TIP #12B05 04 Revenue Law Library Florida Department of 2020

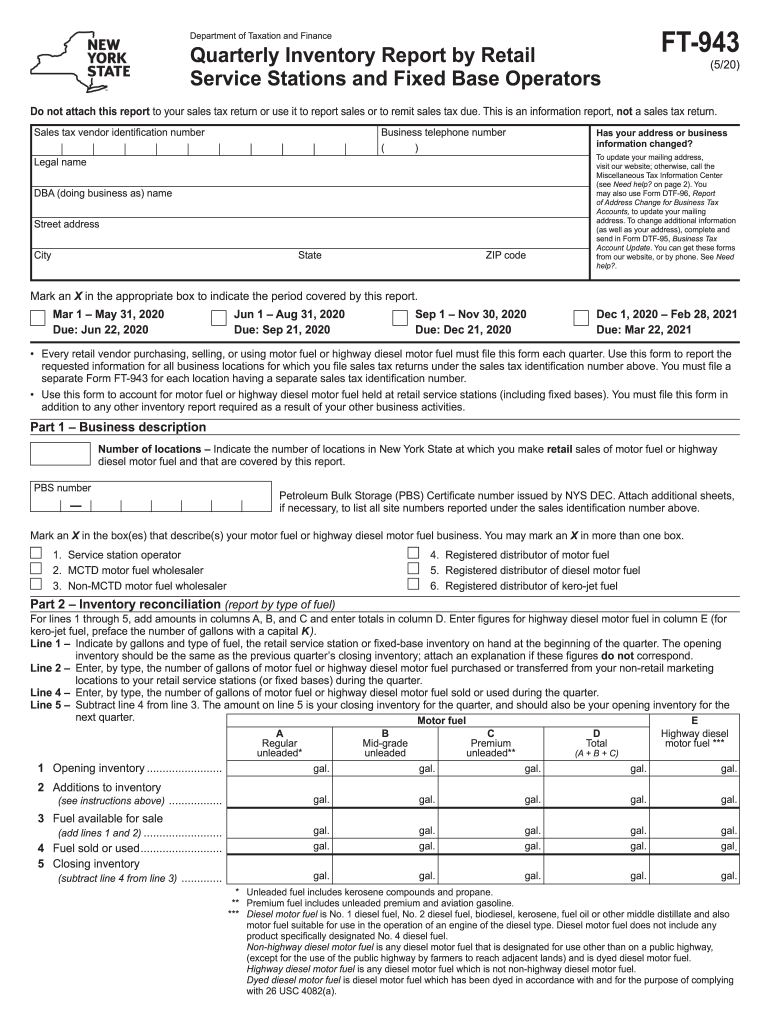

Understanding the NY Forms FT 943

The NY Forms FT 943, also known as the sales tax form FT 943, is a crucial document for businesses operating in New York. This form is primarily used to report and remit sales tax collected by businesses. It is essential for ensuring compliance with state tax regulations, allowing businesses to accurately report their sales and remit the correct amount of tax to the state. Understanding the requirements and proper usage of this form is vital for any business owner or tax professional in New York.

Steps to Complete the NY Forms FT 943

Completing the NY Forms FT 943 involves several key steps. First, gather all necessary sales records, including invoices and receipts, to accurately report the total sales amount. Next, calculate the total sales tax collected during the reporting period. This includes applying the appropriate tax rates based on the type of goods or services sold. Once you have this information, fill out the form carefully, ensuring that all figures are accurate. Finally, review the form for any errors before submitting it to the New York State Department of Taxation and Finance.

Filing Deadlines for NY Forms FT 943

It is important to be aware of the filing deadlines for the NY Forms FT 943 to avoid penalties. Typically, the form must be filed quarterly, with specific due dates depending on the reporting period. For example, the due date for the first quarter is usually April 20, while the second quarter is due July 20. Businesses should keep track of these dates to ensure timely submission and compliance with state tax laws.

Required Documents for NY Forms FT 943

When preparing to file the NY Forms FT 943, certain documents are required to support the information reported. This includes sales records, invoices, and any other relevant financial documentation that verifies the sales tax collected. Additionally, businesses may need to provide proof of any exemptions claimed during the reporting period. Having these documents organized and readily available can facilitate a smoother filing process.

Penalties for Non-Compliance with NY Forms FT 943

Failure to comply with the requirements of the NY Forms FT 943 can result in significant penalties. These may include monetary fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to understand the implications of non-compliance and to take proactive steps to ensure timely and accurate filing of the form.

Digital vs. Paper Version of NY Forms FT 943

Businesses have the option to file the NY Forms FT 943 either digitally or via paper submission. The digital version offers several advantages, including faster processing times and the ability to easily track submissions. Electronic filing also reduces the risk of errors associated with manual entry. However, some businesses may prefer the paper version for record-keeping purposes. Understanding the benefits of each method can help businesses choose the best option for their needs.

IRS Guidelines for Sales Tax Reporting

In addition to state requirements, businesses must also adhere to IRS guidelines regarding sales tax reporting. The IRS provides specific instructions on how to report sales tax collected and any related deductions that may be applicable. Familiarizing oneself with these guidelines can help ensure that businesses remain compliant with both state and federal tax laws.

Quick guide on how to complete tip 12b05 04 revenue law library florida department of

Prepare TIP #12B05 04 Revenue Law Library Florida Department Of effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without any holdup. Handle TIP #12B05 04 Revenue Law Library Florida Department Of on any platform using airSlate SignNow Android or iOS applications and enhance any document-driven operation today.

How to alter and electronically sign TIP #12B05 04 Revenue Law Library Florida Department Of seamlessly

- Locate TIP #12B05 04 Revenue Law Library Florida Department Of and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize relevant sections of your documents or redact sensitive information using tools that airSlate SignNow offers for this purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Select your preferred method of delivering your form, by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your requirements in document management in just a few clicks from a device of your choosing. Modify and electronically sign TIP #12B05 04 Revenue Law Library Florida Department Of and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct tip 12b05 04 revenue law library florida department of

Create this form in 5 minutes!

How to create an eSignature for the tip 12b05 04 revenue law library florida department of

The way to make an eSignature for your PDF document online

The way to make an eSignature for your PDF document in Google Chrome

The way to make an electronic signature for signing PDFs in Gmail

The best way to make an electronic signature straight from your smart phone

The way to make an electronic signature for a PDF document on iOS

The best way to make an electronic signature for a PDF document on Android OS

People also ask

-

What are ny forms ft 943 and why are they important for businesses?

NY forms ft 943 are essential for businesses operating in New York to report and pay their state unemployment insurance taxes. These forms help ensure compliance with state regulations and avoid penalties. Utilizing airSlate SignNow to manage these forms simplifies the process, making it easier for businesses to stay organized and compliant.

-

How does airSlate SignNow support the completion of ny forms ft 943?

AirSlate SignNow provides users with the tools to easily fill out and e-sign ny forms ft 943 digitally. The platform streamlines document management, allowing businesses to prepare, send, and store these forms securely. This reduces paperwork hassles and accelerates the submission process.

-

What features does airSlate SignNow offer for managing ny forms ft 943?

AirSlate SignNow offers several features tailored for managing ny forms ft 943, including customizable templates, easy e-signature capabilities, and document tracking. These features help streamline workflows and enhance collaboration among teams. Additionally, you can easily share forms with stakeholders for faster turnaround times.

-

Is airSlate SignNow affordable for small businesses filing ny forms ft 943?

Yes, airSlate SignNow offers cost-effective pricing plans suitable for small businesses filing ny forms ft 943. With competitive rates, businesses can access powerful features without breaking the bank. Investing in this solution can save time and enhance productivity in managing essential documents.

-

Can I integrate airSlate SignNow with other applications for managing ny forms ft 943?

Absolutely! AirSlate SignNow supports integrations with various applications, facilitating the seamless management of ny forms ft 943. You can connect it with popular tools like Google Drive, Salesforce, and others to streamline your document workflow. This ensures that all your data is synchronized and readily accessible.

-

How secure is airSlate SignNow for handling sensitive ny forms ft 943?

AirSlate SignNow prioritizes security, employing advanced encryption technologies to protect all documents, including ny forms ft 943. The platform also complies with industry standards and regulations to ensure that your sensitive information remains confidential. Trust in our secure solution to handle your crucial business documents safely.

-

What benefits does e-signing ny forms ft 943 with airSlate SignNow provide?

E-signing ny forms ft 943 with airSlate SignNow offers numerous benefits, including quicker turnaround times and enhanced convenience for all signers. The process is entirely digital, reducing the need for physical paperwork and allowing users to sign from anywhere. This flexibility not only saves time but also promotes a more environmentally friendly approach.

Get more for TIP #12B05 04 Revenue Law Library Florida Department Of

Find out other TIP #12B05 04 Revenue Law Library Florida Department Of

- Sign Ohio Sports LLC Operating Agreement Easy

- Sign New Jersey Real Estate Limited Power Of Attorney Computer

- Sign New Mexico Real Estate Contract Safe

- How To Sign South Carolina Sports Lease Termination Letter

- How Can I Sign New York Real Estate Memorandum Of Understanding

- Sign Texas Sports Promissory Note Template Online

- Sign Oregon Orthodontists Last Will And Testament Free

- Sign Washington Sports Last Will And Testament Free

- How Can I Sign Ohio Real Estate LLC Operating Agreement

- Sign Ohio Real Estate Quitclaim Deed Later

- How Do I Sign Wisconsin Sports Forbearance Agreement

- How To Sign Oregon Real Estate Resignation Letter

- Can I Sign Oregon Real Estate Forbearance Agreement

- Sign Pennsylvania Real Estate Quitclaim Deed Computer

- How Do I Sign Pennsylvania Real Estate Quitclaim Deed

- How Can I Sign South Dakota Orthodontists Agreement

- Sign Police PPT Alaska Online

- How To Sign Rhode Island Real Estate LLC Operating Agreement

- How Do I Sign Arizona Police Resignation Letter

- Sign Texas Orthodontists Business Plan Template Later