Fringe Benefits Tax FBT Return Business Details ATO 2020-2026

Understanding the Fringe Benefits Tax (FBT) Return for 2025

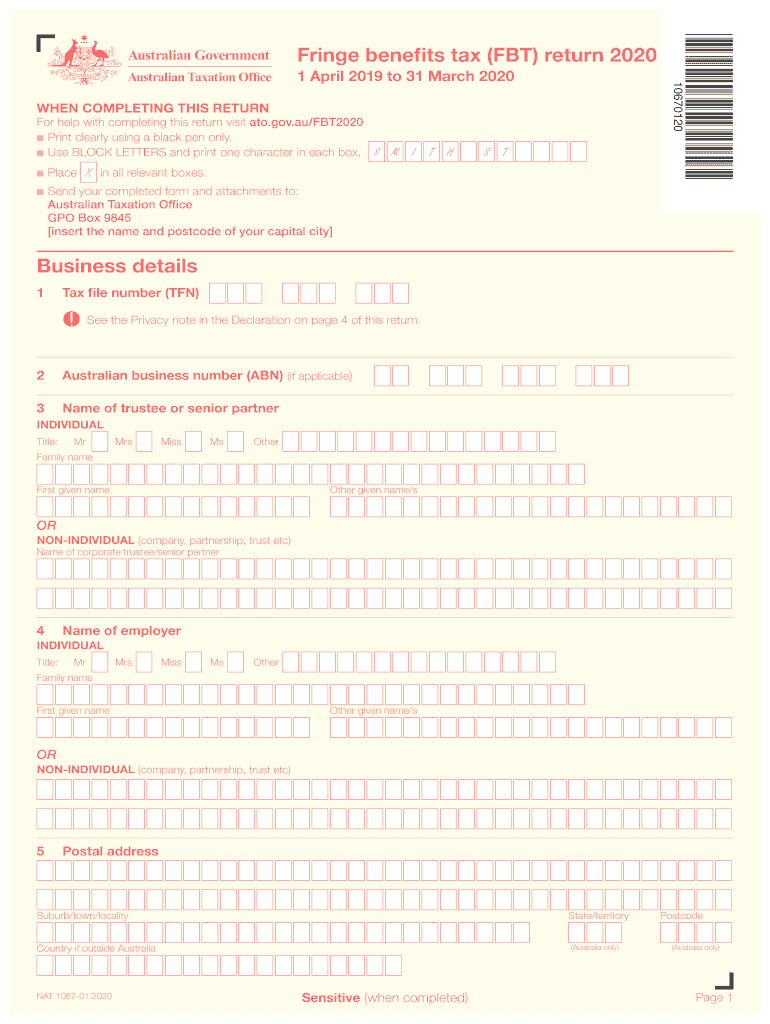

The Fringe Benefits Tax (FBT) Return for 2025 is a crucial document for businesses that provide fringe benefits to their employees. This tax is levied on the value of benefits provided, such as company cars, loans, and entertainment. Understanding the FBT return is essential for compliance with tax obligations and for accurate reporting of benefits to the Australian Taxation Office (ATO). The return must detail the total taxable value of benefits provided during the financial year, ensuring that businesses meet their legal requirements.

Steps to Complete the Fringe Benefits Tax Return for 2025

Completing the FBT return for 2025 involves several key steps to ensure accuracy and compliance. First, businesses must gather all relevant data regarding the fringe benefits provided. This includes calculating the taxable value of each benefit and ensuring proper documentation is maintained. Next, businesses should fill out the FBT return form accurately, reflecting all calculations. Once completed, the form can be submitted to the ATO either online or via mail, depending on the preferred submission method. It is advisable to review all entries for accuracy before submission to avoid penalties.

Required Documents for the FBT Return 2025

To successfully complete the FBT return for 2025, businesses need to compile several essential documents. These typically include records of all fringe benefits provided, such as receipts, invoices, and any relevant agreements. Additionally, businesses should have documentation that outlines the calculations used to determine the taxable value of benefits. Maintaining thorough records will not only aid in the completion of the return but also serve as evidence in case of an audit by the ATO.

Filing Deadlines for the FBT Return 2025

Timely filing of the FBT return is critical to avoid penalties. For the 2025 tax year, the FBT return is generally due on the 21st of May following the end of the FBT year, which runs from April first to March thirty-first. Businesses should mark this date on their calendars and ensure that all necessary documentation is prepared well in advance. Late submissions may incur fines, so adhering to deadlines is essential for compliance.

Penalties for Non-Compliance with the FBT Return

Failure to comply with FBT obligations can result in significant penalties for businesses. The ATO may impose fines for late submissions, inaccuracies, or failure to file altogether. In addition to financial penalties, non-compliance can lead to increased scrutiny during audits and potential legal repercussions. It is important for businesses to understand their responsibilities regarding the FBT return and to take proactive steps to ensure compliance.

Digital vs. Paper Version of the FBT Return

Businesses have the option to submit the FBT return in either digital or paper format. The digital version is often preferred due to its convenience and efficiency. Submitting electronically can reduce processing times and minimize the risk of errors. However, some businesses may still opt for the paper version for various reasons, including lack of access to technology or personal preference. Regardless of the method chosen, ensuring that the return is completed accurately is paramount.

Quick guide on how to complete fringe benefits tax fbt return 2020 business details ato

Effortlessly Prepare Fringe Benefits Tax FBT Return Business Details ATO on Any Device

Managing documents online has gained signNow traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without any holdups. Manage Fringe Benefits Tax FBT Return Business Details ATO on any device through the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Fringe Benefits Tax FBT Return Business Details ATO with Ease

- Find Fringe Benefits Tax FBT Return Business Details ATO and click on Get Form to initiate the process.

- Make use of the tools available to complete your form.

- Highlight relevant sections of your documents or conceal sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select how you wish to deliver your form, whether by email, text message (SMS), invitation link, or download it onto your PC.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Fringe Benefits Tax FBT Return Business Details ATO to guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fringe benefits tax fbt return 2020 business details ato

Create this form in 5 minutes!

How to create an eSignature for the fringe benefits tax fbt return 2020 business details ato

How to make an eSignature for your PDF online

How to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is an FBT return form?

An FBT return form is a document filed by employers to report fringe benefits provided to employees within a financial year. It details the taxable value of benefits given and helps businesses ensure compliance with tax regulations. Understanding the FBT return form is vital for accurate reporting and avoiding penalties.

-

How can airSlate SignNow help with my FBT return form?

airSlate SignNow streamlines the process of preparing and submitting your FBT return form. Our platform allows users to easily fill out the necessary details, electronically sign, and securely share the form with the relevant tax authorities. This reduces the time spent on paperwork and minimizes errors.

-

Is the FBT return form process easy with airSlate SignNow?

Yes, airSlate SignNow provides an intuitive interface that simplifies the FBT return form process. Users can easily navigate through the form, utilize templates, and manage documents efficiently. This ease of use empowers businesses to focus on compliance without stress.

-

What pricing options does airSlate SignNow offer for businesses preparing an FBT return form?

airSlate SignNow offers flexible pricing plans tailored to different business needs when managing your FBT return form. Our plans are designed to be cost-effective while providing essential features for document management and eSigning. Contact our sales team for a quote customized to your requirements.

-

Are there integrations available for the FBT return form process?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications to enhance your FBT return form workflow. Whether it's accounting software, CRMs, or cloud storage, our integrations help you streamline data flow and improve efficiency.

-

What are the benefits of using airSlate SignNow for my FBT return form?

Using airSlate SignNow for your FBT return form offers numerous benefits including enhanced security, time savings, and reduced paperwork. Our electronic signing capabilities eliminate the need for physical signatures, ensuring that your documents are processed faster and efficiently. Additionally, you can track the status of your form in real-time.

-

Can airSlate SignNow assist with electronic signatures on the FBT return form?

Yes, airSlate SignNow is designed to facilitate electronic signatures on all document types, including your FBT return form. This feature allows multiple stakeholders to sign quickly and securely, making the submission process much more efficient. Plus, it's legally binding, ensuring compliance with regulations.

Get more for Fringe Benefits Tax FBT Return Business Details ATO

- Jury instruction sale or receipt of a stolen motor vehicle form

- Instruction sale 497334314 form

- Tender format 235323936

- Information and exercise sheet

- Pupils should cardinal pole roman catholic school form

- Application for a re entry visa for minors including form

- Qatar foundation schools draft school school calen form

- Baufinanzierung wohnflchenberechnung form

Find out other Fringe Benefits Tax FBT Return Business Details ATO

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease

- Electronic signature Nebraska Healthcare / Medical RFP Secure

- Electronic signature Nevada Healthcare / Medical Emergency Contact Form Later

- Electronic signature New Hampshire Healthcare / Medical Credit Memo Easy

- Electronic signature New Hampshire Healthcare / Medical Lease Agreement Form Free

- Electronic signature North Dakota Healthcare / Medical Notice To Quit Secure

- Help Me With Electronic signature Ohio Healthcare / Medical Moving Checklist

- Electronic signature Education PPT Ohio Secure

- Electronic signature Tennessee Healthcare / Medical NDA Now

- Electronic signature Tennessee Healthcare / Medical Lease Termination Letter Online

- Electronic signature Oklahoma Education LLC Operating Agreement Fast

- How To Electronic signature Virginia Healthcare / Medical Contract

- How To Electronic signature Virginia Healthcare / Medical Operating Agreement

- Electronic signature Wisconsin Healthcare / Medical Business Letter Template Mobile

- Can I Electronic signature Wisconsin Healthcare / Medical Operating Agreement