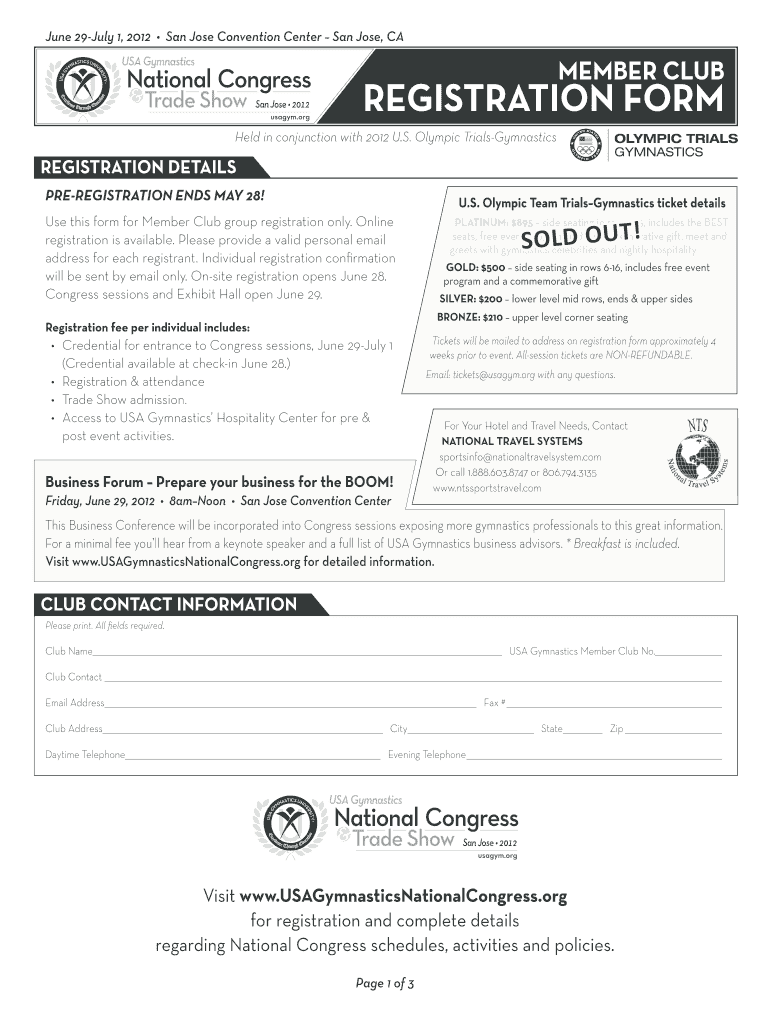

MEMBER CLUB REGISTRATION FORM USA Gymnastics Usagym

Understanding the California Quicstop Franchise

The California Quicstop franchise offers a unique business opportunity for aspiring entrepreneurs. This franchise model is designed to provide convenience and accessibility to customers, combining elements of retail and service. Franchisees benefit from established brand recognition, operational support, and a proven business framework. Understanding the operational guidelines, market positioning, and customer engagement strategies is essential for success within this franchise system.

Steps to Complete the Franchise Application

Completing the California Quicstop franchise application involves several key steps to ensure a smooth process. Begin by gathering necessary documents, including personal identification, financial statements, and any relevant business experience. Next, fill out the application form accurately, providing detailed information about your background and motivations for joining the franchise. Once completed, submit the application through the designated channels, either online or via mail, as specified by the franchise guidelines. Following submission, prepare for an interview or discussion with franchise representatives to further discuss your application and potential fit within the franchise network.

Key Elements of the Franchise Agreement

The franchise agreement for California Quicstop includes several critical components that outline the relationship between the franchisor and franchisee. Key elements typically include franchise fees, royalty structures, territory rights, and operational guidelines. It is important to thoroughly review these terms to understand your obligations and the support you will receive. Additionally, the agreement may specify training programs, marketing support, and compliance requirements to ensure brand consistency and operational success.

Legal Considerations for Franchise Ownership

Owning a California Quicstop franchise comes with various legal responsibilities. Franchisees must comply with federal and state regulations, including those related to business licenses, health and safety standards, and employment laws. Understanding these legal frameworks is crucial to avoid penalties and ensure the franchise operates within the law. Franchisees should also consider consulting with a legal professional to review the franchise agreement and any other legal documents associated with the business.

Eligibility Criteria for Prospective Franchisees

To qualify for a California Quicstop franchise, applicants must meet specific eligibility criteria. This often includes having a certain level of financial resources to cover initial investments and ongoing operational costs. Additionally, candidates should possess relevant business experience or a strong willingness to learn and adapt to the franchise model. A background in retail or customer service may also be advantageous. Meeting these criteria increases the likelihood of a successful franchise operation.

Franchise Support and Training Programs

California Quicstop provides comprehensive support and training programs to its franchisees. These programs are designed to equip new franchise owners with the necessary skills and knowledge to operate successfully. Training typically covers operational procedures, customer service standards, and marketing strategies. Ongoing support may include regular communication with franchise representatives, access to marketing materials, and updates on industry trends. This support system is vital for maintaining brand integrity and ensuring franchisee success.

Quick guide on how to complete usa gymnastics member club

Complete usa gymnastics member club effortlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents promptly without any delays. Manage california quicstop franchise on any device with the airSlate SignNow applications for Android or iOS and enhance any document-based task today.

The simplest way to modify and eSign club registration form with ease

- Obtain gymnastics registration form and click on Get Form to initiate.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivery for your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign usa gym club and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

FAQs usagym

-

I have created a registration form in HTML. When someone fills it out, how do I get the filled out form sent to my email?

Are you assuming that the browser will send the email? That is not the way it is typically done. You include in your registration form a and use PHP or whatever on the server to send the email. In PHP it is PHP: mail - Manual But if you are already on the server it seems illogical to send an email. Just register the user immediately.

-

How can someone get a translator for a USA tourist visa interview? Is there any form to fill out or do they give a translator during interview time?

The officer who interviews the visa applicant will usually speak and understand the most common local language. If not, another officer or a local consular employee will probably be able to translate. If the language is obscure enough, the consular officer might still find, somewhere in the embassy/consulate, an employee who has it.I remember an instance when the only employee who spoke both the primary local language and the very rare language of the visa applicant was one of the oldest, shyest, most reticent, lowest-level gardeners. He was so proud of the officers’ need of and appreciation for that rare skill that one time, that he began to dress better, stand straighter, feel and act more confident, and volunteer for and learn from special, complicated jobs. He eventually earned a permanent promotion to head gardener and did an excellent job at it.

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How can I change CA firms if I filled out an articleship form in February but did not submit it to the ICAI? Can the principal have restrictions in registration?

If the article ship registration has not been done, the principal can generally not restrict you.However, if there are any serious mis conduct on your end, then he can place his views to the Institute, so that the Institute can take appropriate action in such a way that you are not enrolled as an articled clerk under ICAI rules. But this is very rare, and exceptional circumstances.In general, and if you have conducted yourselves professionally, then there is no need to worry.

Related searches to gymnastics registration form template

Create this form in 5 minutes!

How to create an eSignature for the gymnastics franchise california

How to make an electronic signature for the Member Club Registration Form Usa Gymnastics Usagym online

How to make an electronic signature for your Member Club Registration Form Usa Gymnastics Usagym in Google Chrome

How to create an electronic signature for signing the Member Club Registration Form Usa Gymnastics Usagym in Gmail

How to create an electronic signature for the Member Club Registration Form Usa Gymnastics Usagym right from your smartphone

How to generate an eSignature for the Member Club Registration Form Usa Gymnastics Usagym on iOS

How to make an eSignature for the Member Club Registration Form Usa Gymnastics Usagym on Android

People also ask club registration form

-

What is the California QuicStop franchise?

The California QuicStop franchise is a business opportunity that allows individuals to own and operate a convenience store franchise in California. It offers a proven business model, training, and support to help franchisees succeed in their entrepreneurial endeavors.

-

What are the initial costs associated with the California QuicStop franchise?

The initial costs for the California QuicStop franchise can vary based on location and specific franchise requirements. Prospective franchisees should expect costs related to franchising fees, store setup, inventory, and ongoing operational expenses. It's advisable to review the franchise disclosure document for detailed financial requirements.

-

What benefits does the California QuicStop franchise offer?

Owning a California QuicStop franchise provides numerous benefits, including brand recognition, training programs, and a supportive network of fellow franchisees. Additionally, operating under a well-established brand can attract customers and foster trust in the community. Franchisees also benefit from ongoing marketing support and operational assistance.

-

How does the California QuicStop franchise integrate with airSlate SignNow?

The California QuicStop franchise can streamline its document signing and management processes by integrating with airSlate SignNow. This digital solution enables franchise owners to send and eSign documents efficiently, reducing paperwork and enhancing operational efficiency. By utilizing airSlate SignNow, franchisees can focus more on growing their business.

-

What kind of training is provided to California QuicStop franchisees?

California QuicStop franchisees receive comprehensive training designed to prepare them for successful operations. This includes instruction on store management, inventory control, customer service, and marketing strategies. Ongoing training sessions ensure that franchisees stay updated on industry trends and best practices.

-

Can I operate a California QuicStop franchise part-time?

While it is possible to operate a California QuicStop franchise part-time, it is generally recommended to be involved full-time for optimal success. Running a franchise requires signNow time dedicated to customer service, inventory management, and marketing efforts. However, many franchisees adopt flexible schedules to manage their workload.

-

What marketing support is available for the California QuicStop franchise?

Franchisees of the California QuicStop franchise benefit from extensive marketing support including brand development, promotional materials, and marketing strategies. The franchise encourages local marketing initiatives to help attract customers. Ongoing guidance from the franchise's marketing team is also available to assist with campaigns and branding.

Get more for gymnastics registration form

- Honor code contract miami dade county public schools form

- Georgia pta audit financial review form

- Pta request form

- Application for membership privileges the club at lake sinclair form

- Backup offer addendum agent services hawaii life form

- Sample pet addendum to a rental agreement humane form

- Ameren il military support program application form

- Cps science fair safety sheet form

Find out other usa gym club

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement