Ind4000 Payment to Individuals Form Revised April DOC Basic Overview of the Accounts Payable Module in DaFIS Nyu

Overview of the Ind4000 Payment to Individuals Form

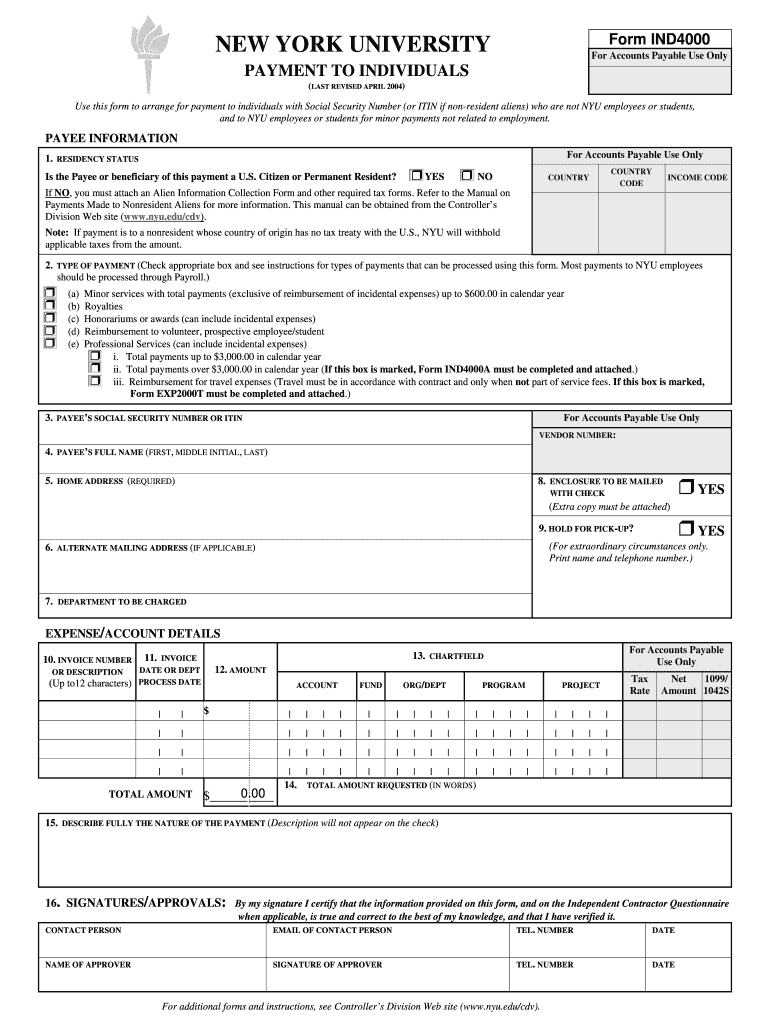

The Ind4000 Payment to Individuals form is essential for documenting payments made to individuals by organizations. This form is particularly relevant in the context of accounts payable, ensuring that all financial transactions are recorded accurately. It is crucial for compliance with IRS regulations, as it helps organizations maintain proper records and report payments made to individuals, including contractors and vendors.

Steps to Complete the Ind4000 Payment to Individuals Form

Completing the Ind4000 form involves several key steps. First, gather all necessary information, including the recipient's name, address, and taxpayer identification number. Next, detail the payment amount and the purpose of the payment. Ensure that all entries are accurate, as errors can lead to compliance issues. Once completed, the form should be signed and dated by the authorized individual within the organization. Finally, retain a copy for your records and submit the original to the appropriate department for processing.

Legal Use of the Ind4000 Payment to Individuals Form

The Ind4000 form must be used in accordance with IRS guidelines to ensure its legal validity. This includes adhering to specific requirements regarding the information provided and the timing of submissions. Organizations must ensure that they issue the form to recipients in a timely manner, typically by January 31 of the year following the payment. Failure to comply with these regulations can result in penalties and complications during audits.

Key Elements of the Ind4000 Payment to Individuals Form

Several key elements must be included in the Ind4000 form to ensure its effectiveness and compliance. These include:

- Recipient Information: Full name, address, and taxpayer identification number.

- Payment Details: Amount paid and the purpose of the payment.

- Signature: An authorized signature from the issuing organization.

- Date: The date the payment was made and the form was completed.

Examples of Using the Ind4000 Payment to Individuals Form

The Ind4000 form can be utilized in various scenarios, such as:

- Payments to independent contractors for services rendered.

- Reimbursements to individuals for expenses incurred on behalf of the organization.

- Honorariums paid to speakers or consultants.

Form Submission Methods for the Ind4000 Payment to Individuals Form

Organizations can submit the Ind4000 form through multiple methods. These include:

- Online Submission: Many organizations opt for electronic submission to streamline the process.

- Mail: The completed form can be mailed to the appropriate department or agency.

- In-Person: Some organizations may choose to deliver the form in person for immediate processing.

Quick guide on how to complete ind4000 payment to individuals form revised april 2004doc basic overview of the accounts payable module in dafis nyu

Complete Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides you with all the resources required to create, edit, and eSign your documents quickly and without interruptions. Manage Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest method to edit and eSign Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu without hassle

- Locate Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using features that airSlate SignNow specifically provides for that purpose.

- Create your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to submit your form, whether via email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ind4000 payment to individuals form revised april 2004doc basic overview of the accounts payable module in dafis nyu

How to make an eSignature for your Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu online

How to generate an eSignature for the Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu in Google Chrome

How to generate an electronic signature for signing the Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu in Gmail

How to generate an eSignature for the Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu right from your mobile device

How to generate an electronic signature for the Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu on iOS devices

How to generate an eSignature for the Ind4000 Payment To Individuals Form Revised April 2004doc Basic Overview Of The Accounts Payable Module In Dafis Nyu on Android

People also ask

-

What is the Ind4000 Payment To Individuals Form Revised April doc, and how does it relate to the Accounts Payable Module in DaFIS Nyu?

The Ind4000 Payment To Individuals Form Revised April doc is a key document used for processing payments to individuals within the Accounts Payable Module in DaFIS Nyu. This form ensures compliance with payment regulations and streamlines the payment process, making it easier for organizations to manage their accounts payable efficiently.

-

How does airSlate SignNow simplify the completion of the Ind4000 Payment To Individuals Form?

airSlate SignNow offers a user-friendly platform that allows businesses to easily fill out and eSign the Ind4000 Payment To Individuals Form Revised April doc. By integrating eSignature capabilities, it accelerates the approval process and ensures that all necessary parties can sign the document electronically, enhancing efficiency.

-

What are the pricing options for using airSlate SignNow with the Ind4000 Payment To Individuals Form?

airSlate SignNow provides various pricing plans tailored to different business needs, ensuring you can access features suited for processing the Ind4000 Payment To Individuals Form Revised April doc. Whether you’re a small business or a large organization, you can find a plan that fits your budget while still offering comprehensive eSigning solutions.

-

Can I integrate airSlate SignNow with other software systems for managing the Ind4000 Payment To Individuals Form?

Yes, airSlate SignNow offers seamless integrations with various accounting and financial software, enhancing the management of the Ind4000 Payment To Individuals Form Revised April doc. This ensures that you can efficiently sync data across platforms, reducing manual entry and errors in your accounts payable processes.

-

What features does airSlate SignNow provide to enhance the use of the Ind4000 Payment To Individuals Form?

airSlate SignNow includes advanced features such as templates, automated workflows, and real-time tracking for the Ind4000 Payment To Individuals Form Revised April doc. These features help streamline the document management process, making it easier to maintain compliance and monitor the status of payments.

-

How does using airSlate SignNow benefit my business in processing payments via the Ind4000 form?

Using airSlate SignNow for processing payments through the Ind4000 Payment To Individuals Form Revised April doc can signNowly reduce turnaround times and enhance accuracy. The platform's eSigning capabilities and document automation minimize delays, allowing your business to maintain efficient cash flow management.

-

Is there customer support available for issues related to the Ind4000 Payment To Individuals Form in airSlate SignNow?

Absolutely! airSlate SignNow offers dedicated customer support to assist you with any issues related to the Ind4000 Payment To Individuals Form Revised April doc. Whether you need help with setup, troubleshooting, or best practices, our support team is here to ensure you have a smooth experience.

Get more for Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu

- Form medalert rev 1015 florida board of bar examiners floridabarexam

- 8128 mercury court san diego ca 92111 form

- Emergency verified motion for child pick up order forms divorceline

- Florida supreme court approved family law form 12903banswer to petion for dissolution of marriage 1210

- Clerk of the court duval county injunction form

- Miami dade eviction summons form

- Miami dade county eviction package form

- 981a1 petition to terminate parental rights pending stepparent adoption when should this form be used

Find out other Ind4000 Payment To Individuals Form Revised April doc Basic Overview Of The Accounts Payable Module In DaFIS Nyu

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure