PDF General Instructions for Forms W 2 and W 3 PDF Internal Revenue

Understanding the PDF General Instructions for Forms W-2 and W-3

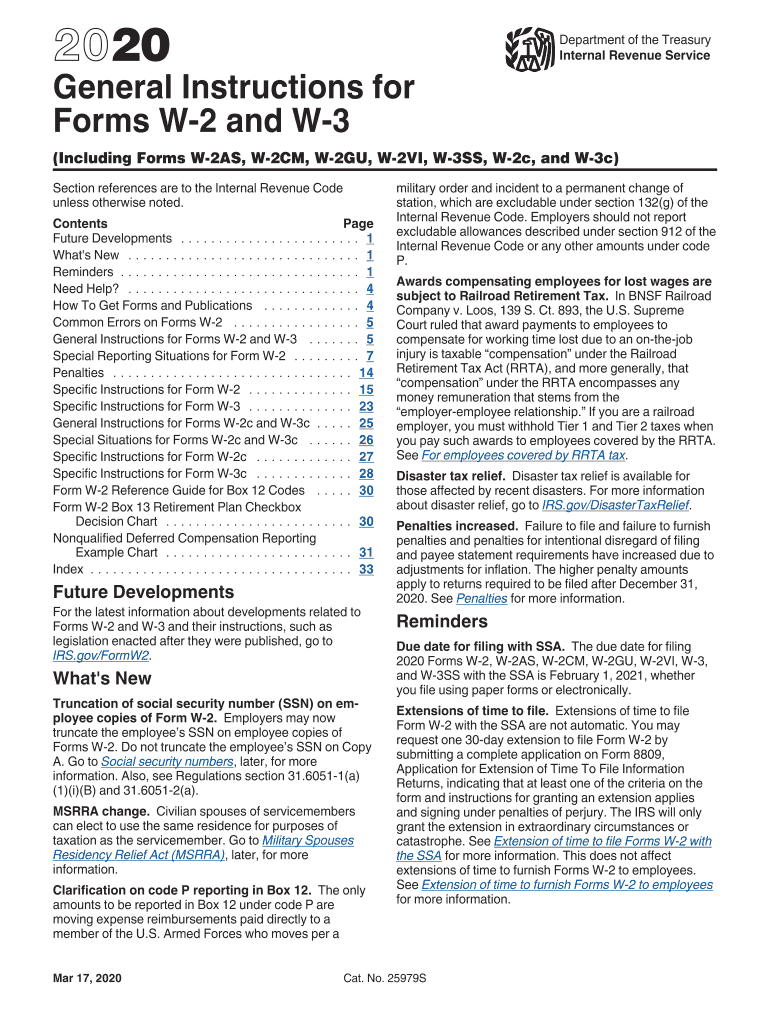

The PDF General Instructions for Forms W-2 and W-3 provide essential guidance for employers and employees regarding the completion and submission of these tax forms. Form W-2 is used to report wages paid to employees and the taxes withheld from them, while Form W-3 serves as a summary of all W-2 forms submitted by an employer. These instructions outline the necessary steps to ensure compliance with IRS requirements, including formatting, filing deadlines, and specific details that must be included on each form.

Steps to Complete the PDF General Instructions for Forms W-2 and W-3

Completing the PDF General Instructions for Forms W-2 and W-3 involves several key steps:

- Review the instructions thoroughly to understand the requirements for both forms.

- Gather all necessary information, including employee details, wages, and tax withholdings.

- Fill out Form W-2 accurately, ensuring that all fields are completed as per the guidelines.

- Prepare Form W-3 to summarize the information reported on all W-2 forms.

- Submit the completed forms to the IRS by the specified deadlines.

IRS Guidelines for Forms W-2 and W-3

The IRS provides specific guidelines that must be followed when completing Forms W-2 and W-3. These include:

- Ensuring accurate reporting of wages and tax withholdings.

- Using the correct form versions for the tax year being reported.

- Adhering to submission deadlines to avoid penalties.

- Providing copies of Form W-2 to employees by the required date.

Filing Deadlines for Forms W-2 and W-3

Filing deadlines are crucial for compliance with IRS regulations. Employers must submit Forms W-2 and W-3 to the IRS by January 31 of the year following the tax year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. Additionally, employers must provide copies of Form W-2 to their employees by the same date to ensure they can file their personal tax returns on time.

Legal Use of the PDF General Instructions for Forms W-2 and W-3

The legal use of the PDF General Instructions for Forms W-2 and W-3 is essential for ensuring that employers comply with federal tax laws. These instructions serve as an authoritative source for understanding the requirements for reporting employee wages and tax withholdings. Failure to adhere to these guidelines can result in penalties and legal repercussions for employers, making it imperative to follow the instructions closely.

Required Documents for Completing Forms W-2 and W-3

To accurately complete Forms W-2 and W-3, employers need to gather several documents, including:

- Employee records that detail wages and tax withholdings.

- Previous W-2 forms for returning employees, if applicable.

- Employer identification numbers (EIN) and other relevant tax information.

Form Submission Methods for W-2 and W-3

Forms W-2 and W-3 can be submitted to the IRS through various methods. Employers have the option to file electronically using the IRS e-file system, which is often faster and more efficient. Alternatively, forms can be mailed to the appropriate IRS address. It is important to choose a submission method that aligns with the employer's capabilities and ensures compliance with IRS deadlines.

Quick guide on how to complete pdf general instructions for forms w 2 and w 3 pdf internal revenue

Accomplish PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, allowing you to access the appropriate form and securely store it online. airSlate SignNow equips you with every tool necessary to create, modify, and electronically sign your documents swiftly without delays. Manage PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue with ease

- Find PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive information using tools provided specifically for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to preserve your modifications.

- Choose your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Alter and electronically sign PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pdf general instructions for forms w 2 and w 3 pdf internal revenue

The best way to create an eSignature for your PDF online

The best way to create an eSignature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

How to make an eSignature right from your smartphone

The way to generate an electronic signature for a PDF on iOS

How to make an eSignature for a PDF on Android

People also ask

-

What is w2 direction in airSlate SignNow?

W2 direction in airSlate SignNow refers to the process of managing and signing W-2 forms electronically. This feature simplifies the tax document handling, ensuring that employees can receive their W-2 forms quickly and securely. With airSlate SignNow, you can streamline the W-2 direction process, making it more efficient for your business.

-

How does airSlate SignNow enhance W-2 direction for businesses?

AirSlate SignNow enhances W-2 direction by providing an easy-to-use interface that enables businesses to send and receive W-2 forms electronically. This not only speeds up the distribution process but also reduces the risk of errors. By leveraging our eSigning capabilities, you can ensure that all W-2 documents are properly signed and archived.

-

What are the pricing plans available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. Each plan includes efficient features for W-2 direction, ranging from basic eSigning capabilities to advanced workflow automation. You can choose a plan that best fits your needs and budget while enhancing your document management processes.

-

Is airSlate SignNow compliant with tax regulations for W-2 direction?

Yes, airSlate SignNow is designed to comply with all relevant tax regulations, ensuring that your W-2 direction process adheres to legal requirements. Our platform provides secure storage and transmission of W-2 forms, helping you maintain compliance while remaining efficient in your document workflows.

-

Can airSlate SignNow integrate with my accounting software for W-2 direction?

Absolutely! AirSlate SignNow can integrate with various accounting software platforms, allowing for a seamless W-2 direction process. This integration ensures that your W-2 forms are automatically populated and sent for eSignature, minimizing the need for manual data entry and streamlining your financial operations.

-

What are the benefits of using airSlate SignNow for W-2 direction?

Using airSlate SignNow for W-2 direction offers numerous benefits including reduced processing time, enhanced security, and improved accuracy. By digitizing your W-2 forms, you minimize paper usage and associated costs. This not only enhances your operational efficiency but also contributes positively to the environment.

-

How can I get started with airSlate SignNow for W-2 direction?

Getting started with airSlate SignNow for W-2 direction is quick and easy. Simply sign up for an account, choose a plan, and you can begin uploading and sending your W-2 forms for electronic signature. Our user-friendly platform guides you through the process, making it accessible for all users, regardless of their technical expertise.

Get more for PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue

Find out other PDF General Instructions For Forms W 2 And W 3 PDF Internal Revenue

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement

- eSign Missouri Landlord tenant lease agreement Secure

- eSign Rhode Island Landlord tenant lease agreement Later

- How Can I eSign North Carolina lease agreement

- eSign Montana Lease agreement form Computer

- Can I eSign New Hampshire Lease agreement form

- How To eSign West Virginia Lease agreement contract

- Help Me With eSign New Mexico Lease agreement form

- Can I eSign Utah Lease agreement form

- Can I eSign Washington lease agreement

- Can I eSign Alabama Non disclosure agreement sample

- eSign California Non disclosure agreement sample Now

- eSign Pennsylvania Mutual non-disclosure agreement Now

- Help Me With eSign Utah Non disclosure agreement sample

- How Can I eSign Minnesota Partnership agreements