Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax 2019

Understanding the G 75 Excise Form

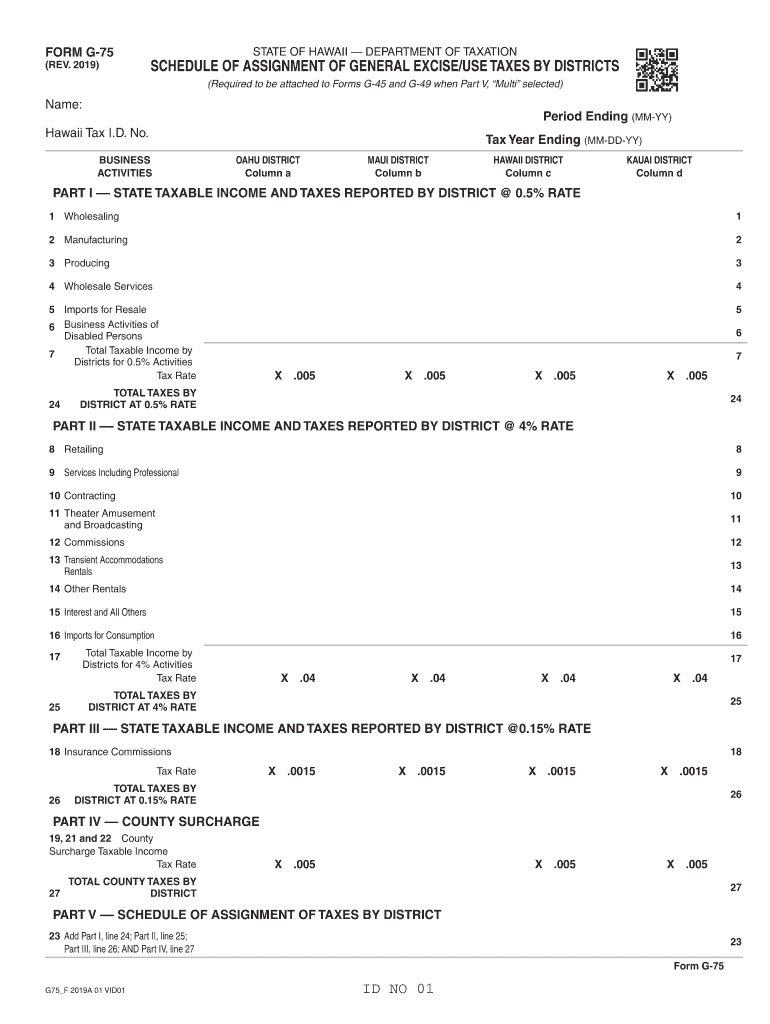

The G 75 excise form, commonly referred to as the Hawaii 75 use form, is essential for reporting and paying the general excise tax in Hawaii. This form is utilized by businesses and individuals who engage in taxable activities within the state. It is crucial to understand the purpose of this form, as it ensures compliance with Hawaii's tax regulations. The G 75 form serves as a declaration of the gross income generated from business operations, which is subject to the general excise tax.

Steps to Complete the G 75 Excise Form

Filling out the G 75 excise form accurately is vital for ensuring compliance with state tax laws. Here are the key steps to complete the form:

- Gather necessary financial records, including sales receipts and income statements.

- Enter your business information, including the name, address, and taxpayer identification number.

- Report the total gross income from all taxable activities during the reporting period.

- Calculate the general excise tax owed based on the applicable tax rate.

- Review the form for accuracy before submission.

Legal Use of the G 75 Excise Form

The G 75 excise form is legally binding when completed and submitted according to Hawaii's tax laws. To ensure its legality, it is important to comply with the following:

- Provide accurate and truthful information on the form.

- Submit the form by the designated deadlines to avoid penalties.

- Utilize a reliable eSignature solution to sign the form digitally, ensuring compliance with the ESIGN Act and UETA.

Filing Deadlines for the G 75 Excise Form

Timely filing of the G 75 excise form is crucial to avoid penalties. The deadlines for submission typically align with the state’s tax reporting schedule. Businesses must file the form monthly, quarterly, or annually, depending on their gross income. It is important to stay informed about specific due dates to ensure compliance and avoid late fees.

Required Documents for Filing the G 75 Excise Form

When preparing to file the G 75 excise form, certain documents are necessary to support your reported income. These documents may include:

- Sales receipts and invoices that detail gross income.

- Bank statements that reflect business transactions.

- Previous tax returns for reference and consistency.

Form Submission Methods for the G 75 Excise Form

The G 75 excise form can be submitted through various methods to accommodate different preferences. Options typically include:

- Online submission through the Hawaii Department of Taxation website.

- Mailing a paper copy of the completed form to the appropriate tax office.

- In-person submission at designated tax offices for immediate processing.

Penalties for Non-Compliance with the G 75 Excise Form

Failure to file the G 75 excise form on time or providing inaccurate information can result in significant penalties. These may include:

- Late fees based on the amount of tax owed.

- Interest charges on unpaid taxes.

- Potential legal action for persistent non-compliance.

Quick guide on how to complete schedule ge form g 45g 49 rev 2019 general exciseuse tax

Effortlessly prepare Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents swiftly without delays. Manage Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric operations today.

The simplest way to edit and eSign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax with ease

- Obtain Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searching, or errors requiring new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ge form g 45g 49 rev 2019 general exciseuse tax

Create this form in 5 minutes!

How to create an eSignature for the schedule ge form g 45g 49 rev 2019 general exciseuse tax

How to create an electronic signature for a PDF file in the online mode

How to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

How to create an eSignature from your smartphone

How to create an eSignature for a PDF file on iOS devices

How to create an eSignature for a PDF file on Android

People also ask

-

What is the g 75 pricing model for airSlate SignNow?

The g 75 pricing model for airSlate SignNow offers flexible plans that cater to businesses of all sizes. You can choose between monthly and annual billing options to find what fits your budget best. Discounts may be available for annual subscriptions, providing additional savings for your organization.

-

What features are included in the g 75 plan of airSlate SignNow?

The g 75 plan includes comprehensive features such as unlimited eSignatures, template creation, and advanced security options. It also allows for document tracking and team collaboration to streamline your signing process. These features ensure you have everything needed for efficient document management.

-

How does g 75 benefit small businesses using airSlate SignNow?

The g 75 plan is particularly beneficial for small businesses as it provides an affordable eSignature solution without compromising on features. With its easy-to-use interface and robust capabilities, small businesses can enhance productivity and reduce delays in document processing. This leads to faster transaction times and improved client satisfaction.

-

Can I integrate g 75 with other applications?

Yes, airSlate SignNow's g 75 plan offers seamless integrations with popular applications such as Google Drive, Dropbox, and Salesforce. This allows users to streamline workflows and manage documents efficiently within their existing systems. The ability to connect with other apps enhances productivity and saves time.

-

Is customer support available for g 75 users?

Absolutely! Users of the g 75 plan receive dedicated customer support to assist with any queries or issues. This includes access to resources such as FAQs, live chat, and email support, ensuring you have help whenever you need it. Excellent customer support enhances the overall experience with airSlate SignNow.

-

What security measures are in place for g 75 users?

The g 75 plan includes top-notch security features such as encryption, two-factor authentication, and compliance with industry standards like GDPR and HIPAA. These measures ensure that your documents are protected from unauthorized access. By prioritizing security, airSlate SignNow helps you safeguard sensitive information.

-

How does g 75 compare to other plans offered by airSlate SignNow?

The g 75 plan strikes a balance between affordability and comprehensive features, making it an excellent choice for many businesses. While it offers essential functionalities, higher-tier plans include advanced features like API access and more customization options. Evaluating your business needs will help determine if g 75 is the right fit.

Get more for Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax

- Revocation of premarital or prenuptial agreement virginia form

- Va divorce form

- Physicians workers compensation form

- No fault agreed uncontested divorce package for dissolution of marriage for persons with no children with or without property 497427954 form

- Virginia subpoena duces tecum form

- Va corporation search form

- Professional corporation package for virginia virginia form

- Virginia agreement form

Find out other Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form