Use This Form for Tax Years and Forward 2022

What is the ohio it nrc 2024 Form Used For?

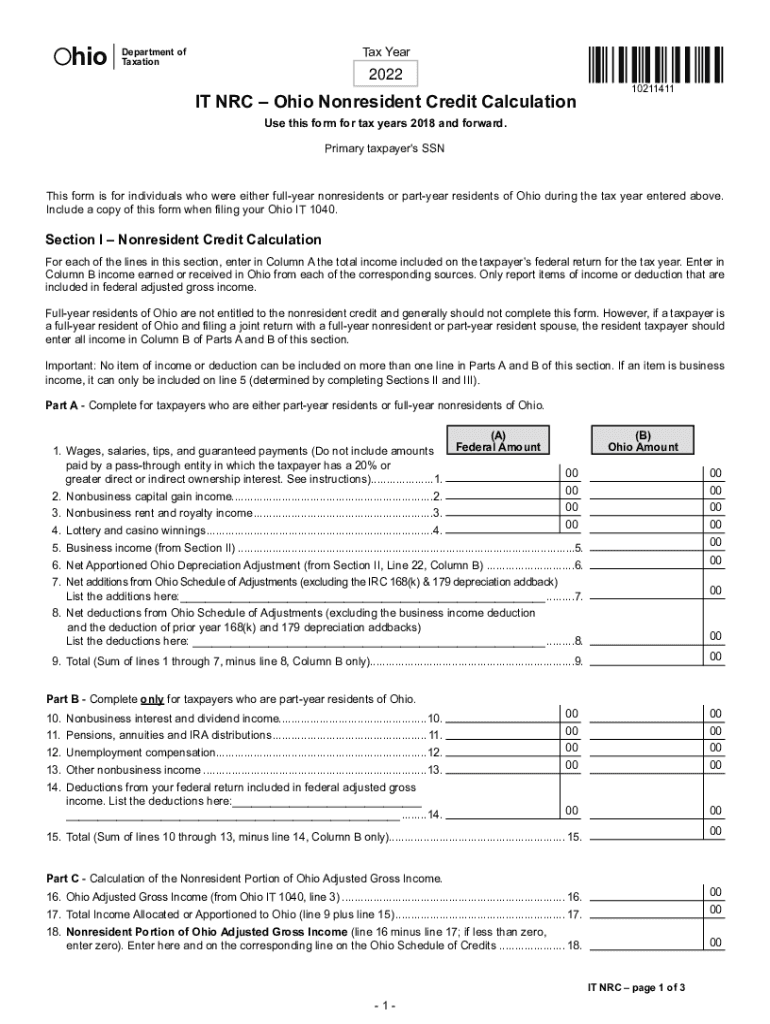

The ohio it nrc 2024 form is primarily utilized for claiming a nonresident credit for income taxes paid to other states. This form allows individuals who earn income in Ohio but reside in another state to receive a credit for taxes paid to their home state. The goal is to prevent double taxation on the same income, ensuring that taxpayers are not penalized for earning income across state lines. This form is essential for nonresidents who wish to accurately report their income and claim the appropriate credits on their Ohio tax returns.

Steps to Complete the ohio it nrc 2024 Form

Completing the ohio it nrc 2024 form involves several critical steps:

- Gather Necessary Information: Collect your personal information, including your Social Security number, address, and details about your income sources.

- Determine Eligibility: Ensure you meet the criteria for claiming the nonresident credit, such as having paid income taxes to another state.

- Fill Out the Form: Accurately complete all sections of the form, providing details about your income and taxes paid to other states.

- Attach Supporting Documents: Include any necessary documentation, such as W-2 forms or tax returns from the other state.

- Review for Accuracy: Double-check all entries for correctness to avoid delays or issues with processing.

- Submit the Form: File the completed form according to the submission guidelines, either online, by mail, or in person.

Required Documents for the ohio it nrc 2024 Form

When filing the ohio it nrc 2024 form, certain documents are essential to support your claim:

- W-2 Forms: These forms report your wages and the taxes withheld by your employer.

- Tax Returns from Other States: Include copies of your tax returns from the state where you reside, showing the income earned and taxes paid.

- Proof of Residency: Documentation that verifies your residency in another state, such as a driver's license or utility bill.

- Any Additional Forms: Depending on your income sources, you may need to provide other relevant tax forms.

Filing Deadlines for the ohio it nrc 2024 Form

It is crucial to be aware of the filing deadlines associated with the ohio it nrc 2024 form to avoid penalties:

- Standard Filing Deadline: Typically, the deadline for filing the ohio it nrc form aligns with the state income tax return deadline, usually April 15.

- Extensions: If you cannot meet the standard deadline, you may apply for an extension, but ensure to check specific state guidelines for extended deadlines.

Legal Use of the ohio it nrc 2024 Form

The legal use of the ohio it nrc 2024 form is governed by state tax laws designed to ensure compliance and avoid double taxation. To be legally binding, the form must be accurately completed and submitted within the required timeframe. Additionally, all claims for nonresident credits must be substantiated with appropriate documentation, as failure to do so may result in denial of the credit and potential penalties. Understanding these legal requirements is essential for ensuring that your submission is valid and recognized by the state tax authorities.

Examples of Using the ohio it nrc 2024 Form

Here are a few scenarios illustrating how the ohio it nrc 2024 form can be utilized:

- Scenario One: A resident of Kentucky works remotely for an Ohio-based company and earns income during the tax year. They file the ohio it nrc form to claim a credit for taxes paid to Kentucky.

- Scenario Two: An individual living in Indiana travels to Ohio for temporary work assignments. They complete the ohio it nrc form to ensure they receive credit for taxes paid to Indiana while working in Ohio.

Quick guide on how to complete use this form for tax years 2018 and forward

Prepare Use This Form For Tax Years And Forward effortlessly on any device

Web-based document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the features you need to create, modify, and eSign your documents quickly without delays. Handle Use This Form For Tax Years And Forward on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused task today.

How to adjust and eSign Use This Form For Tax Years And Forward with ease

- Locate Use This Form For Tax Years And Forward and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Select relevant sections of the documents or redact sensitive data with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and eSign Use This Form For Tax Years And Forward and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct use this form for tax years 2018 and forward

Create this form in 5 minutes!

How to create an eSignature for the use this form for tax years 2018 and forward

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Ohio IT NRC and how does it relate to airSlate SignNow?

Ohio IT NRC refers to the integration of information technology with regulatory compliance in Ohio. airSlate SignNow facilitates this by providing a secure platform for electronic signatures, ensuring that businesses can easily comply with IT regulations and streamline their documentation processes.

-

What features does airSlate SignNow offer for Ohio IT NRC compliance?

airSlate SignNow offers several features to support Ohio IT NRC compliance, including secure document storage, encrypted signatures, and audit trails. These functionalities ensure that all transactions are legally binding and compliant with state regulations.

-

How can airSlate SignNow benefit businesses in Ohio seeking IT NRC solutions?

Businesses in Ohio can benefit from airSlate SignNow by enhancing efficiency and reducing costs associated with document management. Its user-friendly interface allows companies to quickly obtain electronic signatures and maintain compliance with Ohio IT NRC standards.

-

What are the pricing options for airSlate SignNow in the context of Ohio IT NRC?

airSlate SignNow offers flexible pricing plans tailored to business needs, which are particularly beneficial for Ohio-based companies focused on IT NRC compliance. Users can choose from monthly or annual subscriptions, providing an affordable solution for all sizes of organizations.

-

Can airSlate SignNow integrate with other software for Ohio IT NRC users?

Yes, airSlate SignNow offers seamless integrations with various software platforms that Ohio IT NRC users often rely on, such as CRM systems and cloud storage services. This capability enhances workflow efficiency and simplifies document management.

-

Is the airSlate SignNow platform secure for handling Ohio IT NRC documents?

Absolutely! airSlate SignNow prioritizes security, employing advanced encryption and compliance with industry standards, making it a safe choice for handling Ohio IT NRC documents. Businesses can trust that their sensitive information is protected throughout the signing process.

-

How easy is it to use airSlate SignNow for Ohio IT NRC documentation?

Using airSlate SignNow for Ohio IT NRC documentation is incredibly straightforward. The intuitive design allows users to upload, send, and sign documents with minimal effort, making it accessible for everyone in the organization without the need for extensive training.

Get more for Use This Form For Tax Years And Forward

- Mississippi agreement 497314316 form

- Assignment and instruction to apply escrowed funds mississippi form

- Escrow agreement between limited partnerships mississippi form

- Escrow agreement involving bank loan mississippi form

- Notice of satisfaction of escrow agreement mississippi form

- Escrow release mississippi form

- Ms eviction form

- Debtor form

Find out other Use This Form For Tax Years And Forward

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free

- Can I Sign California Finance & Tax Accounting Profit And Loss Statement

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later