FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request 2020-2026

Understanding the FTB 4107 Mandatory E Pay Requirement Waiver Request

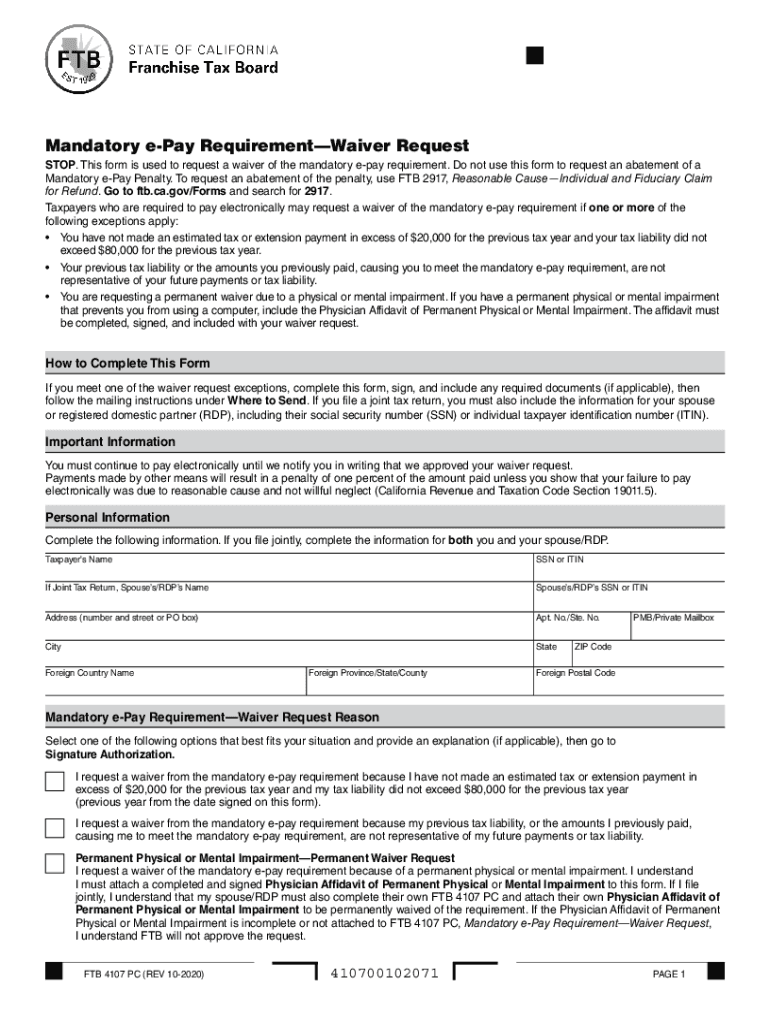

The FTB 4107 serves as a waiver request for the mandatory e-pay requirement in California. This form is particularly relevant for businesses that may not meet the criteria for electronic payment but still need to comply with state regulations. By submitting this form, taxpayers can request an exemption from the e-pay mandate, allowing them to continue using traditional payment methods without facing penalties. Understanding the specific conditions under which this waiver can be granted is crucial for compliance and financial planning.

Steps to Complete the FTB 4107 Mandatory E Pay Requirement Waiver Request

Completing the FTB 4107 form involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your business details and the reasons for requesting the waiver. Next, fill out the form carefully, ensuring that all sections are completed accurately. Pay special attention to the justification section, as this will be critical for the approval process. Once completed, review the form for any errors before submitting it to the appropriate state agency. This thorough approach can help prevent delays in processing your request.

Eligibility Criteria for the FTB 4107 Mandatory E Pay Requirement Waiver Request

To qualify for the FTB 4107 waiver, businesses must meet specific eligibility criteria set by the California Franchise Tax Board. Generally, these criteria include situations where electronic payment is not feasible due to financial hardship or technological limitations. Additionally, businesses that are new or have recently changed their payment methods may also be eligible. It is essential to clearly articulate your circumstances in the waiver request to improve the chances of approval.

Legal Use of the FTB 4107 Mandatory E Pay Requirement Waiver Request

The legal standing of the FTB 4107 is significant, as it provides a formal process for taxpayers to request an exemption from mandatory e-pay regulations. This form is recognized by the California Franchise Tax Board and must be submitted in accordance with state laws. It is important to understand that while the waiver request is a legal document, the approval is contingent upon meeting the outlined eligibility criteria and providing adequate justification for the exemption.

Form Submission Methods for the FTB 4107

Submitting the FTB 4107 can be done through various methods, ensuring convenience for taxpayers. The form can be submitted online via the California Franchise Tax Board's website, which is often the fastest method. Alternatively, businesses may choose to mail the completed form to the designated address provided by the FTB. In-person submissions are also an option, although they may require an appointment. Understanding these submission methods can help streamline the process and ensure timely handling of your waiver request.

Penalties for Non-Compliance with the FTB 4107 Requirements

Failing to comply with the mandatory e-pay requirements can result in significant penalties for businesses. These penalties may include fines or additional interest on unpaid taxes. By submitting the FTB 4107 waiver request, businesses can mitigate the risk of such penalties, provided they meet the necessary criteria for exemption. It is advisable to stay informed about compliance requirements to avoid any financial repercussions associated with non-compliance.

Quick guide on how to complete ftb 4107 mandatory e pay requirement waiver request ftb 4107 mandatory e pay requirement waiver request

Accomplish FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers a perfect environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the right form and securely keep it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and eSign your documents swiftly without delays. Manage FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request on any platform with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to alter and eSign FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request effortlessly

- Obtain FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct ftb 4107 mandatory e pay requirement waiver request ftb 4107 mandatory e pay requirement waiver request

Create this form in 5 minutes!

How to create an eSignature for the ftb 4107 mandatory e pay requirement waiver request ftb 4107 mandatory e pay requirement waiver request

The best way to make an electronic signature for your PDF online

The best way to make an electronic signature for your PDF in Google Chrome

The best way to generate an electronic signature for signing PDFs in Gmail

The best way to generate an eSignature right from your smartphone

How to generate an electronic signature for a PDF on iOS

The best way to generate an eSignature for a PDF on Android

People also ask

-

What is the ftb 4107 form, and why do I need it?

The ftb 4107 form is essential for California taxpayers claiming the California Earned Income Tax Credit. This form helps ensure you receive the maximum credits available, which can signNowly reduce your tax burden. Using airSlate SignNow simplifies the document signing process for submitting your ftb 4107 efficiently.

-

How does airSlate SignNow support the completion of the ftb 4107?

airSlate SignNow offers a user-friendly platform for filling out your ftb 4107 form electronically. With customizable templates and eSignature capabilities, you can complete the form accurately and securely in one seamless workflow. This streamlines your tax filing experience, ensuring you don't miss out on important credits.

-

Is there a cost associated with using airSlate SignNow for the ftb 4107 form?

airSlate SignNow provides a cost-effective solution with various pricing plans to fit different needs. Many users find the value in the time saved and ease of use when completing important forms like the ftb 4107. Check our website for competitive pricing tailored to your business or personal needs.

-

What features does airSlate SignNow offer for document management related to the ftb 4107?

With airSlate SignNow, you can access features such as document sharing, collaborative editing, and secure eSigning tailored to the ftb 4107. These features ensure that you can manage your tax documents efficiently, reducing errors and expediting the submission process. Additionally, the platform is designed to keep your information secure.

-

Can I integrate airSlate SignNow with other platforms for my ftb 4107 submissions?

Yes! airSlate SignNow seamlessly integrates with various applications to enhance your document workflow for the ftb 4107 submissions. You can connect it with popular platforms like Google Drive, Dropbox, and others, making it easier to store and share your tax documents securely.

-

What benefits does using airSlate SignNow provide for filing the ftb 4107?

Using airSlate SignNow for your ftb 4107 filing offers multiple benefits, including increased efficiency, reduced paper clutter, and enhanced security. The platform's intuitive interface helps you complete and sign forms more quickly, ensuring that you can focus on what matters most – getting your tax credits without hassle.

-

Is airSlate SignNow suitable for both individuals and businesses filing the ftb 4107?

Absolutely! airSlate SignNow caters to both individuals and businesses needing to file the ftb 4107 form. Our flexible solutions accommodate various user needs, from freelancers to larger organizations, ensuring that all parties can efficiently manage their tax documentation.

Get more for FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request

- Release minor child form

- Waiver and release from liability for adult for canoeing kayaking form

- Release minor form 497427172

- Waiver and release from liability for adult for laser tag facility form

- Waiver and release from liability for minor child for laser tag facility form

- Waiver and release from liability for adult for rugby club form

- Waiver and release from liability for minor child for rugby club form

- Waiver and release from liability for adult for squash club form

Find out other FTB 4107 Mandatory E Pay Requirement Waiver Request FTB 4107 Mandatory E Pay Requirement Waiver Request

- Sign Non-Profit Document New Mexico Mobile

- Sign Alaska Orthodontists Business Plan Template Free

- Sign North Carolina Life Sciences Purchase Order Template Computer

- Sign Ohio Non-Profit LLC Operating Agreement Secure

- Can I Sign Ohio Non-Profit LLC Operating Agreement

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe