Form 1096 Annual Summary and Transmittal of U S Information Returns

What is the Form 1096 Annual Summary And Transmittal Of U S Information Returns

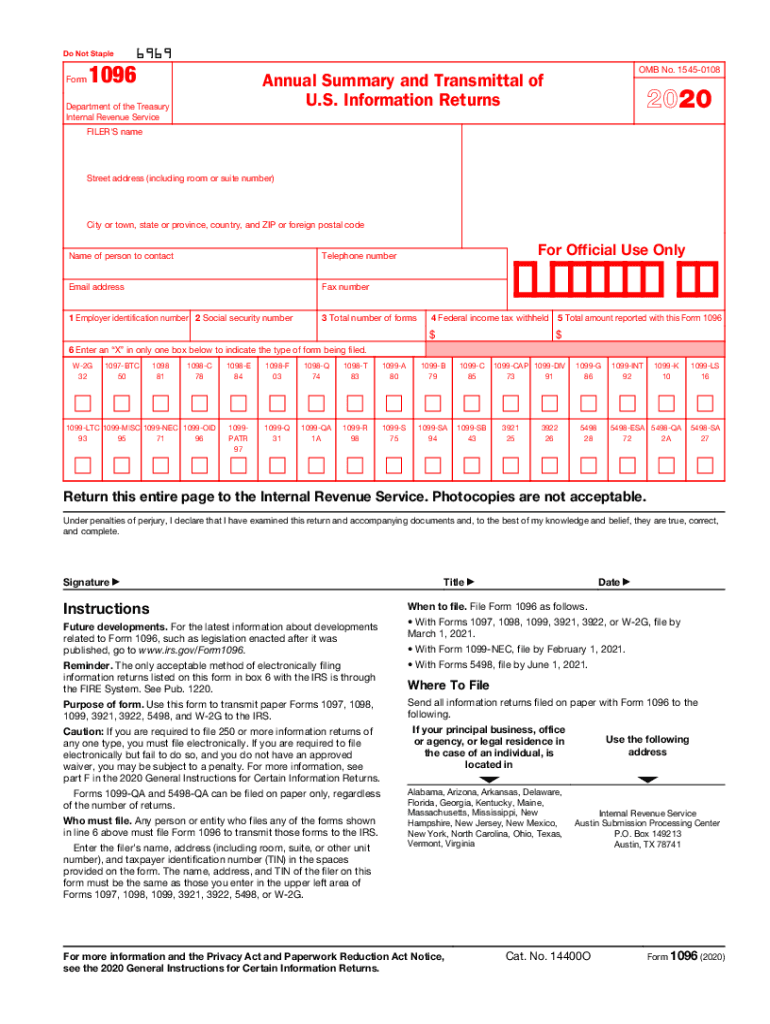

The 1096 form 2020, officially known as the Annual Summary and Transmittal of U.S. Information Returns, serves as a cover sheet for submitting various types of information returns to the Internal Revenue Service (IRS). This form is particularly important for businesses that report payments made to non-employees or other entities, such as independent contractors. It consolidates information from multiple forms, including the 1099 series, making it easier for the IRS to process and track tax obligations.

How to use the Form 1096 Annual Summary And Transmittal Of U S Information Returns

Using the 1096 form 2020 involves several key steps. First, gather all relevant information returns that need to be submitted, such as 1099 forms. Each form must be filled out accurately with the necessary details about the payee and the amounts paid. Once all forms are completed, the 1096 serves as a summary that lists the total number of forms being submitted and the total amount reported. It is essential to ensure that the information on the 1096 matches the details on the accompanying forms to avoid discrepancies during processing.

Steps to complete the Form 1096 Annual Summary And Transmittal Of U S Information Returns

Completing the 1096 form 2020 requires careful attention to detail. Follow these steps:

- Begin by entering your name, address, and taxpayer identification number (TIN) in the designated fields.

- Indicate the type of return being transmitted by selecting the appropriate box.

- List the total number of forms being submitted in the "Number of Forms" box.

- Enter the total amount reported on all accompanying forms in the "Total Amount" box.

- Sign and date the form to certify the accuracy of the information provided.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the 1096 form 2020. It is crucial to adhere to these guidelines to ensure compliance and avoid penalties. The form must be submitted by the deadline, which is typically the last day of February for paper filings or March 31 for electronic submissions. Additionally, the IRS requires that all information returns be accurate and complete, as discrepancies can lead to audits or penalties.

Filing Deadlines / Important Dates

For the 1096 form 2020, the filing deadlines are critical for compliance. The form must be filed by February 28, 2021, if submitting by mail, and by March 31, 2021, if filing electronically. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can vary from year to year. Timely submission helps avoid late fees and potential issues with the IRS.

Penalties for Non-Compliance

Failure to file the 1096 form 2020 or submitting incorrect information can result in significant penalties. The IRS imposes fines for late filings, which can increase based on the length of delay. Additionally, inaccuracies in the information provided can lead to audits or further scrutiny of your tax filings. It is essential to ensure that all details are correct and that the form is submitted on time to mitigate these risks.

Quick guide on how to complete 2020 form 1096 annual summary and transmittal of us information returns

Easily prepare Form 1096 Annual Summary And Transmittal Of U S Information Returns on any device

Online document management has become widely embraced by businesses and individuals alike. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Manage Form 1096 Annual Summary And Transmittal Of U S Information Returns on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Form 1096 Annual Summary And Transmittal Of U S Information Returns effortlessly

- Obtain Form 1096 Annual Summary And Transmittal Of U S Information Returns and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal significance as a conventional ink signature.

- Review the details and click on the Done button to save your changes.

- Choose how you would like to send your document, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1096 Annual Summary And Transmittal Of U S Information Returns and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 1096 annual summary and transmittal of us information returns

The best way to create an eSignature for your PDF in the online mode

The best way to create an eSignature for your PDF in Chrome

The best way to generate an electronic signature for putting it on PDFs in Gmail

How to make an eSignature right from your smart phone

The way to generate an electronic signature for a PDF on iOS devices

How to make an eSignature for a PDF on Android OS

People also ask

-

What is the 1096 form 2020?

The 1096 form 2020 is a summary form that businesses use to report various types of payments made that are also summarized on 1099 forms. This form is essential for the IRS, as it consolidates information on income reported by independent contractors and other non-employees. Accurate completion of the 1096 form 2020 can help businesses avoid penalties during tax season.

-

How does airSlate SignNow simplify the 1096 form 2020 process?

airSlate SignNow offers an intuitive platform that allows users to easily upload and eSign the 1096 form 2020. With its user-friendly interface, businesses can streamline their filing process without the hassle of printing and mailing physical documents. This means you can save time and enhance accuracy when dealing with tax forms.

-

Is there a cost associated with using airSlate SignNow for the 1096 form 2020?

Yes, airSlate SignNow provides a range of pricing plans tailored to suit various business needs. The costs can vary depending on the features you require, such as advanced integrations or additional document storage. However, the service remains cost-effective compared to traditional methods of managing the 1096 form 2020.

-

What features does airSlate SignNow offer for the 1096 form 2020?

airSlate SignNow includes several features designed to simplify the management of the 1096 form 2020, such as customizable templates, document forwarding, and tracking capabilities. Additionally, the platform allows for secure eSigning and real-time collaboration among team members, enhancing efficiency. These features ensure that your paperwork is organized and accessible.

-

Can I store and access the 1096 form 2020 through airSlate SignNow?

Absolutely! airSlate SignNow enables users to securely store their 1096 form 2020 and other important documents in the cloud. This means you can access your forms anytime and anywhere, making document management hassle-free. You'll never have to worry about losing important tax documents again.

-

Does airSlate SignNow integrate with other software for 1096 form 2020 management?

Yes, airSlate SignNow boasts a variety of integrations with popular business software that can enhance your management of the 1096 form 2020. Applications like accounting software allow for seamless data transfer, which reduces manual entry errors. These integrations can help create a more streamlined workflow during tax season.

-

How can airSlate SignNow help with compliance for the 1096 form 2020?

Using airSlate SignNow can signNowly improve compliance when filing the 1096 form 2020. The platform offers features like automatic reminders for submission deadlines and helps ensure that all necessary fields are properly filled out. This minimizes the risk of errors and helps you stay compliant with IRS regulations.

Get more for Form 1096 Annual Summary And Transmittal Of U S Information Returns

Find out other Form 1096 Annual Summary And Transmittal Of U S Information Returns

- How Can I eSign Hawaii Non-Profit Cease And Desist Letter

- Can I eSign Florida Non-Profit Residential Lease Agreement

- eSign Idaho Non-Profit Business Plan Template Free

- eSign Indiana Non-Profit Business Plan Template Fast

- How To eSign Kansas Non-Profit Business Plan Template

- eSign Indiana Non-Profit Cease And Desist Letter Free

- eSign Louisiana Non-Profit Quitclaim Deed Safe

- How Can I eSign Maryland Non-Profit Credit Memo

- eSign Maryland Non-Profit Separation Agreement Computer

- eSign Legal PDF New Jersey Free

- eSign Non-Profit Document Michigan Safe

- eSign New Mexico Legal Living Will Now

- eSign Minnesota Non-Profit Confidentiality Agreement Fast

- How Do I eSign Montana Non-Profit POA

- eSign Legal Form New York Online

- Can I eSign Nevada Non-Profit LLC Operating Agreement

- eSign Legal Presentation New York Online

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile