Salvation Army Receipt 2016-2026

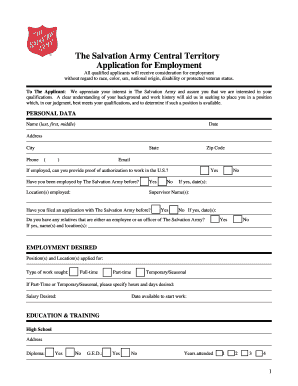

What is the Salvation Army Receipt

The Salvation Army receipt serves as official documentation for donations made to the organization. It is essential for individuals seeking tax deductions related to their charitable contributions. This receipt typically includes the donor's name, the date of the donation, a description of the items donated, and the estimated value of those items. It is important to retain this receipt for tax filing purposes, as it provides proof of the donation to the IRS.

How to obtain the Salvation Army Receipt

To obtain a Salvation Army receipt, donors can request one at the time of donation. When donating items, such as clothing or household goods, the donor should ask the staff for a receipt. Additionally, if donations are made online or through scheduled pickups, the organization usually provides an electronic receipt via email. Donors should ensure they keep a record of their donations to facilitate the receipt process.

Steps to complete the Salvation Army Receipt

Completing the Salvation Army receipt involves several straightforward steps. First, gather all relevant information, including the date of the donation and a detailed list of the items contributed. Next, fill out the receipt with this information, ensuring accuracy in the description and estimated value of each item. Finally, sign and date the receipt to validate it for tax purposes. If using an electronic format, ensure that the eSignature complies with legal standards.

Legal use of the Salvation Army Receipt

The Salvation Army receipt is legally recognized as proof of charitable contributions, which is crucial for tax deductions. To be valid, the receipt must include specific details such as the donor's name, the date of the donation, and a description of the donated items. It is advisable to keep this receipt with other tax documents, as the IRS may require it during an audit or when verifying deductions.

IRS Guidelines

The IRS has specific guidelines regarding charitable contributions that affect how the Salvation Army receipt should be used. For donations valued at more than $250, donors must obtain a written acknowledgment from the charity, which the Salvation Army receipt serves as. It is essential to ensure that the value of the donated items is reasonable and that the receipt is kept for at least three years after filing the tax return to comply with IRS regulations.

Examples of using the Salvation Army Receipt

There are various scenarios in which the Salvation Army receipt can be utilized. For instance, if an individual donates a bag of clothing valued at $100, they can use the receipt to claim this amount as a deduction on their tax return. Similarly, if a business donates office furniture, the receipt can substantiate the donation's value for tax reporting. Keeping these receipts organized can simplify the tax filing process and ensure compliance with IRS requirements.

Quick guide on how to complete salvation army receipt

Complete Salvation Army Receipt effortlessly on any device

Web-based document management has become widely accepted by businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to easily find the right form and securely keep it online. airSlate SignNow furnishes you with all the necessary tools to create, adjust, and eSign your documents quickly without delays. Manage Salvation Army Receipt on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest way to modify and eSign Salvation Army Receipt seamlessly

- Find Salvation Army Receipt and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools offered by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign Salvation Army Receipt while ensuring exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the salvation army receipt

How to make an eSignature for a PDF document in the online mode

How to make an eSignature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to create an electronic signature right from your mobile device

The best way to make an eSignature for a PDF document on iOS devices

The best way to create an electronic signature for a PDF on Android devices

People also ask

-

What is the salvation army donation form, and how does it work?

The salvation army donation form is a straightforward digital document designed to facilitate donations to the Salvation Army. Users can easily fill out the form online, providing necessary details about their contributions. Once completed, the form can be e-signed using airSlate SignNow, making the donation process quick and hassle-free.

-

How can I access the salvation army donation form?

You can access the salvation army donation form directly through the official Salvation Army website or via provided links. With airSlate SignNow, you can also create a custom version tailored to your needs. Simply navigate to the forms section and search for the donation form to get started.

-

Is there a fee to use the salvation army donation form with airSlate SignNow?

Using the salvation army donation form on airSlate SignNow is cost-effective, with various pricing plans available based on your business needs. Basic usage of the form may have no fees, while advanced features or high-volume signing might incur charges. It's important to review the pricing options on the airSlate SignNow website to choose the right package.

-

What features does the salvation army donation form offer?

The salvation army donation form offers a range of features, including customizable fields, e-signature capability, and secure data storage. With airSlate SignNow, you can track the status of your forms and receive notifications upon completion. Additionally, the platform ensures that all donated information is kept confidential and compliant with data protection regulations.

-

Can I integrate the salvation army donation form with other applications?

Yes, the salvation army donation form can be easily integrated with various applications through airSlate SignNow's robust API. This means you can streamline your donation processes by connecting the form with your CRM, payment gateways, and more. Integration helps enhance functionality and improve overall efficiency.

-

What benefits can I expect from using the salvation army donation form?

By using the salvation army donation form, you can simplify the donation process for your supporters, making it more accessible and user-friendly. The e-signature feature ensures that contributions are legally binding while reducing paper usage. Additionally, the digital format allows for faster processing and improved organization of donation records.

-

Is the salvation army donation form mobile-friendly?

Absolutely! The salvation army donation form is designed to be mobile-friendly, allowing donors to contribute easily from their smartphones or tablets. With airSlate SignNow, the responsive design ensures that all features, including e-signatures, work seamlessly on mobile devices, enhancing donor convenience.

Get more for Salvation Army Receipt

- Power of attorney forms package mississippi

- Mississippi uniform

- Employment hiring process package mississippi form

- Mississippi authorization form

- Ms revocation 497315687 form

- Employment or job termination package mississippi form

- Newly widowed individuals package mississippi form

- Employment interview package mississippi form

Find out other Salvation Army Receipt

- Can I eSign Hawaii Car Dealer Word

- How To eSign Hawaii Car Dealer PPT

- How To eSign Hawaii Car Dealer PPT

- How Do I eSign Hawaii Car Dealer PPT

- Help Me With eSign Hawaii Car Dealer PPT

- How Can I eSign Hawaii Car Dealer Presentation

- How Do I eSign Hawaii Business Operations PDF

- How Can I eSign Hawaii Business Operations PDF

- How To eSign Hawaii Business Operations Form

- How Do I eSign Hawaii Business Operations Form

- Help Me With eSign Hawaii Business Operations Presentation

- How Do I eSign Idaho Car Dealer Document

- How Do I eSign Indiana Car Dealer Document

- How To eSign Michigan Car Dealer Document

- Can I eSign Michigan Car Dealer PPT

- How Can I eSign Michigan Car Dealer Form

- Help Me With eSign Kansas Business Operations PPT

- How Can I eSign Mississippi Car Dealer Form

- Can I eSign Nebraska Car Dealer Document

- Help Me With eSign Ohio Car Dealer Document