Fillable Massachusetts M 4 Form 2016

What is the Fillable Massachusetts M-4 Form

The Fillable Massachusetts M-4 Form is a crucial document used for state tax withholding. This form allows employees to provide their employers with information about their tax situation, including the number of allowances they wish to claim. By accurately completing the M-4, individuals can ensure that the correct amount of state income tax is withheld from their paychecks, helping to avoid underpayment or overpayment of taxes.

Steps to Complete the Fillable Massachusetts M-4 Form

Completing the Fillable Massachusetts M-4 Form involves several straightforward steps:

- Gather necessary personal information, including your Social Security number and filing status.

- Determine the number of allowances you wish to claim based on your personal and financial situation.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the form for any errors or omissions before submission.

- Submit the completed form to your employer, who will use it to adjust your state tax withholding.

Legal Use of the Fillable Massachusetts M-4 Form

The Fillable Massachusetts M-4 Form is legally recognized for state tax purposes. Employers are required to keep this form on file for their employees, as it serves as the basis for withholding state income tax. Proper completion and submission of the M-4 ensure compliance with Massachusetts tax laws, protecting both employees and employers from potential penalties associated with incorrect withholding.

Filing Deadlines / Important Dates

It is essential to be aware of key deadlines related to the Fillable Massachusetts M-4 Form. Employees should submit their M-4 to their employer as soon as they start a new job or experience a change in financial circumstances that affects their tax situation. Employers must ensure that they have the most current M-4 on file for each employee to maintain compliance with state tax regulations.

Form Submission Methods (Online / Mail / In-Person)

The Fillable Massachusetts M-4 Form can be submitted in various ways to accommodate different preferences:

- Online: Many employers offer electronic submission options through payroll systems.

- Mail: Employees can print the completed form and send it to their employer via postal service.

- In-Person: Directly handing the form to the employer's HR or payroll department is also an option.

Required Documents

To complete the Fillable Massachusetts M-4 Form, individuals typically need to provide specific documents that support their claims. These may include:

- Social Security number

- Previous year’s tax return for reference

- Any relevant financial documents that affect withholding, such as W-2 forms or other income statements.

Quick guide on how to complete fillable massachusetts m 4 form 2020

Complete Fillable Massachusetts M 4 Form effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Fillable Massachusetts M 4 Form on any device using the airSlate SignNow Android or iOS applications and streamline your document-related tasks today.

How to modify and eSign Fillable Massachusetts M 4 Form with ease

- Obtain Fillable Massachusetts M 4 Form and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to finalize your edits.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Fillable Massachusetts M 4 Form to ensure exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct fillable massachusetts m 4 form 2020

Create this form in 5 minutes!

How to create an eSignature for the fillable massachusetts m 4 form 2020

The way to make an electronic signature for your PDF document in the online mode

The way to make an electronic signature for your PDF document in Chrome

The best way to make an electronic signature for putting it on PDFs in Gmail

The best way to make an eSignature from your mobile device

The way to generate an electronic signature for a PDF document on iOS devices

The best way to make an eSignature for a PDF file on Android devices

People also ask

-

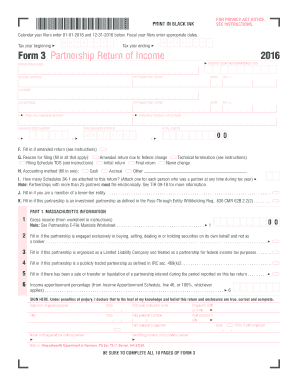

What is a Massachusetts partnership return?

A Massachusetts partnership return refers to the tax return filed by partnerships operating in Massachusetts. This return, known as Form 3, details the partnership's income, deductions, and credits. Filing a Massachusetts partnership return is essential to ensure compliance with state tax laws and to allocate the income correctly among partners.

-

Why is it important to file a Massachusetts partnership return on time?

Filing a Massachusetts partnership return on time helps avoid penalties and interest for late submissions. Timely filing also ensures that partners can report their income accurately on their personal tax returns. This is crucial for maintaining good financial practices and tax compliance within the state.

-

What features does airSlate SignNow offer for managing my Massachusetts partnership return?

airSlate SignNow provides features that simplify the signing and management of documents related to your Massachusetts partnership return. With our platform, you can easily send, sign, and store your tax documents securely. This streamlined process saves time and enhances collaboration among partners.

-

How can airSlate SignNow help reduce costs when filing a Massachusetts partnership return?

Using airSlate SignNow can signNowly reduce costs associated with filing a Massachusetts partnership return by eliminating the need for physical paperwork and postage. Our electronic signature solution speeds up the process, resulting in fewer delays and potentially lower accountant fees. This cost-effective approach allows partnerships to manage their filings more efficiently.

-

Do I need any specific integrations for filing my Massachusetts partnership return with airSlate SignNow?

airSlate SignNow seamlessly integrates with various accounting software that can be used to prepare your Massachusetts partnership return. This integration streamlines the process by allowing data to flow easily between applications, reducing the chances of errors. Check our integration options to find the best fit for your workflow.

-

Is airSlate SignNow secure for handling my sensitive Massachusetts partnership return documents?

Yes, airSlate SignNow prioritizes the security of your documents, including sensitive information contained in your Massachusetts partnership return. Our platform employs advanced encryption and complies with industry standards to protect your data. You can trust that your partnership’s information is safe with us.

-

Can I customize documents for my Massachusetts partnership return using airSlate SignNow?

Absolutely! With airSlate SignNow, you can customize your documents to meet the specific needs of your Massachusetts partnership return. This flexibility allows you to add specific fields, branding, and other elements that enhance the professional appearance of your documents and ensure compliance with state requirements.

Get more for Fillable Massachusetts M 4 Form

Find out other Fillable Massachusetts M 4 Form

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online