Student and Spouse Will Not File and Are Not Required to File a Income Tax Return with the IRS 2019

Understanding the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

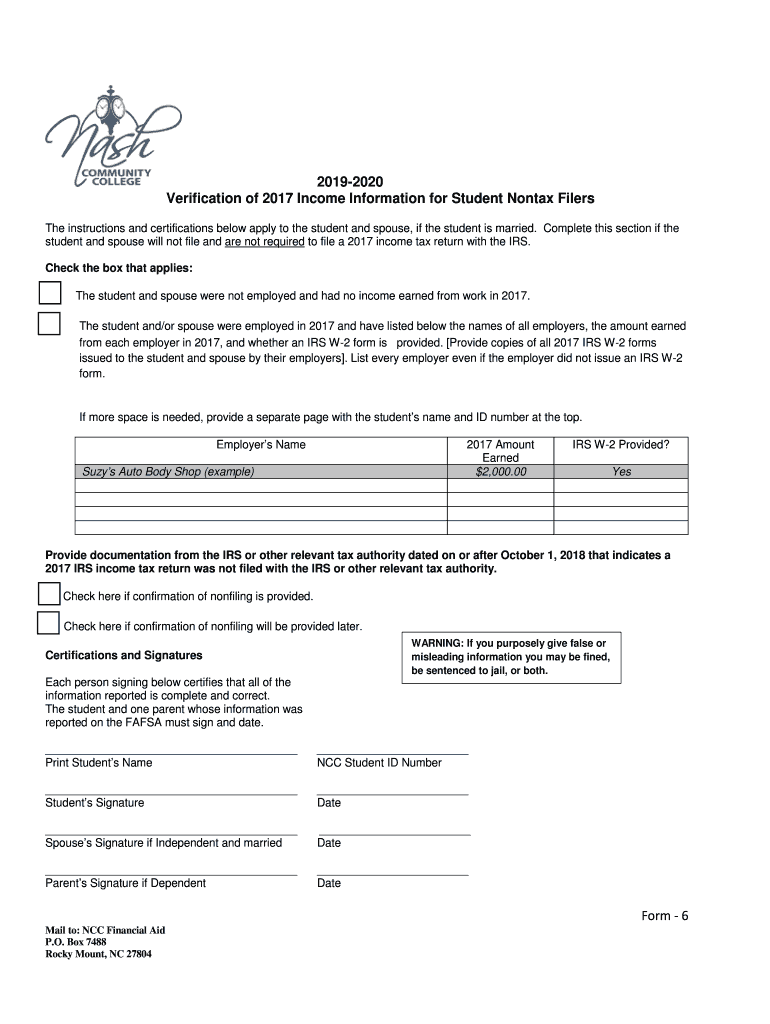

The form for students and spouses who will not file and are not required to file an income tax return with the IRS serves as an important document for those who meet specific criteria. This form is typically utilized by individuals who have little to no income or who fall under certain exemptions set by the IRS. Understanding the purpose of this form is essential for ensuring compliance with tax regulations while also protecting one’s financial interests.

Steps to Complete the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

Completing the form requires careful attention to detail. Begin by gathering necessary information such as Social Security numbers, income details, and any applicable exemptions. Follow these steps:

- Provide personal information, including names and addresses.

- Indicate the reason for not filing, ensuring it aligns with IRS guidelines.

- Review the form for accuracy before submission.

It is crucial to ensure all information is correct to avoid complications with the IRS.

Legal Use of the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

This form is legally recognized and can be used to establish that a student and their spouse are not obligated to file a tax return. Compliance with IRS regulations is necessary to avoid penalties. The form must be filled out accurately and submitted on time to ensure it serves its intended purpose without legal repercussions.

Required Documents for the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

To complete the form successfully, certain documents may be required. These typically include:

- Proof of income or lack thereof, such as pay stubs or bank statements.

- Social Security cards for both the student and spouse.

- Any documentation supporting claims for exemptions.

Having these documents ready can streamline the process and ensure compliance with IRS requirements.

IRS Guidelines for the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

The IRS provides specific guidelines regarding who qualifies to use this form. Generally, individuals who earn below a certain income threshold or meet specific criteria related to their tax status may be eligible. It is important to review the latest IRS publications or consult a tax professional to ensure that all eligibility requirements are met.

Examples of Using the Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

Common scenarios where this form is applicable include:

- A full-time student with no income.

- A spouse who is a dependent and does not earn taxable income.

- Couples who fall below the IRS income threshold for filing.

These examples illustrate the practical applications of the form, helping individuals understand their filing obligations.

Quick guide on how to complete student and spouse will not file and are not required to file a 2017 income tax return with the irs

Effortlessly prepare Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Manage Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related processes today.

How to modify and electronically sign Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS effortlessly

- Find Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive data using tools that airSlate SignNow specifically offers for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to send your form, through email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form hunting, or mistakes that require printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Adjust and electronically sign Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS to ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct student and spouse will not file and are not required to file a 2017 income tax return with the irs

Create this form in 5 minutes!

How to create an eSignature for the student and spouse will not file and are not required to file a 2017 income tax return with the irs

How to make an electronic signature for your PDF document in the online mode

How to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

The best way to generate an electronic signature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What happens if my Student and Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS?

If your student and spouse will not file and are not required to file an income tax return with the IRS, they may not need to report certain income or claim refunds. However, it's essential to ensure that you are aware of any education credits or financial aid eligibility that may depend on filing a tax return.

-

How does airSlate SignNow assist in signing documents related to taxes?

airSlate SignNow provides a secure and efficient platform for signing tax-related documents electronically. This can be particularly useful for those in situations where a student and spouse will not file and are not required to file an income tax return with the IRS, as it allows for quick handling and submission of any necessary forms.

-

Is airSlate SignNow cost-effective for students and their spouses?

Yes, airSlate SignNow offers competitive pricing that can be particularly beneficial for students and spouses. With its focus on a cost-effective solution, it is designed to accommodate users who may be in situations where the student and spouse will not file or are not required to file an income tax return with the IRS.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow features user-friendly tools for document creation, editing, and signing, ensuring a seamless experience for users. This is especially advantageous for individuals whose student and spouse will not file and are not required to file an income tax return with the IRS, allowing effortless management of necessary documentation.

-

Can airSlate SignNow integrate with other software that handles tax filing?

Yes, airSlate SignNow offers integrations with various applications and software that can facilitate easier document management during tax season. This feature is handy for users whose student and spouse will not file and are not required to file an income tax return with the IRS, as it allows for smooth collaboration across platforms.

-

How secure is airSlate SignNow for handling sensitive documents?

airSlate SignNow prioritizes the security of your documents with advanced encryption and compliance protocols. This is crucial for anyone in a situation where a student and spouse will not file and are not required to file an income tax return with the IRS, ensuring that personal information remains protected.

-

What benefits does using airSlate SignNow provide to students and their spouses?

Using airSlate SignNow enables students and their spouses to enjoy the convenience of eSignature services, facilitating quick processing of important documents. This is particularly beneficial for individuals who will not file and are not required to file an income tax return with the IRS, saving time and reducing hassle during tax season.

Get more for Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

Find out other Student And Spouse Will Not File And Are Not Required To File A Income Tax Return With The IRS

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed

- Electronic signature Minnesota Doctors Last Will And Testament Later

- How To Electronic signature Michigan Doctors LLC Operating Agreement

- How Do I Electronic signature Oregon Construction Business Plan Template

- How Do I Electronic signature Oregon Construction Living Will

- How Can I Electronic signature Oregon Construction LLC Operating Agreement

- How To Electronic signature Oregon Construction Limited Power Of Attorney

- Electronic signature Montana Doctors Last Will And Testament Safe