CONNECTICUT Internal Revenue Service 2019

Understanding the Connecticut Internal Revenue Service

The Connecticut Internal Revenue Service (IRS) plays a crucial role in managing tax-related matters for residents and businesses in the state. It oversees the collection of state taxes, ensuring compliance with tax laws and regulations. This agency also provides resources and support to taxpayers, helping them understand their obligations and rights under Connecticut tax law.

Steps to Complete the Connecticut Internal Revenue Service Form

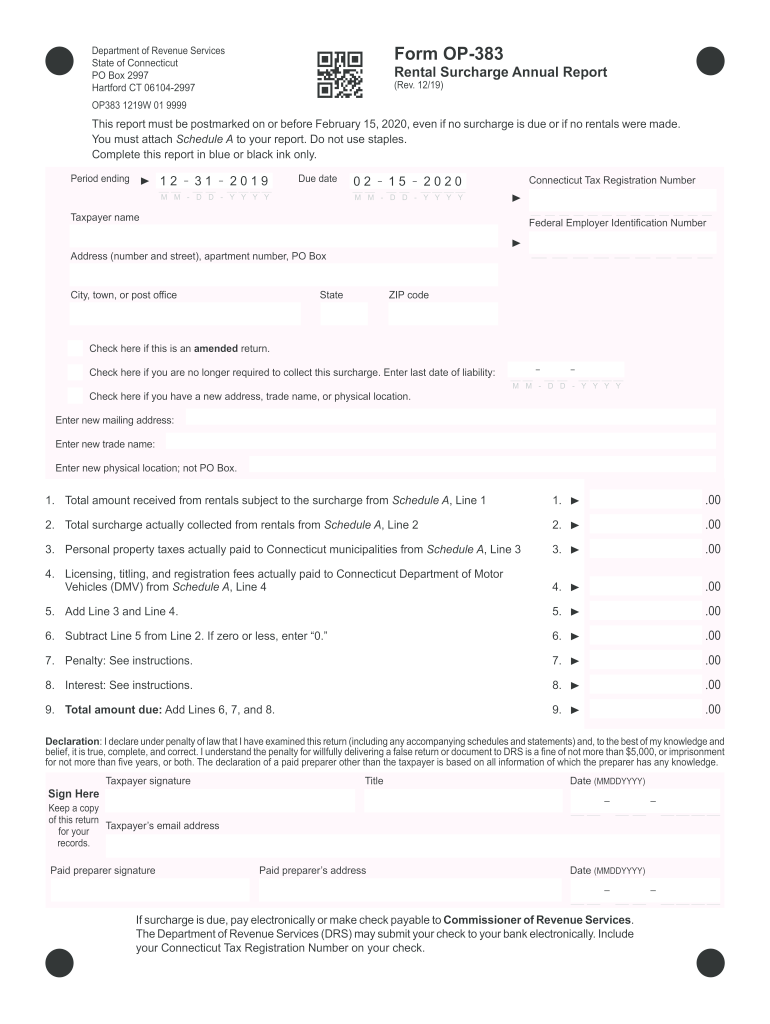

Filling out the 2017 CT Form OP 383 requires careful attention to detail. Here are the steps to ensure accurate completion:

- Gather necessary documents, including previous tax returns and income statements.

- Carefully read the instructions accompanying the form to understand each section.

- Fill in your personal information, ensuring accuracy in names, addresses, and Social Security numbers.

- Report your income and deductions as specified, double-checking for any errors.

- Review the completed form for completeness before submission.

Legal Use of the Connecticut Internal Revenue Service Form

The 2017 CT Form OP 383 is legally binding when completed correctly and submitted on time. It is essential to comply with all state regulations regarding tax filings to avoid penalties. The form must be signed and dated to validate the information provided. Understanding the legal implications of this form can help ensure that taxpayers meet their obligations without facing unnecessary legal issues.

Filing Deadlines and Important Dates

Timely submission of the 2017 CT Form OP 383 is critical to avoid penalties. The typical filing deadline aligns with the federal tax deadline, which is usually April 15. However, it is advisable to check for any state-specific extensions or changes to deadlines each tax year. Keeping a calendar of important dates can help taxpayers stay organized and compliant.

Required Documents for Submission

To complete the 2017 CT Form OP 383, taxpayers need to gather several key documents:

- W-2 forms from employers.

- 1099 forms for any additional income sources.

- Records of deductions, such as receipts for charitable contributions.

- Any prior year tax returns for reference.

Having these documents ready will facilitate a smoother and more accurate filing process.

Form Submission Methods

Taxpayers in Connecticut have multiple options for submitting the 2017 CT Form OP 383. They can file electronically through approved e-filing services, which can expedite processing times. Alternatively, forms can be mailed to the appropriate state address or submitted in person at local tax offices. Each method has its advantages, so it is important to choose the one that best fits individual needs.

Quick guide on how to complete connecticut internal revenue service

Effortlessly Prepare CONNECTICUT Internal Revenue Service on Any Device

Managing documents online has become increasingly popular among organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and efficiently. Handle CONNECTICUT Internal Revenue Service on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign CONNECTICUT Internal Revenue Service with Ease

- Locate CONNECTICUT Internal Revenue Service and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to send your form—via email, SMS, invite link, or download it to your computer.

No more lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign CONNECTICUT Internal Revenue Service and ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct connecticut internal revenue service

Create this form in 5 minutes!

How to create an eSignature for the connecticut internal revenue service

The way to create an electronic signature for your PDF document in the online mode

The way to create an electronic signature for your PDF document in Chrome

How to make an electronic signature for putting it on PDFs in Gmail

The best way to make an electronic signature right from your mobile device

The best way to create an electronic signature for a PDF document on iOS devices

The best way to make an electronic signature for a PDF on Android devices

People also ask

-

What is the 2017 ct form op 383?

The 2017 ct form op 383 is a specific tax form used in Connecticut for businesses to report their operational income. It is essential for ensuring compliance with state tax regulations. Properly filling out this form can help avoid penalties and ensure that your business remains in good standing.

-

How can airSlate SignNow assist with the 2017 ct form op 383?

airSlate SignNow simplifies the process of signing and sending the 2017 ct form op 383 by providing an easy-to-use platform for electronic signatures. With our solution, you can quickly get your documents signed and submitted to relevant authorities. This signNowly reduces turnaround time compared to traditional methods.

-

What features does airSlate SignNow offer for handling tax forms like the 2017 ct form op 383?

Our platform includes key features such as document templates, secure cloud storage, real-time tracking, and audit trails. These features ensure that you can manage your tax forms, including the 2017 ct form op 383, efficiently and securely. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

Is there a free trial available for using airSlate SignNow to manage the 2017 ct form op 383?

Yes, we offer a free trial for new users to explore how airSlate SignNow can help with managing the 2017 ct form op 383 and other documentation needs. This trial allows you to experience our features without any commitment, making it easier to assess the value our solution can provide.

-

What pricing plans does airSlate SignNow offer for managing forms like the 2017 ct form op 383?

airSlate SignNow offers various pricing plans tailored to fit different business needs, whether you are a small business or an enterprise. Our plans provide flexibility and can accommodate your volume of documents, including those pertaining to the 2017 ct form op 383. Detailed pricing information is available on our website.

-

Can I integrate airSlate SignNow with other software for handling the 2017 ct form op 383?

Absolutely! airSlate SignNow integrates seamlessly with a variety of software applications, enhancing your ability to manage the 2017 ct form op 383. This integration simplifies workflow processes by allowing users to send, sign, and store documents directly within their existing systems.

-

What are the security features of airSlate SignNow when handling the 2017 ct form op 383?

Security is a top priority for airSlate SignNow, especially when handling sensitive documents like the 2017 ct form op 383. Our platform utilizes advanced encryption methods, secure user authentication, and compliance with industry regulations to ensure your documents are protected throughout the signing process.

Get more for CONNECTICUT Internal Revenue Service

Find out other CONNECTICUT Internal Revenue Service

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself

- Can I Electronic signature Florida Sublease Agreement Template

- How Can I Electronic signature Tennessee Sublease Agreement Template

- Electronic signature Maryland Roommate Rental Agreement Template Later

- Electronic signature Utah Storage Rental Agreement Easy

- Electronic signature Washington Home office rental agreement Simple

- Electronic signature Michigan Email Cover Letter Template Free

- Electronic signature Delaware Termination Letter Template Now

- How Can I Electronic signature Washington Employee Performance Review Template

- Electronic signature Florida Independent Contractor Agreement Template Now

- Electronic signature Michigan Independent Contractor Agreement Template Now

- Electronic signature Oregon Independent Contractor Agreement Template Computer

- Electronic signature Texas Independent Contractor Agreement Template Later

- Electronic signature Florida Employee Referral Form Secure

- How To Electronic signature Florida CV Form Template