Form 451, Exemption Application Nebraska Revenue 2020-2026

What is the Form 451, Exemption Application Nebraska Revenue

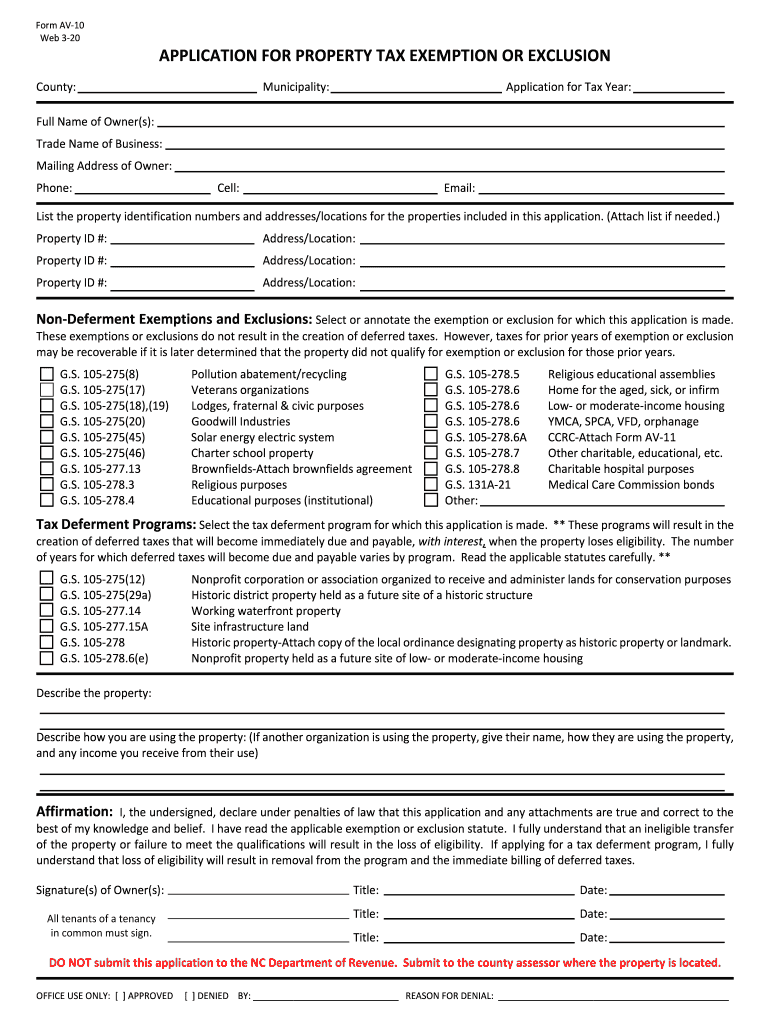

The Form 451 is an official document used in Nebraska to apply for property tax exemptions. This form is essential for individuals and organizations seeking to reduce their property tax liability based on specific criteria established by state law. The application is typically submitted to the local county assessor's office and serves to inform the authorities about the eligibility of the property for exemption. Understanding the purpose and requirements of Form 451 is crucial for applicants aiming to navigate the property tax system effectively.

How to use the Form 451, Exemption Application Nebraska Revenue

Using Form 451 involves several straightforward steps to ensure that your application is complete and accurate. First, gather all necessary information regarding the property and the applicant. This includes details such as the property address, ownership information, and the specific exemption being sought. Next, fill out the form carefully, ensuring that all sections are completed as required. After completing the form, review it for accuracy before submitting it to the appropriate county office. Proper use of the form can significantly impact the approval process for your property tax exemption.

Steps to complete the Form 451, Exemption Application Nebraska Revenue

Completing the Form 451 involves a series of detailed steps:

- Collect necessary documentation, including proof of ownership and any relevant financial information.

- Fill out the applicant's details, including name, address, and contact information.

- Provide specific information about the property, including its location and the type of exemption requested.

- Include any required signatures and dates to validate the application.

- Review the completed form for accuracy and completeness before submission.

Following these steps carefully can help ensure that your application is processed smoothly and efficiently.

Eligibility Criteria

To qualify for the exemption under Form 451, applicants must meet specific eligibility criteria set forth by Nebraska law. Generally, the property must be owned by a qualifying entity, such as a nonprofit organization, or fall under specific categories like religious or educational use. Additionally, the property must be used exclusively for the purposes outlined in the exemption application. Understanding these criteria is essential for applicants to determine their eligibility before submitting the form.

Form Submission Methods (Online / Mail / In-Person)

Form 451 can be submitted through various methods, offering flexibility to applicants. The most common submission methods include:

- By Mail: Applicants can print the completed form and send it directly to their local county assessor's office via postal service.

- In-Person: Applicants may also choose to deliver the form in person at the county assessor's office, allowing for immediate confirmation of receipt.

- Online: Some counties may offer an online submission option through their official websites, enabling applicants to submit the form electronically.

Choosing the appropriate submission method can help streamline the application process and ensure timely consideration.

Key elements of the Form 451, Exemption Application Nebraska Revenue

Understanding the key elements of Form 451 is vital for a successful application. The form typically includes sections for:

- Applicant information, including name and contact details.

- Property details, such as address and type of property.

- Specific exemption type being requested.

- Signatures of the applicant or authorized representative.

Each section must be completed accurately to avoid delays in processing and to enhance the chances of approval.

Quick guide on how to complete form 451 exemption application nebraska revenue

Complete Form 451, Exemption Application Nebraska Revenue effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a flawless eco-friendly alternative to traditional printed and signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents rapidly without delays. Manage Form 451, Exemption Application Nebraska Revenue on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form 451, Exemption Application Nebraska Revenue with ease

- Obtain Form 451, Exemption Application Nebraska Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and holds the same legal validity as a standard wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select how you wish to send your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Alter and eSign Form 451, Exemption Application Nebraska Revenue to ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 451 exemption application nebraska revenue

Create this form in 5 minutes!

How to create an eSignature for the form 451 exemption application nebraska revenue

The best way to make an electronic signature for your PDF file online

The best way to make an electronic signature for your PDF file in Google Chrome

The best way to make an eSignature for signing PDFs in Gmail

How to generate an eSignature right from your mobile device

How to generate an electronic signature for a PDF file on iOS

How to generate an eSignature for a PDF on Android devices

People also ask

-

What is Form 451 and how does airSlate SignNow assist with it?

Form 451 is a specific document commonly used in various sectors. airSlate SignNow simplifies the process of creating, signing, and managing Form 451 by providing intuitive templates and easy e-signature features, ensuring that your documents are completed efficiently and securely.

-

Is airSlate SignNow suitable for businesses of all sizes to manage Form 451?

Yes, airSlate SignNow is designed to cater to businesses of all sizes. Whether you're a solopreneur or part of a large corporation, our platform can help you manage Form 451 and other important documents with ease, enhancing productivity and compliance.

-

What are the key features of airSlate SignNow for processing Form 451?

Key features of airSlate SignNow that benefit users dealing with Form 451 include customizable templates, robust e-signature capabilities, secure cloud storage, and real-time tracking of document statuses. These functionalities streamline workflows and ensure that important forms are managed effectively.

-

How does pricing work for using airSlate SignNow with Form 451?

airSlate SignNow offers flexible pricing plans tailored to fit different business needs. Our pricing is transparent and competitive, allowing you to utilize our platform for Form 451 without incurring hidden fees, thus providing excellent value for your investment.

-

Can I integrate airSlate SignNow with other software for managing Form 451?

Absolutely! airSlate SignNow supports seamless integrations with numerous third-party applications such as CRM platforms, productivity tools, and cloud storage services. This capability allows you to enhance your workflow while managing Form 451 alongside your existing software solutions.

-

What are the security measures in place for handling Form 451 with airSlate SignNow?

Security is a top priority at airSlate SignNow. Our platform utilizes advanced encryption protocols and secure access controls to safeguard your documents, including Form 451, ensuring that your sensitive information remains protected throughout the signing process.

-

How can airSlate SignNow improve the turnaround time for Form 451?

By utilizing airSlate SignNow's automated workflows and quick e-signature features, businesses can drastically reduce turnaround times for Form 451. This efficiency not only speeds up document completion but also accelerates decision-making processes.

Get more for Form 451, Exemption Application Nebraska Revenue

Find out other Form 451, Exemption Application Nebraska Revenue

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal

- Sign Idaho Basic rental agreement or residential lease Online

- How To Sign Oregon Business agreements

- Sign Colorado Generic lease agreement Safe

- How Can I Sign Vermont Credit agreement

- Sign New York Generic lease agreement Myself

- How Can I Sign Utah House rent agreement format

- Sign Alabama House rental lease agreement Online

- Sign Arkansas House rental lease agreement Free

- Sign Alaska Land lease agreement Computer

- How Do I Sign Texas Land lease agreement

- Sign Vermont Land lease agreement Free

- Sign Texas House rental lease Now

- How Can I Sign Arizona Lease agreement contract

- Help Me With Sign New Hampshire lease agreement

- How To Sign Kentucky Lease agreement form

- Can I Sign Michigan Lease agreement sample

- How Do I Sign Oregon Lease agreement sample

- How Can I Sign Oregon Lease agreement sample