Form 1099 DIV Internal Revenue ServiceAn Official

What is the Form 1099 DIV?

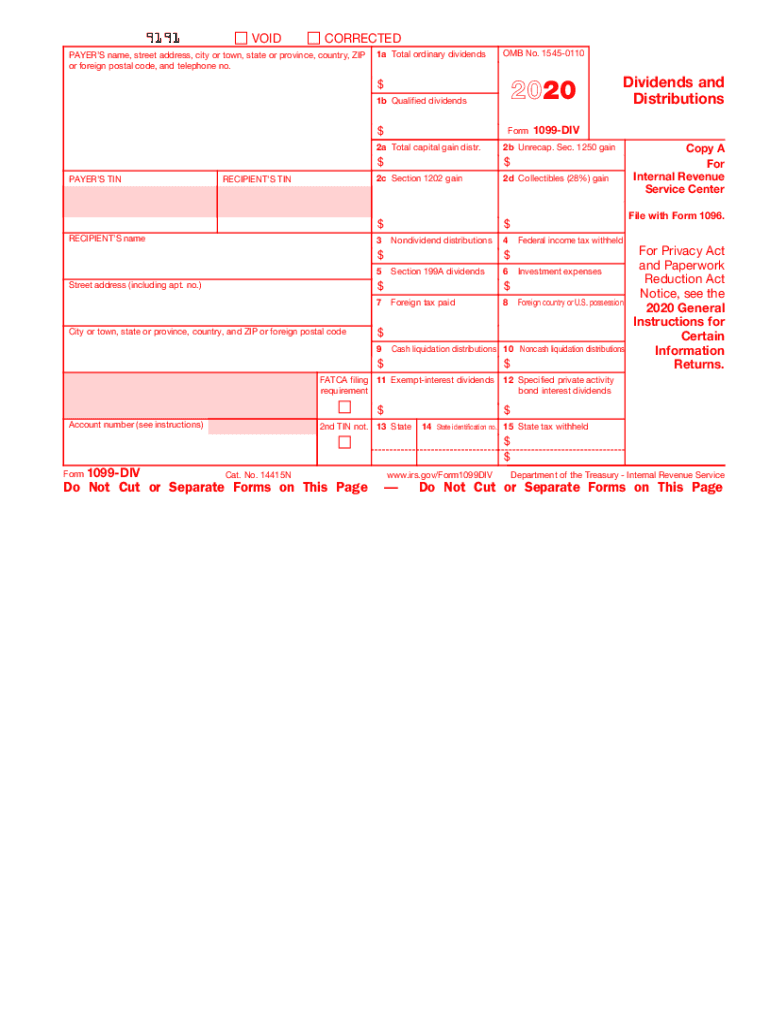

The Form 1099 DIV is an official document issued by the Internal Revenue Service (IRS) that reports dividends and distributions received by a taxpayer. This form is essential for individuals and entities that have received dividends from stocks, mutual funds, or other investments during the tax year. The information reported on the 1099 DIV is used to calculate taxable income, making it a crucial component of tax filings.

Key elements of the Form 1099 DIV

The 1099 DIV form includes several key elements that taxpayers should be aware of:

- Box 1a: Total ordinary dividends, which are generally taxable income.

- Box 1b: Qualified dividends that may be taxed at a lower rate.

- Box 2a: Total capital gain distributions, which are also taxable.

- Box 3: Non-dividend distributions that may reduce the basis of the stock.

- Box 4: Federal income tax withheld, if applicable.

Steps to complete the Form 1099 DIV

Completing the Form 1099 DIV involves several steps:

- Gather all necessary documentation, including brokerage statements and records of dividend payments.

- Fill out the payer's information, including name, address, and taxpayer identification number.

- Enter the recipient's information accurately, ensuring the name and Social Security number are correct.

- Report the amounts in the appropriate boxes based on the dividend information received.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the Form 1099 DIV. Typically, the form must be sent to recipients by January 31 of the year following the tax year. Additionally, the IRS requires that the form be filed by the end of February if submitting by paper, or by March 31 if filing electronically. Adhering to these deadlines helps avoid penalties and ensures compliance with IRS regulations.

Penalties for Non-Compliance

Failure to file the Form 1099 DIV accurately or on time can result in penalties. The IRS imposes fines based on how late the form is filed, with penalties increasing the longer the delay. Additionally, incorrect information can lead to further complications, including audits or additional tax liabilities. It is crucial to ensure that all details on the form are correct and submitted in a timely manner to avoid these penalties.

Digital vs. Paper Version

Taxpayers have the option to file the Form 1099 DIV either digitally or via paper. Digital filing is often more efficient and can reduce the risk of errors. It allows for quicker processing and easier record-keeping. However, some may prefer the traditional paper method, especially if they are more comfortable with physical documents. Regardless of the method chosen, it is essential to ensure that all information is accurately reported.

Quick guide on how to complete 2019 form 1099 div internal revenue servicean official

Complete Form 1099 DIV Internal Revenue ServiceAn Official effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the resources you require to create, modify, and electronically sign your documents quickly without delay. Handle Form 1099 DIV Internal Revenue ServiceAn Official on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The simplest method to modify and eSign Form 1099 DIV Internal Revenue ServiceAn Official effortlessly

- Find Form 1099 DIV Internal Revenue ServiceAn Official and then click Get Form to begin.

- Use the tools we offer to finalize your document.

- Highlight important portions of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns about missing or lost documents, tiresome form searches, or mistakes that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and eSign Form 1099 DIV Internal Revenue ServiceAn Official and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 div internal revenue servicean official

The best way to create an eSignature for your PDF file in the online mode

The best way to create an eSignature for your PDF file in Chrome

The best way to make an eSignature for putting it on PDFs in Gmail

How to make an eSignature from your smartphone

The way to generate an electronic signature for a PDF file on iOS devices

How to make an eSignature for a PDF file on Android

People also ask

-

What is a 1099 div 2020 pdf and why do I need it?

A 1099 div 2020 pdf is a tax form used to report dividends and distributions to taxpayers. If you received dividends from investments during 2020, this form is essential for filing your taxes accurately. Ensuring you have the correct 1099 div 2020 pdf will help avoid tax penalties and simplify your tax preparation.

-

How can I obtain my 1099 div 2020 pdf?

You can obtain your 1099 div 2020 pdf from your financial institution or brokerage firm, which typically provides these forms by January of the following year. If you haven't received it, check your online account or contact customer service. Additionally, you can use airSlate SignNow to securely request and manage your documents.

-

Does airSlate SignNow support signing 1099 div 2020 pdf documents?

Yes, airSlate SignNow allows you to electronically sign 1099 div 2020 pdf documents easily and securely. Our platform enables you to sign, send, and store your tax documents in a compliant manner. This feature streamlines the process, saving you time during tax season.

-

What features does airSlate SignNow offer for handling tax documents like the 1099 div 2020 pdf?

airSlate SignNow provides features such as eSigning, document templates, and cloud storage that make managing tax documents like the 1099 div 2020 pdf simple. You can customize templates for your documents, ensuring you have a consistent and professional look for all tax-related paperwork. Our platform also keeps all your documents secure and easily accessible.

-

Is airSlate SignNow a cost-effective solution for managing 1099 div 2020 pdf documents?

Absolutely! airSlate SignNow offers a range of pricing plans to fit different business needs, making it a cost-effective solution for managing your 1099 div 2020 pdf documents. By using our service, you save on shipping costs and reduce the time spent on paperwork, allowing you to focus more on your core business activities.

-

Can I integrate airSlate SignNow with other tools for managing documents like the 1099 div 2020 pdf?

Yes, airSlate SignNow integrates seamlessly with various tools like Google Drive, Dropbox, and other business applications. This means you can easily access, manage, and send your 1099 div 2020 pdf documents alongside your other important files. Integration enhances your workflow efficiency and keeps all your documentation organized.

-

What should I do if I encounter issues with my 1099 div 2020 pdf form?

If you encounter issues with your 1099 div 2020 pdf form, first double-check the information against your investment records. If discrepancies persist, contact your issuing financial institution for clarification. For document-related concerns using airSlate SignNow, our customer support team is available to assist you.

Get more for Form 1099 DIV Internal Revenue ServiceAn Official

Find out other Form 1099 DIV Internal Revenue ServiceAn Official

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF