Calendar Year Filers Enter 01012019 and 12312019 Below; Fiscal Year Filers Enter Appropriate Dates 2019-2026

Understanding Calendar Year and Fiscal Year Filers

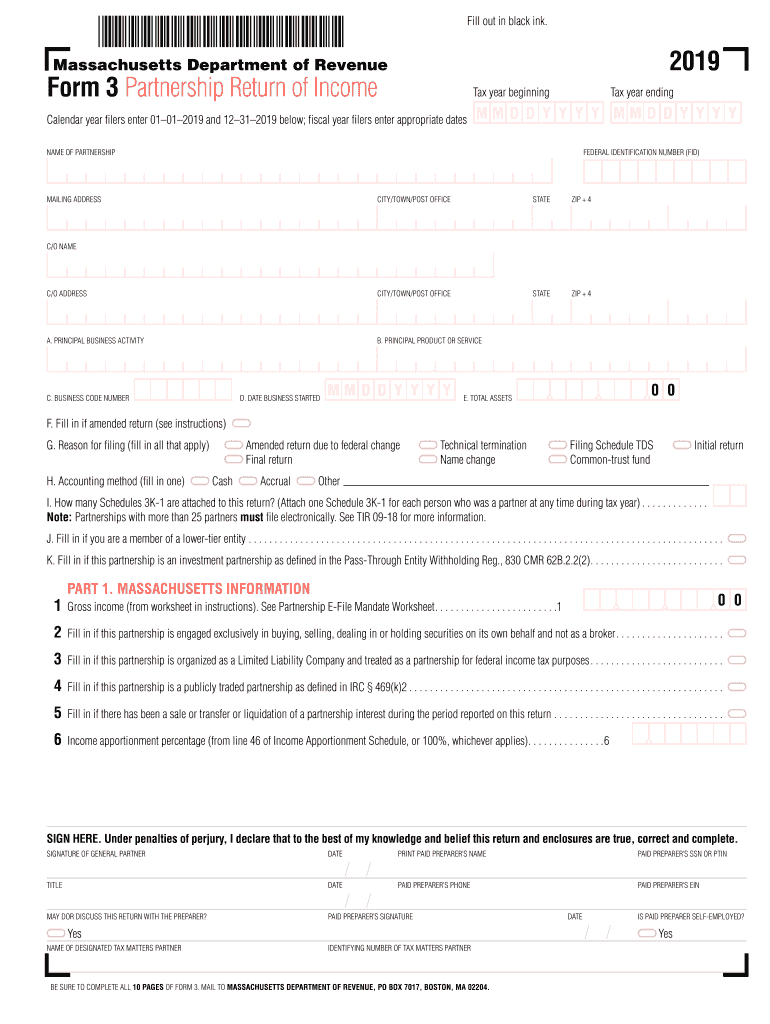

The 2020 form mas distinguishes between calendar year filers and fiscal year filers. Calendar year filers report their income and expenses for the period from January 1 to December 31. In contrast, fiscal year filers report for a twelve-month period that does not coincide with the calendar year. When filling out the form, calendar year filers should enter the dates 01/01/2019 and 12/31/2019 in the designated sections. Fiscal year filers must enter the appropriate start and end dates that reflect their specific fiscal year.

Steps to Complete the Form as a Calendar Year Filer

To accurately complete the 2020 form mas as a calendar year filer, follow these steps:

- Begin by entering your business name and address at the top of the form.

- In the section for reporting periods, input 01/01/2019 and 12/31/2019.

- Fill in all income and expense sections with accurate figures from your records.

- Ensure that any deductions or credits applicable to your business are included.

- Review the completed form for accuracy before submission.

Required Documents for Submission

When preparing to submit the 2020 form mas, gather the necessary documents to ensure completeness. Required documents typically include:

- Financial statements, including profit and loss statements.

- Receipts for any claimed deductions.

- Previous year’s tax returns for reference.

- Any supporting documentation for credits or special deductions.

Filing Deadlines for the 2020 Form

It is essential to be aware of the filing deadlines for the 2020 form mas. Generally, forms must be filed by the fifteenth day of the fourth month following the end of your tax year. For calendar year filers, this typically means a deadline of April 15, 2020. If this date falls on a weekend or holiday, the deadline may be adjusted accordingly.

Penalties for Non-Compliance

Failure to file the 2020 form mas on time can result in penalties. Common penalties include:

- Late filing penalties, which can accumulate daily until the form is submitted.

- Interest on any unpaid taxes, which accrues from the due date.

- Potential legal ramifications for ongoing non-compliance.

Digital vs. Paper Version of the Form

The 2020 form mas can be completed and submitted either digitally or via paper. Digital submission is often faster and can streamline the process. Electronic filing may also provide immediate confirmation of receipt. Conversely, paper submissions may take longer to process and require additional time for confirmation. Consider your business needs and preferences when choosing the method of filing.

Quick guide on how to complete calendar year filers enter 01012019 and 12312019 below fiscal year filers enter appropriate dates

Effortlessly Prepare Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the correct form and safely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without holdups. Manage Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates on any device using the airSlate SignNow apps available for Android or iOS and enhance any document-centric process today.

The easiest way to modify and eSign Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates effortlessly

- Find Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates and click Get Form to begin.

- Utilize the tools provided to fill out your form.

- Emphasize important parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to finalize your changes.

- Choose how you wish to deliver your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates and maintain excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct calendar year filers enter 01012019 and 12312019 below fiscal year filers enter appropriate dates

Create this form in 5 minutes!

How to create an eSignature for the calendar year filers enter 01012019 and 12312019 below fiscal year filers enter appropriate dates

The way to create an eSignature for a PDF file online

The way to create an eSignature for a PDF file in Google Chrome

The best way to create an electronic signature for signing PDFs in Gmail

How to make an electronic signature from your mobile device

The best way to generate an eSignature for a PDF file on iOS

How to make an electronic signature for a PDF file on Android devices

People also ask

-

What is the 2020 form mas, and how can SignNow help with it?

The 2020 form mas is an essential document used by businesses for various compliance and operational purposes. SignNow streamlines the eSigning process for this form, allowing users to quickly send, sign, and store their 2020 form mas securely online.

-

How does SignNow pricing compare for businesses needing the 2020 form mas?

SignNow offers competitive pricing tailored for businesses needing to manage documents like the 2020 form mas. With different plans that cater to various needs, users can choose an option that fits their budget while benefiting from the full functionality for managing the 2020 form mas.

-

What key features does SignNow offer for managing the 2020 form mas?

SignNow provides a range of features beneficial for the 2020 form mas, including reusable templates, automated workflows, and robust eSigning capabilities. These features ensure that businesses can process their forms efficiently and effectively without any hassle.

-

Are there integrations available with SignNow for the 2020 form mas?

Yes, SignNow seamlessly integrates with numerous applications that businesses commonly use, making it easier to manage the 2020 form mas along with other documents. These integrations can enhance productivity by connecting SignNow with popular tools like Google Drive, Salesforce, and more.

-

What benefits does SignNow provide for businesses using the 2020 form mas?

By utilizing SignNow for the 2020 form mas, businesses can enhance their operational efficiency and reduce turnaround times for document approvals. The eSigning process is secure and legally binding, which signNowly benefits compliance and record-keeping.

-

Is SignNow mobile-friendly for handling the 2020 form mas?

Absolutely! SignNow's mobile app allows users to access and manage the 2020 form mas on the go. This flexibility ensures that users can send, receive, and sign documents anytime, anywhere, which is especially useful for busy professionals.

-

How secure is SignNow in handling the 2020 form mas?

SignNow takes security seriously, employing advanced encryption and compliance with industry standards to protect the 2020 form mas. Users can have peace of mind knowing their documents are secured from unauthorized access and tampering.

Get more for Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates

Find out other Calendar Year Filers Enter 01012019 And 12312019 Below; Fiscal Year Filers Enter Appropriate Dates

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease