SU 07 20 2020-2026

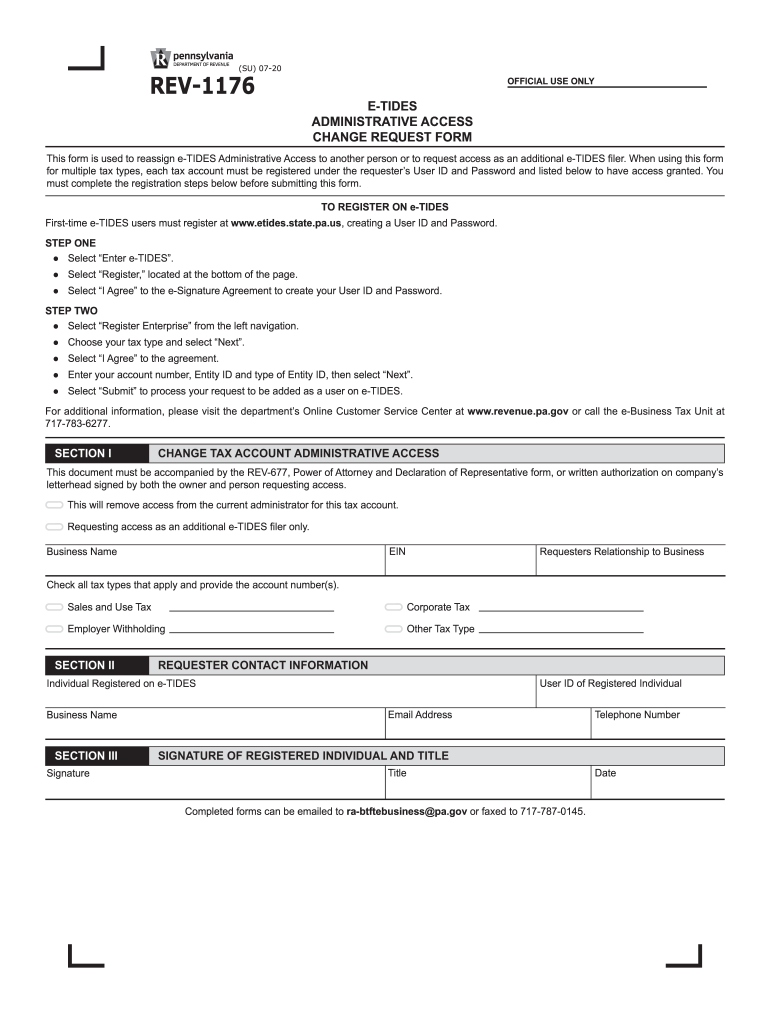

What is the Pennsylvania eTides?

The Pennsylvania eTides is an online platform designed for businesses to manage their tax obligations efficiently. It serves as a comprehensive tool for filing various tax forms, including the revenue eTides forms. The platform simplifies the process of submitting tax-related documents, ensuring compliance with state regulations. Users can access their accounts, view filing history, and receive updates on their submissions, making it a vital resource for Pennsylvania businesses.

Steps to Complete the Pennsylvania eTides Form

Completing the Pennsylvania eTides form involves several straightforward steps:

- Log into your eTides account using your credentials.

- Select the appropriate form you need to complete, such as the rev 1176.

- Fill in the required fields, ensuring all information is accurate and complete.

- Review your entries for any errors or omissions.

- Submit the form electronically through the platform.

- Save or print the confirmation for your records.

Legal Use of the Pennsylvania eTides Form

The Pennsylvania eTides form is legally recognized when completed and submitted in accordance with state regulations. To ensure its validity, users must adhere to the guidelines set forth by the Pennsylvania Department of Revenue. This includes providing accurate information and using a secure method for submission. The eTides platform complies with legal standards for electronic signatures, making it a trustworthy option for businesses.

Required Documents for eTides Submission

When preparing to submit a Pennsylvania eTides form, certain documents may be necessary. These can include:

- Previous tax returns or forms for reference.

- Financial statements that support your current filing.

- Identification information, such as your business tax identification number.

- Any additional documentation required for specific tax types.

Filing Deadlines for Pennsylvania eTides

It is crucial for businesses to be aware of filing deadlines associated with the Pennsylvania eTides forms. Generally, these deadlines align with the state’s tax year. Businesses should mark their calendars for key dates to avoid penalties. Late submissions can result in additional fees or interest on unpaid taxes, emphasizing the importance of timely filing.

Form Submission Methods

Users can submit the Pennsylvania eTides forms through various methods, primarily online via the eTides platform. This digital submission is the most efficient way to ensure timely processing. Additionally, businesses may have the option to submit forms by mail or in person, depending on the specific requirements of the form being filed. However, online submission is recommended for its speed and convenience.

Quick guide on how to complete su 07 20

Effortlessly Create SU 07 20 on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to quickly create, modify, and eSign your documents without delays. Manage SU 07 20 on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign SU 07 20 with Ease

- Locate SU 07 20 and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Mark relevant portions of your documents or redact sensitive information using the tools that airSlate SignNow offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Choose how you prefer to send your form: via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign SU 07 20 and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct su 07 20

Create this form in 5 minutes!

How to create an eSignature for the su 07 20

The way to make an eSignature for a PDF file online

The way to make an eSignature for a PDF file in Google Chrome

The way to create an electronic signature for signing PDFs in Gmail

The way to make an eSignature straight from your mobile device

The way to make an eSignature for a PDF file on iOS

The way to make an eSignature for a PDF document on Android devices

People also ask

-

What are Pennsylvania eTides and how does airSlate SignNow facilitate their use?

Pennsylvania eTides is an online platform that allows businesses to manage their tax obligations electronically. airSlate SignNow streamlines this process by enabling users to easily eSign and send documents required for eTides, ensuring compliance and reducing time spent on paperwork.

-

What features does airSlate SignNow offer for Pennsylvania eTides users?

airSlate SignNow provides features such as customizable templates, secure document sharing, and real-time status tracking that are crucial for Pennsylvania eTides users. These tools help streamline document management, making it easier to meet state requirements efficiently.

-

Is airSlate SignNow a cost-effective solution for managing Pennsylvania eTides?

Yes, airSlate SignNow is a cost-effective solution designed to help businesses manage Pennsylvania eTides without overspending on manual processes. It offers competitive pricing plans that cater to different needs, ensuring businesses can choose a budget-friendly option that fits their requirements.

-

How does airSlate SignNow ensure the security of documents for Pennsylvania eTides?

airSlate SignNow prioritizes the security of documents with features like AES-256 encryption and two-factor authentication. These security measures are essential for Pennsylvania eTides users, providing peace of mind that their sensitive information is protected during the eSigning process.

-

Can airSlate SignNow integrate with other software used for Pennsylvania eTides?

Yes, airSlate SignNow offers integrations with various other software platforms commonly used for Pennsylvania eTides, such as accounting and tax software. This allows for a seamless workflow, enabling users to manage their documents and tax processes without switching between multiple applications.

-

What benefits can I expect from using airSlate SignNow for Pennsylvania eTides?

Using airSlate SignNow for Pennsylvania eTides allows for faster document processing, improved accuracy, and reduced paperwork. The electronic signing capability helps businesses save time and resources, making it easier to comply with state regulations while maintaining operational efficiency.

-

Is there a mobile app for airSlate SignNow that supports Pennsylvania eTides?

Yes, airSlate SignNow has a mobile app that allows users to manage Pennsylvania eTides on the go. The app facilitates easy eSigning and document management, ensuring that users can stay compliant and efficient even when they are away from their desks.

Get more for SU 07 20

Find out other SU 07 20

- Can I Sign Nevada Articles of Incorporation Template

- Sign New Mexico Articles of Incorporation Template Safe

- Sign Ohio Articles of Incorporation Template Simple

- Can I Sign New Jersey Retainer Agreement Template

- Sign West Virginia Retainer Agreement Template Myself

- Sign Montana Car Lease Agreement Template Fast

- Can I Sign Illinois Attorney Approval

- Sign Mississippi Limited Power of Attorney Later

- How Can I Sign Kansas Attorney Approval

- How Do I Sign New Mexico Limited Power of Attorney

- Sign Pennsylvania Car Lease Agreement Template Simple

- Sign Rhode Island Car Lease Agreement Template Fast

- Sign Indiana Unlimited Power of Attorney Online

- Can I Sign Idaho Affidavit of No Lien

- Sign New York Affidavit of No Lien Online

- How To Sign Delaware Trademark License Agreement

- How To Sign Nevada Retainer for Attorney

- How To Sign Georgia Assignment of License

- Sign Arizona Assignment of Lien Simple

- How To Sign Kentucky Assignment of Lien