Form 100 California Corporation Franchise or Income Tax Return Form 100 California Corporation Franchise or Income Tax Return 2019-2026

Understanding the Form 100 California Corporation Franchise or Income Tax Return

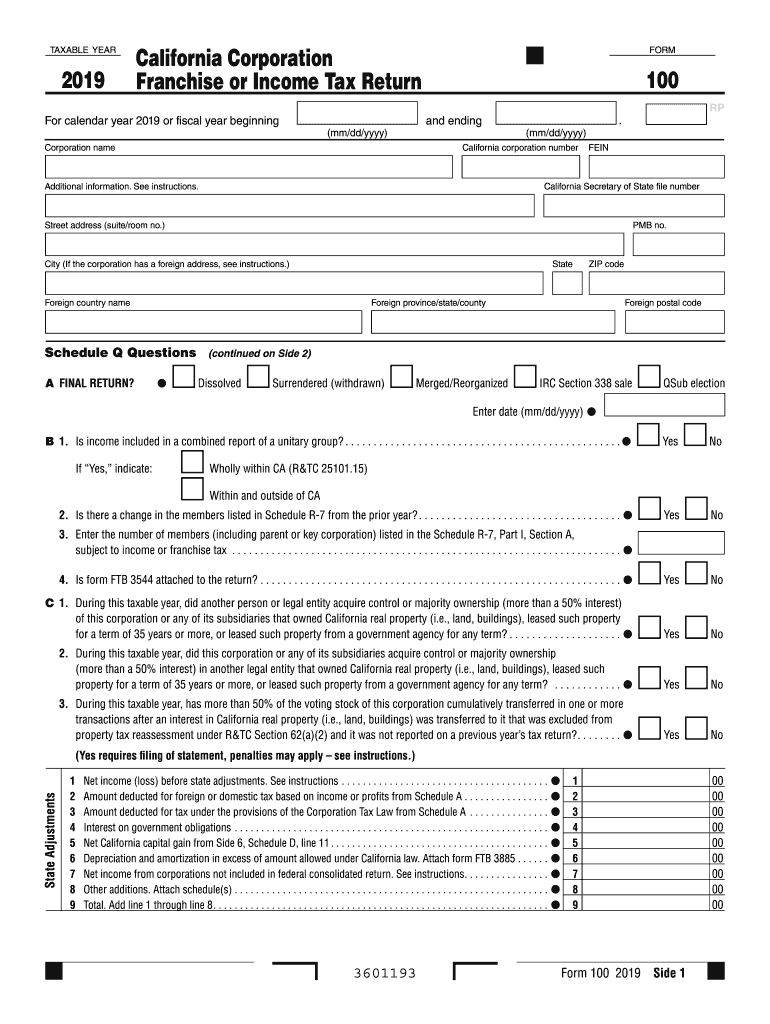

The Form 100 is a crucial document for California corporations, used to report income and calculate the franchise tax owed to the state. This form is specifically designed for corporations operating in California, including C corporations and certain types of limited liability companies (LLCs). It encompasses various income sources, deductions, and tax credits applicable to the corporation's financial activities during the tax year.

Steps to Complete the Form 100 California Corporation Franchise or Income Tax Return

Completing the Form 100 involves several key steps to ensure accuracy and compliance. Start by gathering all necessary financial documents, including income statements, balance sheets, and prior tax returns. Next, follow these steps:

- Identify the filing period: Determine the tax year for which you are filing.

- Fill in corporate information: Include the corporation's name, address, and federal employer identification number (EIN).

- Report income: Document all sources of income, including sales revenue and investment income.

- Calculate deductions: List allowable deductions such as business expenses, losses, and credits.

- Determine the tax liability: Use the provided tax rate schedule to calculate the franchise tax owed.

- Sign and date the form: Ensure that the form is signed by an authorized officer of the corporation.

Filing Deadlines for the Form 100

Corporations must be aware of the filing deadlines to avoid penalties. The Form 100 is typically due on the fifteenth day of the fourth month following the close of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by April 15. Extensions may be available, but it is essential to file for an extension before the original due date to avoid late fees.

Legal Use of the Form 100 California Corporation Franchise or Income Tax Return

The Form 100 serves as a legal document that reports a corporation's income and tax liability to the California Franchise Tax Board. Proper completion and submission of this form are essential for compliance with state tax laws. Failure to file or inaccuracies in the form can lead to penalties, interest on unpaid taxes, and potential legal repercussions.

Required Documents for Filing the Form 100

When preparing to file the Form 100, certain documents are necessary to ensure a complete and accurate submission. These documents include:

- Financial statements: Income statements and balance sheets for the tax year.

- Prior year tax returns: Copies of the previous year's Form 100 or other relevant tax returns.

- Supporting schedules: Any additional schedules required for specific deductions or credits claimed.

- Documentation for credits: Evidence supporting any tax credits being claimed.

Obtaining the Form 100 California Corporation Franchise or Income Tax Return

The Form 100 can be obtained directly from the California Franchise Tax Board's website or through authorized tax professionals. It is important to ensure that you are using the most current version of the form, as tax laws and requirements can change annually. Additionally, many tax preparation software programs include the Form 100, making it easier to complete and file electronically.

Quick guide on how to complete 2019 form 100 california corporation franchise or income tax return 2019 form 100 california corporation franchise or income

Complete Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return effortlessly on any gadget

Web-based document management has become increasingly favored by organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and eSign your documents promptly without interruptions. Handle Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to alter and eSign Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return with ease

- Locate Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return and then click Get Form to initiate the process.

- Utilize the tools available to complete your form.

- Select important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Decide how you want to share your form, via email, text message (SMS), invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Adjust and eSign Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return and guarantee excellent communication at every phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 form 100 california corporation franchise or income tax return 2019 form 100 california corporation franchise or income

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 100 california corporation franchise or income tax return 2019 form 100 california corporation franchise or income

The way to generate an eSignature for your PDF file in the online mode

The way to generate an eSignature for your PDF file in Chrome

How to make an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your smartphone

The way to create an electronic signature for a PDF file on iOS devices

The best way to generate an electronic signature for a PDF on Android

People also ask

-

What is the 2013 franchise tax and who needs to file it?

The 2013 franchise tax is a tax imposed on businesses operating in certain states. Companies with revenue above a specific threshold are required to file this tax. It's crucial to understand your obligations to avoid penalties, ensuring you remain compliant with regulations.

-

How can airSlate SignNow help with filing the 2013 franchise tax?

airSlate SignNow provides an efficient platform for electronically signing and sending important tax documents, including those for the 2013 franchise tax. This streamlines the process, making it simpler to gather signatures and ensure timely submissions, reducing the risk of delays.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow offers features like document templates, customizable workflows, and secure storage to manage documents related to the 2013 franchise tax. These tools allow for efficient organization and retrieval of necessary forms, aiding in seamless filing and compliance.

-

Is airSlate SignNow cost-effective for small businesses handling the 2013 franchise tax?

Yes, airSlate SignNow has a pricing structure designed to be affordable for small businesses managing the 2013 franchise tax. By offering scalable plans, businesses can choose options that fit their budget without sacrificing essential features for document signing and management.

-

Can I integrate airSlate SignNow with accounting software for the 2013 franchise tax?

Absolutely! airSlate SignNow integrates with various accounting software solutions, allowing users to streamline the workflow related to the 2013 franchise tax. This ensures that all financial documents are synchronized and accessible, promoting better financial management and compliance.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the 2013 franchise tax, ensures faster processing times and reduced paperwork. The platform minimizes manual errors through its user-friendly interface, making it easier to track the status of documents and enhance overall productivity.

-

How secure is airSlate SignNow for sensitive documents like the 2013 franchise tax?

airSlate SignNow prioritizes security, utilizing advanced encryption protocols to protect sensitive documents, including those for the 2013 franchise tax. Users can have peace of mind knowing their information is handled securely and complies with industry regulations to ensure data protection.

Get more for Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return

Find out other Form 100 California Corporation Franchise Or Income Tax Return Form 100 California Corporation Franchise Or Income Tax Return

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now

- Electronic signature Connecticut Car Dealer Warranty Deed Computer

- Electronic signature New Mexico Banking Job Offer Online

- How Can I Electronic signature Delaware Car Dealer Purchase Order Template

- How To Electronic signature Delaware Car Dealer Lease Template