Texas Equity 2018-2026

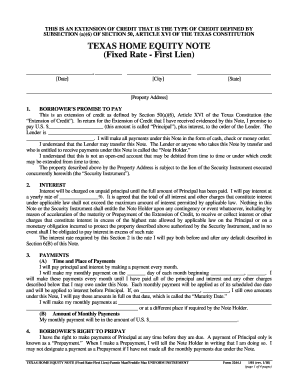

What is the Texas Equity

The Texas equity refers to the value of a homeowner's interest in their property after deducting any outstanding debts secured by the property. This concept is particularly relevant when considering home equity loans or lines of credit. In Texas, homeowners have specific rights and regulations governing how they can access this equity, ensuring they are protected during the lending process. Understanding the Texas equity is essential for homeowners looking to leverage their property for financial needs.

How to use the Texas Equity

Using the Texas equity involves several steps, primarily focused on accessing funds through a home equity loan or line of credit. Homeowners can tap into their equity to finance major expenses, such as home renovations, education, or debt consolidation. To utilize this equity, homeowners must first determine their available equity by assessing their home's current market value and subtracting any existing mortgage balances. Once they have this information, they can approach lenders to explore their options for accessing funds.

Steps to complete the Texas Equity

Completing the Texas equity process typically involves a series of steps:

- Evaluate your home's market value through appraisals or comparative market analysis.

- Calculate your available equity by subtracting your mortgage balance from the market value.

- Research potential lenders and their terms for home equity loans or lines of credit.

- Gather necessary documentation, including income verification and property details.

- Submit your application to the chosen lender and await approval.

- Review the loan terms carefully before signing any agreements.

Legal use of the Texas Equity

The legal use of Texas equity is governed by state laws that protect homeowners. Texas law requires specific disclosures and compliance with regulations when accessing home equity. For instance, lenders must provide clear information about the terms of the loan, including interest rates and fees. Additionally, homeowners must be aware of the limitations on how much equity they can borrow, which is capped at a certain percentage of their home's value. Understanding these legal parameters helps ensure that homeowners make informed decisions regarding their equity.

Required Documents

When applying for a home equity loan or line of credit in Texas, several documents are typically required:

- Proof of identity, such as a driver's license or passport.

- Income verification, including pay stubs or tax returns.

- Current mortgage statement showing the outstanding balance.

- Property tax statements to confirm ownership and value.

- Homeowners insurance policy details to protect the property.

Eligibility Criteria

Eligibility for accessing Texas equity often depends on several factors, including:

- The homeowner's credit score, which affects loan approval and interest rates.

- The amount of equity available in the property, which must meet lender requirements.

- The homeowner's income and financial stability to ensure they can repay the loan.

- Compliance with Texas state laws regarding home equity borrowing.

Quick guide on how to complete texas equity

Complete Texas Equity effortlessly on any device

Online document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without any hold-ups. Handle Texas Equity on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Texas Equity with ease

- Obtain Texas Equity and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and select the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), an invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Texas Equity to ensure outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the texas equity

How to generate an eSignature for a PDF file in the online mode

How to generate an eSignature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your smartphone

The best way to create an eSignature for a PDF file on iOS devices

The best way to make an eSignature for a PDF file on Android

People also ask

-

What is Texas home equity?

Texas home equity allows homeowners to borrow against the equity of their property. It enables residents to access funds for various purposes, such as home improvements, debt consolidation, or other financial needs. Understanding Texas home equity is essential for making informed borrowing decisions.

-

How does airSlate SignNow support Texas home equity transactions?

airSlate SignNow streamlines the process of signing documents related to Texas home equity transactions. Our platform allows for quick and secure electronic signatures, ensuring that all parties can easily complete necessary paperwork. This efficiency can signNowly enhance your home equity borrowing experience.

-

What are the pricing options for using airSlate SignNow with Texas home equity?

airSlate SignNow offers flexible pricing plans to accommodate various business needs, including those related to Texas home equity. Our cost-effective solutions make it simple for users to manage document workflows without overspending. You can select a plan that best fits your requirements.

-

What features does airSlate SignNow provide for Texas home equity documentation?

With airSlate SignNow, you gain access to features like template creation, document sharing, and real-time tracking, all tailored for Texas home equity documents. These features help simplify the signing process, ensuring a seamless experience for both lenders and borrowers. Efficiently managing your documents has never been easier.

-

What benefits does using airSlate SignNow offer for Texas home equity transactions?

Using airSlate SignNow for Texas home equity transactions provides numerous benefits, including enhanced security, compliance, and ease of use. By eliminating the need for paper-based processes, you save time and resources. This allows you to focus on maximizing your home equity benefits.

-

Can airSlate SignNow integrate with other platforms for Texas home equity management?

Yes, airSlate SignNow can seamlessly integrate with various platforms that assist in Texas home equity management. Our integrations with popular CRM and document management systems enhance your workflow efficiency, allowing for smooth communication and data exchange. This compatibility ensures you can manage your documents effectively.

-

Is it safe to use airSlate SignNow for Texas home equity documents?

Absolutely, airSlate SignNow prioritizes the security of your Texas home equity documents. Our platform uses industry-leading encryption and compliance measures to protect sensitive information. This commitment to security gives you peace of mind while facilitating important transactions.

Get more for Texas Equity

Find out other Texas Equity

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document

- How Do I eSign Hawaii Real Estate Presentation

- How Can I eSign Idaho Real Estate Document

- How Do I eSign Hawaii Sports Document

- Can I eSign Hawaii Sports Presentation

- How To eSign Illinois Sports Form

- Can I eSign Illinois Sports Form

- How To eSign North Carolina Real Estate PDF

- How Can I eSign Texas Real Estate Form

- How To eSign Tennessee Real Estate Document

- How Can I eSign Wyoming Real Estate Form

- How Can I eSign Hawaii Police PDF

- Can I eSign Hawaii Police Form

- How To eSign Hawaii Police PPT

- Can I eSign Hawaii Police PPT

- How To eSign Delaware Courts Form