Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule of Exemptions and Deductions 2023-2026

Overview of the Schedule GE, Form G-45/G-49

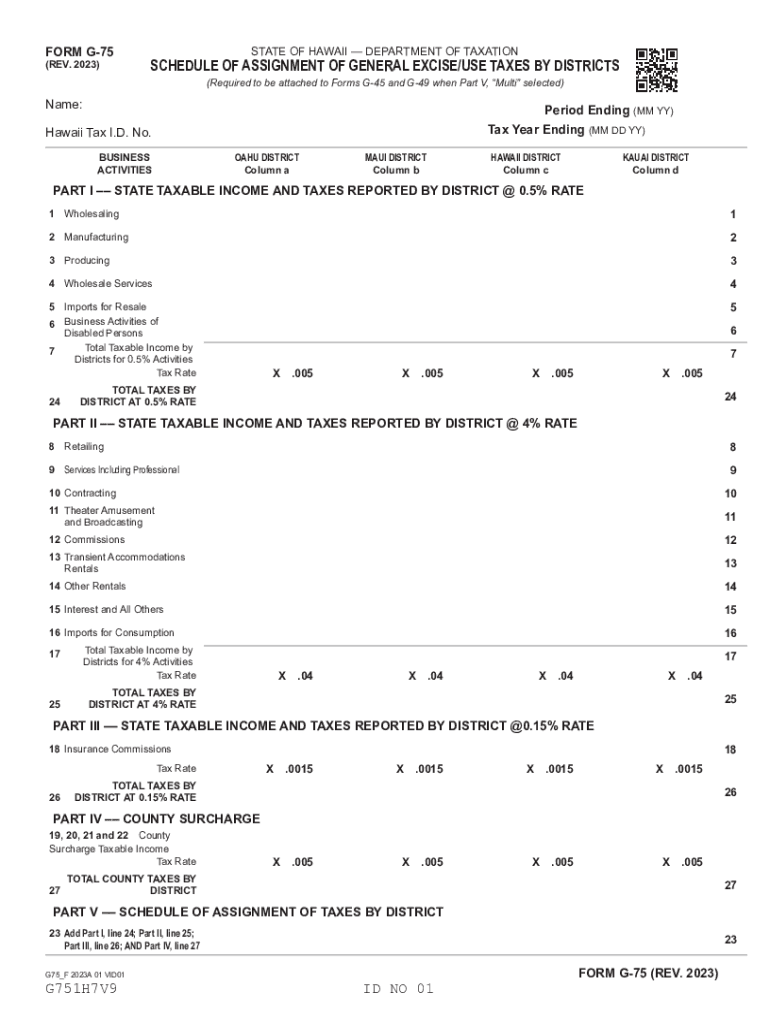

The Schedule GE, Form G-45/G-49 is essential for reporting general excise tax (GET) in Hawaii. This form is used by businesses to calculate and report their excise taxes based on their gross income from sales and services. The form includes sections for exemptions and deductions, allowing businesses to accurately reflect their taxable income. Understanding this form is crucial for compliance with Hawaii's tax regulations and ensuring proper tax reporting.

Steps to Complete the Schedule GE, Form G-45/G-49

Completing the Schedule GE involves several steps to ensure accuracy and compliance. First, gather all necessary financial records, including sales receipts and expense reports. Next, fill out the form by entering your gross income, followed by applicable deductions and exemptions. Carefully calculate the total excise tax owed based on the rates applicable to your business activities. Finally, review the completed form for accuracy before submission.

Legal Use of the Schedule GE, Form G-45/G-49

The legal use of the Schedule GE is governed by Hawaii tax law, which mandates that businesses report their general excise tax accurately. This form is necessary for compliance and helps prevent penalties associated with misreporting. Businesses must understand the legal implications of the information they provide and ensure that all entries are truthful and substantiated by financial records.

Filing Deadlines and Important Dates

Filing deadlines for the Schedule GE are critical for compliance. Typically, the form must be submitted quarterly, with specific due dates depending on the reporting period. It is essential for businesses to be aware of these deadlines to avoid late fees and penalties. Keeping a calendar of important dates can help ensure timely submissions and adherence to Hawaii's tax regulations.

Required Documents for Filing

When filing the Schedule GE, businesses need to prepare several documents. These include financial statements, sales records, and any documentation supporting claimed deductions or exemptions. Having these documents organized and readily available can streamline the filing process and ensure that all necessary information is accurately reported.

Examples of Using the Schedule GE, Form G-45/G-49

Understanding how to use the Schedule GE can be enhanced by reviewing examples. For instance, a retail business might report gross sales of $100,000, with $10,000 in allowable deductions for returns and discounts. By applying the appropriate excise tax rate to the adjusted gross income, the business can accurately calculate its tax liability. These examples illustrate the practical application of the form in various business scenarios.

Quick guide on how to complete schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions

Complete Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions seamlessly on any device

Digital document management has become increasingly favored by enterprises and individuals alike. It offers a superb eco-friendly substitute to conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions on any device with airSlate SignNow’s applications for Android or iOS and enhance any document-related procedure today.

How to modify and electronically sign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions effortlessly

- Locate Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive details using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Modify and electronically sign Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions to maintain excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions

Create this form in 5 minutes!

How to create an eSignature for the schedule ge form g 45g 49 rev general exciseuse tax schedule of exemptions and deductions

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Hawaii excise use tax?

Hawaii excise use tax applies to certain goods and services purchased or used in Hawaii. Businesses engaging in transactions subject to this tax must calculate and remit the appropriate amount. Understanding Hawaii excise use is essential for compliance and avoiding penalties.

-

How does airSlate SignNow help with Hawaii excise use compliance?

AirSlate SignNow streamlines document management and eSigning, making it easier for businesses to maintain compliance with Hawaii excise use requirements. Our solution allows for secure electronic documentation and signature tracking, ensuring your business meets all necessary tax obligations efficiently.

-

What features does airSlate SignNow offer for managing documents related to Hawaii excise use?

AirSlate SignNow provides a variety of features specifically designed for handling documents related to Hawaii excise use. These include customizable templates, automated workflows, and secure cloud storage, empowering businesses to manage their paperwork effectively and ensure compliance.

-

Is there a cost associated with using airSlate SignNow for Hawaii excise use transactions?

Yes, there is a cost associated with using airSlate SignNow, which varies based on the plan you choose. Our pricing is transparent and competitive, making it a cost-effective solution for managing Hawaii excise use documentation while providing excellent value for your business needs.

-

Can I integrate airSlate SignNow with other software for Hawaii excise use management?

Absolutely! AirSlate SignNow offers integrations with various applications and software that can help manage Hawaii excise use efficiently. Whether you need to connect with accounting software or CRM systems, our solution enhances your workflow and keeps all your documents in sync.

-

What are the benefits of using airSlate SignNow for Hawaii excise use documents?

The primary benefits of using airSlate SignNow for Hawaii excise use documents include increased efficiency, enhanced security, and improved tracking of compliance. Our platform simplifies the eSigning process and ensures that your business meets its tax obligations without hassle.

-

How can airSlate SignNow improve my business's efficiency regarding Hawaii excise use?

AirSlate SignNow boosts your business's efficiency by automating the document management process related to Hawaii excise use. This means fewer manual tasks, faster turnaround times for signatures, and reduced paperwork, allowing your team to focus on more strategic initiatives.

Get more for Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions

Find out other Schedule GE, Form G 45G 49, Rev , General ExciseUse Tax Schedule Of Exemptions And Deductions

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later

- Can I eSignature Nevada Non-disclosure agreement PDF