it Nrc 2019

What is the IT NRC?

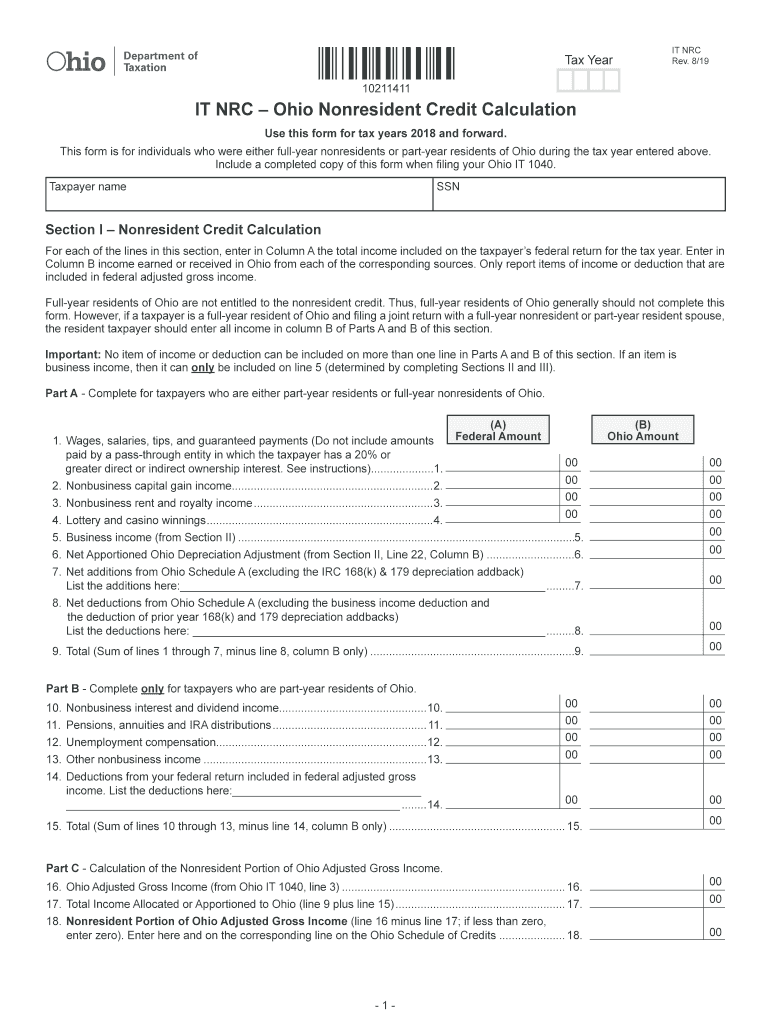

The IT NRC, or Ohio Nonresident Credit, is a tax form specifically designed for individuals who earn income in Ohio but reside in another state. This form allows nonresidents to claim a credit for taxes paid to Ohio, thereby preventing double taxation on the same income. Understanding the IT NRC is essential for ensuring compliance with state tax laws and maximizing potential refunds.

How to Use the IT NRC

To effectively use the IT NRC, nonresidents must first gather all necessary income documentation from Ohio sources. This includes W-2 forms, 1099s, and any other relevant tax documents. Once the income is documented, taxpayers can fill out the IT NRC form, detailing their earnings and the taxes withheld. It is important to follow the instructions carefully to ensure accurate reporting and to claim the appropriate credit.

Steps to Complete the IT NRC

Completing the IT NRC involves several key steps:

- Gather all relevant income documents from Ohio sources.

- Obtain the latest version of the IT NRC form.

- Fill out personal information, including name, address, and Social Security number.

- Report total income earned in Ohio and the taxes withheld.

- Calculate the nonresident credit based on the provided instructions.

- Review the completed form for accuracy.

- Submit the form either electronically or by mail, following the specified guidelines.

Legal Use of the IT NRC

The IT NRC is legally binding when completed correctly and submitted within the designated time frame. It adheres to Ohio's tax regulations, ensuring that nonresidents can claim their credits without issues. Proper use of the form not only helps in complying with tax laws but also protects against potential audits or penalties from the state.

Filing Deadlines / Important Dates

It is crucial to be aware of the filing deadlines for the IT NRC to avoid penalties. Typically, the form must be submitted by the same deadline as the federal tax return, which is usually April 15. However, if this date falls on a weekend or holiday, the deadline may be extended. Keeping track of these dates ensures timely submission and compliance with Ohio tax laws.

Required Documents

When filling out the IT NRC, several documents are required to support your claim:

- W-2 forms from Ohio employers.

- 1099 forms for any freelance or contract work performed in Ohio.

- Proof of residency in your home state.

- Any other documentation that verifies income earned in Ohio.

Eligibility Criteria

To qualify for the IT NRC, individuals must meet specific eligibility criteria. They must be nonresidents of Ohio who have earned income sourced from Ohio. Additionally, they must have paid Ohio state income taxes on that income. Understanding these criteria helps ensure that only eligible individuals apply for the nonresident credit, streamlining the process for both taxpayers and the state.

Quick guide on how to complete it nrc

Effortlessly Complete It Nrc on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delays. Handle It Nrc on any device using the airSlate SignNow apps for Android or iOS and enhance any document-driven operation today.

The Easiest Way to Modify and eSign It Nrc Seamlessly

- Locate It Nrc and click Get Form to begin.

- Use the tools we offer to finish your document.

- Identify essential parts of your documents or obscure sensitive details with tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to store your updates.

- Select your preferred delivery method for your form, whether it be via email, SMS, an invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign It Nrc and guarantee outstanding communication throughout every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct it nrc

Create this form in 5 minutes!

How to create an eSignature for the it nrc

The way to generate an electronic signature for your PDF online

The way to generate an electronic signature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to create an electronic signature from your smartphone

The best way to make an electronic signature for a PDF on iOS

The way to create an electronic signature for a PDF file on Android

People also ask

-

What is airSlate SignNow and how does it relate to ohio it nrc?

airSlate SignNow is a digital solution that enables businesses to send and eSign documents efficiently. By incorporating ohio it nrc, businesses in Ohio can enhance their document workflow and compliance with state regulations. This makes it an ideal choice for organizations looking to streamline their operations.

-

How does airSlate SignNow ensure compliance with ohio it nrc?

airSlate SignNow complies with ohio it nrc by maintaining high security standards and offering legally binding eSignatures. Our platform adheres to local regulations, ensuring that your documents are not only secure but also valid in Ohio. This gives businesses peace of mind when digitizing their documentation processes.

-

What are the pricing plans for airSlate SignNow in relation to ohio it nrc?

The pricing plans for airSlate SignNow are competitive and cater to various business needs, including those relevant to ohio it nrc. We offer flexible subscription options designed for startups to large enterprises in Ohio. You'll find that our plans provide great value for the range of features included.

-

What features does airSlate SignNow offer that support ohio it nrc?

airSlate SignNow offers features such as document templates, automated workflows, and real-time tracking which directly support ohio it nrc. These features enhance efficiency and ensure that businesses can manage their documentation processes swiftly and effectively. By using our platform, organizations in Ohio can optimize their operations signNowly.

-

How does airSlate SignNow benefit businesses in Ohio observing ohio it nrc?

Businesses in Ohio can greatly benefit from using airSlate SignNow as it simplifies the eSigning process while ensuring compliance with ohio it nrc. This leads to increased productivity and reduced turnaround times for document processing. Ultimately, airSlate SignNow supports better decision-making by providing clear visibility into all document transactions.

-

Which integrations does airSlate SignNow support for ohio it nrc users?

airSlate SignNow offers seamless integrations with popular software tools like Google Drive, Salesforce, and Dropbox, which are beneficial for ohio it nrc users. These integrations create a cohesive ecosystem that enhances workflow efficiency and document management. Businesses in Ohio can easily connect their existing tools with our platform.

-

Is training available for using airSlate SignNow under ohio it nrc?

Yes, airSlate SignNow provides comprehensive training and support for users needing to comply with ohio it nrc. Our resources include webinars, tutorials, and customer support to ensure that your team can maximize the platform’s capabilities. We are committed to helping businesses in Ohio succeed in their digital transformation.

Get more for It Nrc

- Utah alternate form

- Letter from landlord to tenant as notice to remove wild animals in premises utah form

- Letter from landlord to tenant as notice to remove unauthorized pets from premises utah form

- Letter from tenant to landlord containing notice that premises in uninhabitable in violation of law and demand immediate repair 497427433 form

- Letter from tenant to landlord containing notice that premises leaks during rain and demand for repair utah form

- Utah tenant landlord form

- Letter from tenant to landlord with demand that landlord repair broken windows utah form

- Letter from tenant to landlord with demand that landlord repair plumbing problem utah form

Find out other It Nrc

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF