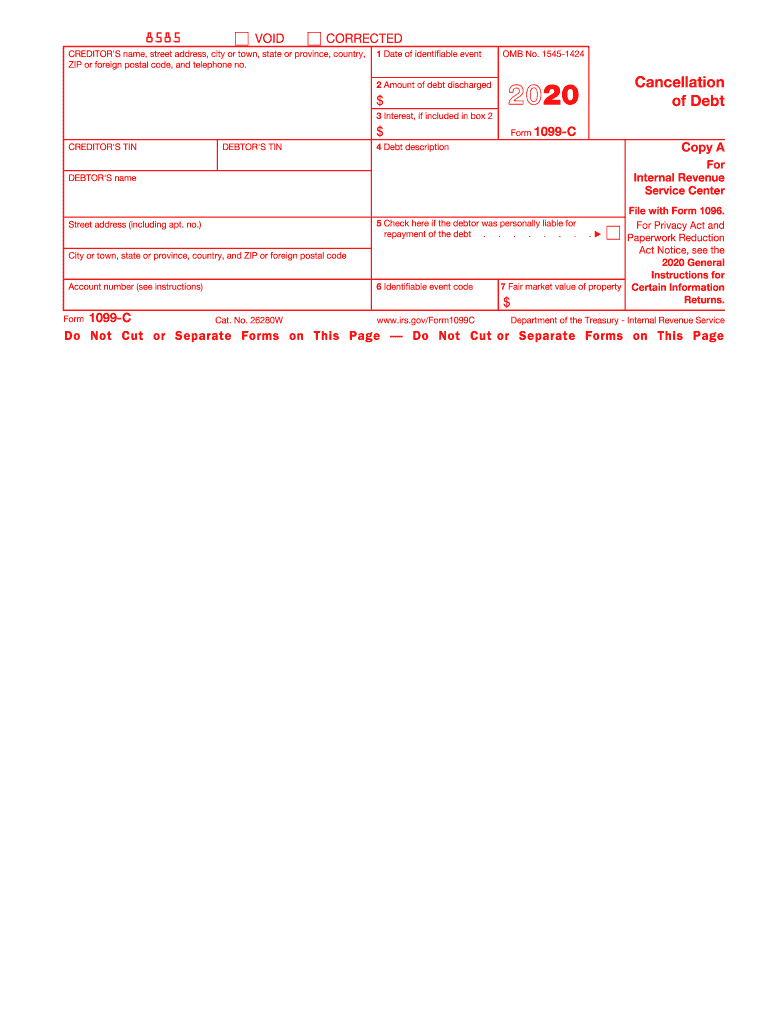

Form 1099 C Cancellation of Debt

What is the Form 1099 C Cancellation Of Debt

The Form 1099 C is a tax document used in the United States to report the cancellation of debt. When a lender forgives or cancels a debt of $600 or more, they are required to issue this form to the borrower and the IRS. This form is essential for taxpayers, as the amount of canceled debt is generally considered taxable income. Understanding the implications of this form is crucial for accurate tax reporting and compliance.

Steps to complete the Form 1099 C Cancellation Of Debt

Completing the Form 1099 C requires attention to detail to ensure accurate reporting. Here are the steps involved:

- Gather necessary information, including the debtor's name, address, and taxpayer identification number.

- Provide details about the creditor, including their name, address, and taxpayer identification number.

- Indicate the date of the debt cancellation and the amount of debt canceled.

- Fill in the appropriate boxes, including the reason for cancellation, which may include bankruptcy or other financial hardships.

- Review the form for accuracy before submission to avoid penalties.

Legal use of the Form 1099 C Cancellation Of Debt

The legal use of the Form 1099 C is governed by IRS regulations. It serves as a formal declaration that a debt has been canceled, which can have significant tax implications for the debtor. Properly issuing and filing this form is essential for compliance with federal tax laws. Failure to issue or report canceled debt can lead to penalties for both the creditor and the debtor. It is advisable to consult with a tax professional if there are uncertainties regarding the legal aspects of this form.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 1099 C. According to these guidelines, creditors must issue the form when debts are canceled, forgiven, or discharged. The IRS requires that the form be sent to the debtor by January 31 of the year following the cancellation. Additionally, the creditor must file the form with the IRS by the end of February if filing by paper or by the end of March if filing electronically. Adhering to these guidelines is crucial to avoid potential penalties.

Filing Deadlines / Important Dates

Understanding the filing deadlines for Form 1099 C is essential for compliance. The form must be provided to the debtor by January 31 of the year following the debt cancellation. If filing with the IRS, the deadlines differ based on the method of submission:

- Paper filing: February 28

- Electronic filing: March 31

Missing these deadlines can result in penalties, so it is important to keep track of these dates each tax year.

Who Issues the Form

The Form 1099 C is typically issued by lenders, including banks, credit unions, and other financial institutions. Any entity that cancels a debt of $600 or more is required to issue this form. This includes businesses that forgive debts for goods or services provided. It is important for both creditors and debtors to understand their responsibilities regarding this form to ensure proper tax reporting.

Quick guide on how to complete 2020 form 1099 c cancellation of debt

Complete Form 1099 C Cancellation Of Debt effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the correct version and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without holdups. Handle Form 1099 C Cancellation Of Debt on any platform with the airSlate SignNow apps available for Android or iOS and enhance all document-centric processes today.

How to modify and eSign Form 1099 C Cancellation Of Debt effortlessly

- Locate Form 1099 C Cancellation Of Debt and click Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional handwritten signature.

- Verify all the information and click on the Done button to store your changes.

- Choose how you wish to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document management needs in just a few clicks from any device of your choosing. Modify and eSign Form 1099 C Cancellation Of Debt while ensuring seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1099 c cancellation of debt

The best way to create an electronic signature for your PDF document in the online mode

The best way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

How to generate an electronic signature right from your mobile device

The way to create an electronic signature for a PDF document on iOS devices

How to generate an electronic signature for a PDF on Android devices

People also ask

-

What is a 1099 C 2020 form?

The 1099 C 2020 form is used to report the cancellation of debt, which can have signNow tax implications for individuals and businesses. It informs the IRS of any forgiven debts over $600, which may need to be reported as income. Understanding how to manage this form is essential for maintaining accurate financial records.

-

How can airSlate SignNow help with 1099 C 2020 documentation?

airSlate SignNow simplifies the process of creating and signing 1099 C 2020 forms by providing an easy-to-use platform for document management. You can quickly prepare, send, and track your forms, ensuring timely compliance with IRS requirements. This streamlining reduces the administrative burden for businesses.

-

Is there a cost associated with using airSlate SignNow for 1099 C 2020 forms?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including affordable options for small businesses. Each plan provides access to essential features for managing 1099 C 2020 forms, allowing you to choose the best fit for your requirements. Pricing is transparent, with no hidden fees.

-

What features does airSlate SignNow offer for 1099 C 2020 forms?

airSlate SignNow includes features like customizable templates, e-signatures, and secure cloud storage, making it ideal for 1099 C 2020 forms. You can gather signatures in minutes and store your documents safely online. Additionally, the platform offers integration with other software to enhance your workflow.

-

Can multiple users collaborate on 1099 C 2020 forms using airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on 1099 C 2020 forms in real-time. You can invite team members to review and edit documents, enhancing efficiency and ensuring that everyone stays on the same page. This feature is particularly useful for businesses with several stakeholders.

-

How secure is airSlate SignNow for handling 1099 C 2020 forms?

airSlate SignNow prioritizes the security of your documents, including 1099 C 2020 forms. The platform employs industry-standard encryption to protect sensitive information, ensuring that your data remains confidential. Regular security audits also ensure that compliance with regulations is maintained.

-

What integrations does airSlate SignNow offer for handling 1099 C 2020 forms?

airSlate SignNow seamlessly integrates with various popular applications, boosting your productivity when handling 1099 C 2020 forms. Whether you're using CRM systems, accounting software, or cloud storage solutions, you can easily connect your workflows to ensure efficiency. This integration allows for a smoother documentation process.

Get more for Form 1099 C Cancellation Of Debt

Find out other Form 1099 C Cancellation Of Debt

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement

- eSignature New Hampshire High Tech Lease Agreement Template Mobile

- eSignature Montana Insurance Lease Agreement Template Online

- eSignature New Hampshire High Tech Lease Agreement Template Free

- How To eSignature Montana Insurance Emergency Contact Form

- eSignature New Jersey High Tech Executive Summary Template Free

- eSignature Oklahoma Insurance Warranty Deed Safe

- eSignature Pennsylvania High Tech Bill Of Lading Safe

- eSignature Washington Insurance Work Order Fast

- eSignature Utah High Tech Warranty Deed Free

- How Do I eSignature Utah High Tech Warranty Deed