickly and without hassle. Manage Mastering Depreciation Final Exam Answers on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The Simplest Way to Edit and Electronically Sign Mastering Depreciation Final Exam Answers with Ease

- Obtain Mastering Depreciation Final Exam Answers and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns over lost or misfiled documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Mastering Depreciation Final Exam Answers to ensure excellent communication throughout every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mastering depreciation final exam answers

The way to generate an electronic signature for your PDF file online

The way to generate an electronic signature for your PDF file in Google Chrome

The way to make an eSignature for signing PDFs in Gmail

The way to create an electronic signature from your mobile device

The best way to make an electronic signature for a PDF file on iOS

The way to create an electronic signature for a PDF file on Android devices

People also ask

-

What are the main features of airSlate SignNow?

airSlate SignNow offers features such as eSigning, document templates, and real-time collaboration to streamline your document workflows. With our platform, you can easily manage and track your documents, ensuring you have the best tools to tackle your 'mastering depreciation final exam answers' efficiently.

-

How can airSlate SignNow help me with my final exam preparation?

By using airSlate SignNow, you can digitally organize your study materials related to 'mastering depreciation final exam answers', making it easier to access and review them. The platform’s eSigning feature allows for quick approvals and feedback from study partners, enhancing your overall preparation experience.

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows users to explore our features without commitment. This is an excellent opportunity to evaluate how our solutions can assist you in preparing for 'mastering depreciation final exam answers' before making a purchase.

-

What pricing options does airSlate SignNow provide?

airSlate SignNow offers flexible pricing plans to cater to various needs, including individual, small business, and enterprise solutions. Our competitive pricing ensures that you can find a plan that suits your budget while effectively helping with tasks such as achieving 'mastering depreciation final exam answers'.

-

Can I integrate airSlate SignNow with other tools?

Absolutely! airSlate SignNow seamlessly integrates with various software solutions such as Google Drive, Salesforce, and various CRMs. These integrations can enhance your workflow, especially when dealing with 'mastering depreciation final exam answers' by connecting your preferred tools.

-

How secure is my information with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform uses industry-standard encryption and compliance measures to ensure that your documents and information related to 'mastering depreciation final exam answers' are protected at all times.

-

Can I customize document templates in airSlate SignNow?

Yes, airSlate SignNow allows users to create and customize document templates to suit their specific needs. This is particularly beneficial for preparing materials related to 'mastering depreciation final exam answers', as you can tailor templates for quick access and efficiency.

Get more for Mastering Depreciation Final Exam Answers

- Assignment of mortgage package maine form

- Assignment of lease package maine form

- Lease purchase agreements package maine form

- Satisfaction cancellation or release of mortgage package maine form

- Premarital agreements package maine form

- Painting contractor package maine form

- Framing contractor package maine form

- Foundation contractor package maine form

Find out other Mastering Depreciation Final Exam Answers

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer