Informative Return for 2019-2026

What is the Informative Return For

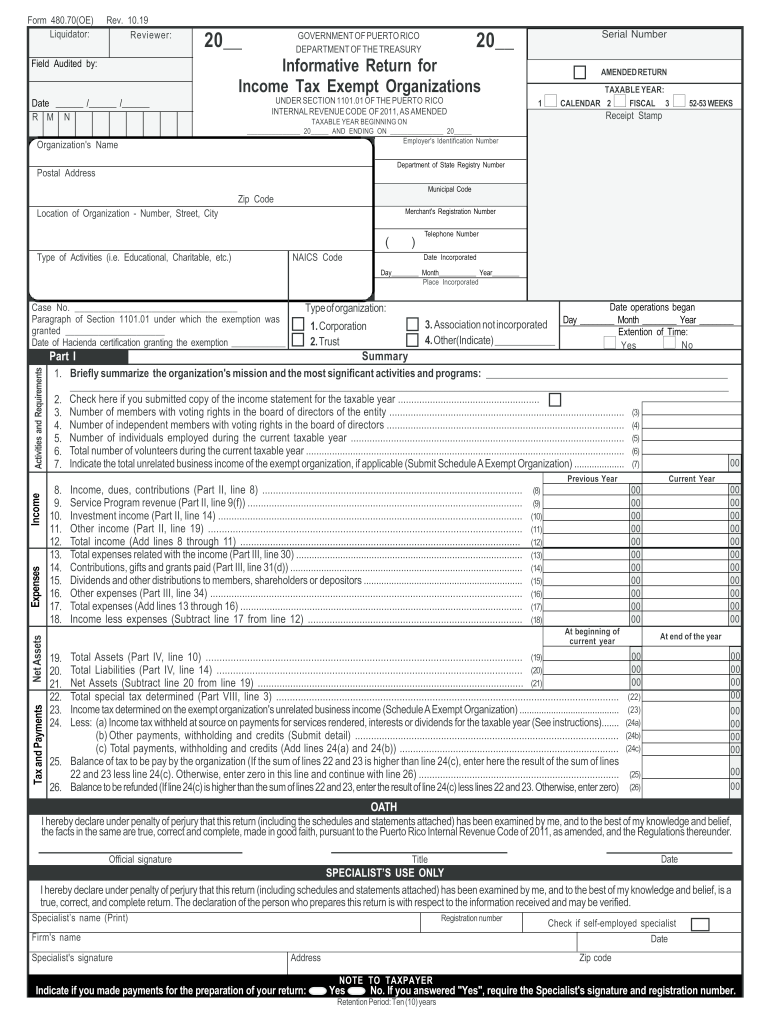

The Puerto Rico 480 70 form serves as an Informative Return for individuals and businesses to report certain types of income to the Puerto Rico Department of Treasury. This form is essential for ensuring compliance with local tax regulations and helps the government track income sources for tax assessment purposes. It is particularly relevant for those who receive income that may not be subject to withholding, making it crucial for accurate tax reporting.

How to use the Informative Return For

To effectively use the Puerto Rico 480 70 form, individuals must gather all necessary financial information related to their income. This includes details about the sources of income, amounts received, and any applicable deductions. Once the information is compiled, the form can be filled out either in its paper format or digitally. It is important to ensure that all entries are accurate and complete to avoid potential penalties.

Steps to complete the Informative Return For

Completing the Puerto Rico 480 70 form involves several key steps:

- Gather all relevant income documentation, including statements and receipts.

- Access the form, either by downloading the PDF version or using an online platform.

- Fill out the form with accurate information, ensuring all income sources are reported.

- Review the completed form for accuracy and completeness.

- Submit the form by the designated deadline, either electronically or by mail.

Legal use of the Informative Return For

The Puerto Rico 480 70 form is legally recognized as a valid method for reporting income to the government. Compliance with the submission of this form is essential to avoid legal repercussions, such as fines or audits. It is crucial that taxpayers understand their obligations under local tax laws and ensure that their submissions adhere to all legal requirements.

Filing Deadlines / Important Dates

Filing deadlines for the Puerto Rico 480 70 form vary based on the taxpayer's specific situation, such as whether they are individuals or businesses. Generally, the form must be submitted by the end of the tax year, with specific dates provided by the Puerto Rico Department of Treasury each year. It is important to stay informed about these deadlines to ensure timely compliance and avoid penalties.

Required Documents

When preparing to complete the Puerto Rico 480 70 form, certain documents are required to ensure accurate reporting. These may include:

- Income statements from employers or clients.

- Bank statements showing deposits of income.

- Receipts for any deductible expenses related to the reported income.

Having these documents on hand will facilitate a smoother filing process and help ensure that all reported information is accurate.

Quick guide on how to complete informative return for

Effortlessly Prepare Informative Return For on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools to create, edit, and electronically sign your documents swiftly without delays. Handle Informative Return For on any platform with airSlate SignNow Android or iOS applications and streamline your document processes today.

How to Edit and Electronically Sign Informative Return For with Ease

- Locate Informative Return For and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or conceal sensitive information with the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional handwritten signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Modify and electronically sign Informative Return For to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct informative return for

Create this form in 5 minutes!

How to create an eSignature for the informative return for

The way to generate an eSignature for your PDF online

The way to generate an eSignature for your PDF in Google Chrome

How to generate an electronic signature for signing PDFs in Gmail

The way to generate an eSignature straight from your smartphone

The way to create an electronic signature for a PDF on iOS

The way to generate an eSignature for a PDF document on Android

People also ask

-

What is the Puerto Rico 480 70 form?

The Puerto Rico 480 70 form is a tax document required for individuals and businesses in Puerto Rico to report specific types of income. Completing this form accurately is crucial to ensure compliance with local tax regulations and avoid penalties. Using airSlate SignNow can simplify the process by allowing you to eSign and submit your documents securely.

-

How can airSlate SignNow help with the Puerto Rico 480 70 form?

airSlate SignNow provides a user-friendly platform for eSigning the Puerto Rico 480 70 form and other documents. With our solution, you can easily fill out, save, and share your completed form electronically. This streamlines the submission process, saving you time and ensuring accuracy.

-

Is there a cost associated with using airSlate SignNow for the Puerto Rico 480 70 form?

Yes, airSlate SignNow offers flexible pricing plans to cater to different business needs. Depending on the plan you choose, you can access various features that can help with the completion and eSigning of the Puerto Rico 480 70 form. Our plans are designed to provide a cost-effective solution for managing your documents efficiently.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features for effective document management, including eSigning, template creation, and document tracking. These features can be particularly beneficial when dealing with forms like the Puerto Rico 480 70 form, allowing for quick modifications and efficient collaboration among team members.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow supports integrations with many popular applications and services, such as Google Drive, Salesforce, and more. This allows you to manage your documents, including the Puerto Rico 480 70 form, seamlessly within your existing workflow, enhancing productivity and convenience.

-

Is airSlate SignNow secure for handling sensitive documents?

Yes, airSlate SignNow prioritizes user security and employs advanced encryption methods to protect your documents. When dealing with sensitive information such as the Puerto Rico 480 70 form, you can have peace of mind knowing that your data is secure and only accessible to authorized users.

-

How can I get started with airSlate SignNow for the Puerto Rico 480 70 form?

Getting started with airSlate SignNow is easy! Simply sign up for an account on our website, and you can begin creating and eSigning documents, including the Puerto Rico 480 70 form, within minutes. Our intuitive interface ensures that you can navigate the platform effortlessly, even if you're new to digital document management.

Get more for Informative Return For

Find out other Informative Return For

- Can I Sign Utah Last Will and Testament

- Sign Washington Last Will and Testament Later

- Sign Wyoming Last Will and Testament Simple

- Sign Connecticut Living Will Online

- How To Sign Georgia Living Will

- Sign Massachusetts Living Will Later

- Sign Minnesota Living Will Free

- Sign New Mexico Living Will Secure

- How To Sign Pennsylvania Living Will

- Sign Oregon Living Will Safe

- Sign Utah Living Will Fast

- Sign Wyoming Living Will Easy

- How Can I Sign Georgia Pet Care Agreement

- Can I Sign Kansas Moving Checklist

- How Do I Sign Rhode Island Pet Care Agreement

- How Can I Sign Virginia Moving Checklist

- Sign Illinois Affidavit of Domicile Online

- How Do I Sign Iowa Affidavit of Domicile

- Sign Arkansas Codicil to Will Free

- Sign Colorado Codicil to Will Now