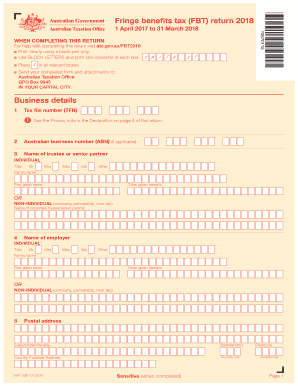

Nat 1067 2020

What is the FBT return 2020 form?

The FBT return 2020 form is a specific tax document used in the United States for reporting fringe benefits provided by employers to their employees. This form is essential for businesses to disclose the value of non-cash benefits, which may include items such as company cars, health insurance, and other perks. Understanding the FBT return is crucial for compliance with tax regulations and for ensuring accurate reporting to the IRS.

How to obtain the FBT return 2020 form

To obtain the FBT return 2020 form, businesses can visit the official IRS website or consult with a tax professional. The form is typically available in a downloadable PDF format, which can be filled out electronically or printed for manual completion. It is important to ensure that you are using the correct version of the form for the 2020 tax year to avoid any discrepancies during filing.

Steps to complete the FBT return 2020 form

Completing the FBT return 2020 form involves several key steps:

- Gather all necessary information regarding fringe benefits provided during the tax year.

- Fill out the form with accurate details, including your business information and the total value of benefits.

- Review the completed form for any errors or omissions.

- Submit the form to the IRS by the designated deadline, either electronically or via mail.

Following these steps carefully will help ensure that your FBT return is accurate and compliant with IRS regulations.

Legal use of the FBT return 2020 form

The legal use of the FBT return 2020 form is governed by IRS regulations, which require accurate reporting of fringe benefits to ensure compliance with tax laws. Employers must understand their obligations regarding the reporting of these benefits, as failure to do so can result in penalties. The form serves as a formal declaration of the benefits provided and is essential for maintaining transparency with tax authorities.

Filing deadlines for the FBT return 2020 form

Filing deadlines for the FBT return 2020 form are critical for compliance. Typically, the form must be submitted by the due date specified by the IRS, which is generally the last day of the month following the end of the tax year. For the 2020 tax year, this means that the form should be filed by March 31, 2021. It is advisable to check for any updates or changes to deadlines that may arise due to specific circumstances.

Required documents for the FBT return 2020 form

When preparing to complete the FBT return 2020 form, certain documents are required to ensure accurate reporting. These may include:

- Records of all fringe benefits provided to employees.

- Documentation of the value of each benefit.

- Payroll records for the relevant tax year.

Having these documents on hand will facilitate a smoother completion process and help prevent errors in reporting.

Quick guide on how to complete nat 1067

Accomplish Nat 1067 with ease on any device

Digital document management has gained traction with enterprises and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents since you can locate the appropriate form and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without delays. Manage Nat 1067 on any device using airSlate SignNow's Android or iOS applications and streamline any document-centric process today.

How to modify and eSign Nat 1067 effortlessly

- Obtain Nat 1067 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Select pertinent sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal authority as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or inaccuracies that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Nat 1067 and guarantee exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct nat 1067

Create this form in 5 minutes!

How to create an eSignature for the nat 1067

The best way to generate an electronic signature for your PDF document online

The best way to generate an electronic signature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The way to make an electronic signature for a PDF document on Android OS

People also ask

-

What is the fbt return 2020 form?

The fbt return 2020 form is a document that employers must submit to report fringe benefits provided to employees during the 2020 financial year. This form is essential for compliance with tax regulations and helps ensure that all taxable benefits are accurately disclosed. Understanding how to fill out the fbt return 2020 form correctly can save you from potential penalties.

-

How can airSlate SignNow help with the fbt return 2020 form process?

airSlate SignNow simplifies the process of preparing and submitting the fbt return 2020 form by providing an easy-to-use electronic signature solution. You can quickly gather the necessary approvals from stakeholders, ensuring that your form is filled out accurately and submitted on time. This efficiency allows you to focus on your business rather than paperwork.

-

What features does airSlate SignNow offer for managing the fbt return 2020 form?

airSlate SignNow offers features such as customizable templates, in-app commenting, and real-time tracking that help streamline the management of the fbt return 2020 form. You can create templates based on your needs, collaborate with your team, and decrease the turnaround time for document signing. This not only reduces errors but improves overall workflow.

-

Is there a cost associated with using airSlate SignNow for the fbt return 2020 form?

Yes, there is a subscription fee to access airSlate SignNow, but it offers a cost-effective solution compared to traditional signing methods. The pricing plans are designed to suit businesses of all sizes, making it an economical choice for handling the fbt return 2020 form efficiently. Additionally, the time saved can lead to signNow financial benefits.

-

Can airSlate SignNow integrate with other systems for the fbt return 2020 form?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and HR software, making it easier to import data for the fbt return 2020 form directly. This integration ensures that all your figures are accurate and up to date, reducing manual entry errors and enhancing overall efficiency.

-

What are the benefits of using airSlate SignNow for the fbt return 2020 form?

Using airSlate SignNow for the fbt return 2020 form offers numerous benefits, including increased accuracy, faster processing times, and enhanced collaboration. By automating the signing process, you can secure necessary approvals quickly, ensuring compliance with tax regulations. This helps you avoid costly mistakes and streamline your operations.

-

How secure is airSlate SignNow when handling the fbt return 2020 form?

airSlate SignNow prioritizes security, employing advanced encryption protocols to protect your documents, including the fbt return 2020 form. All user data is securely stored, and access controls can be customized to ensure only authorized individuals can view or edit the documents. This guarantees that sensitive financial information is well protected.

Get more for Nat 1067

Find out other Nat 1067

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now

- Sign Maryland Courts Quitclaim Deed Free

- How To Sign Massachusetts Courts Quitclaim Deed

- Can I Sign Massachusetts Courts Quitclaim Deed

- eSign California Business Operations LLC Operating Agreement Myself

- Sign Courts Form Mississippi Secure

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself