Rental Surcharge Tax Information CT Gov 2022

Understanding the Rental Surcharge Tax Information

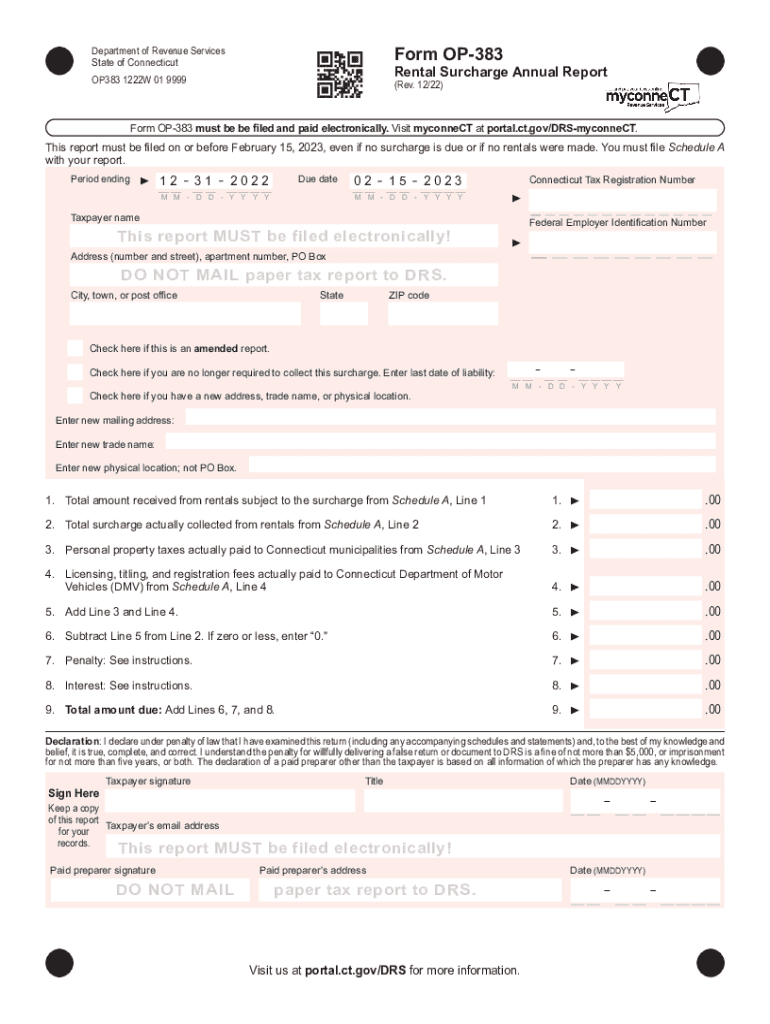

The Rental Surcharge Tax Information, often referred to as the CT op 383 form, is a crucial document for landlords and property owners in Connecticut. This form is used to report and remit the rental surcharge tax imposed by the state. It is essential for maintaining compliance with state tax regulations and ensuring that all rental income is accurately reported. Understanding the specific requirements and implications of this form can help property owners avoid penalties and ensure proper tax management.

Steps to Complete the Rental Surcharge Tax Information

Completing the CT op 383 form involves several key steps that ensure accuracy and compliance. First, gather all necessary documentation related to your rental properties, including income statements and previous tax filings. Next, fill out the form with precise details about your rental income and any applicable deductions. It is important to double-check all entries for accuracy before submission. Finally, submit the completed form either online or via mail, depending on your preference and the submission guidelines provided by the Connecticut Department of Revenue Services.

Legal Use of the Rental Surcharge Tax Information

The CT op 383 form is legally binding, meaning that it must be completed and submitted in accordance with state laws. Failure to comply with the regulations surrounding this form can result in significant penalties, including fines and interest on unpaid taxes. It is vital for landlords to understand the legal implications of this form, as it not only affects their tax obligations but also their standing with state authorities. Utilizing a reliable eSignature solution can help ensure that the submission process is secure and compliant with legal standards.

Filing Deadlines and Important Dates

Being aware of filing deadlines for the CT op 383 form is crucial for property owners. Typically, forms must be submitted by specific dates set by the Connecticut Department of Revenue Services. Missing these deadlines can lead to penalties and interest charges. It is advisable to mark these dates on your calendar and plan ahead to ensure timely submission. Additionally, staying informed about any changes to deadlines or filing requirements can help prevent unexpected issues.

Form Submission Methods

There are multiple methods for submitting the CT op 383 form, including online, by mail, or in person. The online submission is often the most convenient and efficient method, allowing for quick processing and confirmation of receipt. For those who prefer traditional methods, mailing the form is also an option, but it is important to allow sufficient time for delivery. In-person submissions can be made at designated state offices, providing an opportunity to ask questions and receive immediate assistance if needed.

Required Documents for Submission

To successfully complete the CT op 383 form, certain documents are required. These typically include proof of rental income, previous tax returns, and any relevant financial statements related to your rental properties. Having these documents organized and readily available can streamline the completion process and ensure that all necessary information is included. It is advisable to keep copies of all submitted documents for your records.

Penalties for Non-Compliance

Non-compliance with the requirements of the CT op 383 form can lead to serious consequences. Property owners may face financial penalties, including fines based on the amount of unpaid tax or late submissions. Additionally, interest may accrue on any outstanding balances, increasing the total amount owed. Being proactive in understanding and fulfilling the requirements of this form can help mitigate these risks and maintain good standing with state tax authorities.

Quick guide on how to complete rental surcharge tax information ctgov

Effortlessly Prepare Rental Surcharge Tax Information CT gov on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary forms and securely store them online. airSlate SignNow provides all the tools you require to craft, modify, and eSign your documents quickly without delays. Manage Rental Surcharge Tax Information CT gov on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to Modify and eSign Rental Surcharge Tax Information CT gov with Ease

- Find Rental Surcharge Tax Information CT gov and click Get Form to initiate the process.

- Utilize the tools we offer to fill out your document.

- Select important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review the information and click the Done button to save your changes.

- Decide how you'd like to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, or mistakes that require new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Rental Surcharge Tax Information CT gov and ensure effective communication at every stage of your form preparation process using airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct rental surcharge tax information ctgov

Create this form in 5 minutes!

How to create an eSignature for the rental surcharge tax information ctgov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is op 383 in the context of airSlate SignNow?

Op 383 refers to a specific operation or functionality within the airSlate SignNow platform. This feature streamlines the process of sending, signing, and managing documents efficiently. By utilizing op 383, users can enhance their workflow and ensure documents are processed quickly and securely.

-

How much does it cost to use airSlate SignNow with op 383?

The pricing for airSlate SignNow varies depending on the plan you choose, but it remains a cost-effective solution regardless. Users can access features related to op 383 at all subscription levels, ensuring they can leverage its benefits without breaking the bank. Check our pricing page for detailed information on the different plans.

-

What are the key features of airSlate SignNow that include op 383?

Key features surrounding op 383 include document sending, eSigning, and automatic reminders for pending signatures. Additionally, this operation provides users with templates for frequently used documents to save time. The integration of op 383 into your workflow enhances speed and security while managing your documents.

-

How can op 383 benefit my business?

Op 383 can signNowly enhance your business's efficiency by simplifying the document signing process. It reduces turnaround time for contracts and agreements, allowing you to focus on core business activities. Furthermore, this feature helps eliminate paper-based workflows, promoting eco-friendliness and cost savings.

-

Is airSlate SignNow compatible with other software when using op 383?

Yes, airSlate SignNow, including op 383, integrates seamlessly with various software applications, such as CRM and project management tools. This compatibility allows for a more cohesive workflow without the hassle of switching between different applications. Check our integrations page to see all supported platforms.

-

Can I customize documents using op 383 in airSlate SignNow?

Absolutely! Op 383 provides various customization options for your documents. You can create templates, add your branding, and specify fields for signers to ensure a professional presentation tailored to your business's needs.

-

Is mobile access available for airSlate SignNow when utilizing op 383?

Yes, airSlate SignNow ensures that users can access op 383 features through mobile devices. This functionality allows users to send and sign documents on the go, ensuring that business can continue seamlessly, even outside the office. The mobile-friendly design enhances accessibility and user experience.

Get more for Rental Surcharge Tax Information CT gov

Find out other Rental Surcharge Tax Information CT gov

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself

- Sign Vermont Construction Rental Lease Agreement Safe

- Sign Utah Construction Cease And Desist Letter Computer

- Help Me With Sign Utah Construction Cease And Desist Letter

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure