DELINQUENT EARNED INCOME TAX DEPARTMENT Dear 2019

Understanding the Delinquent Earned Income Tax Department

The Delinquent Earned Income Tax Department is a specialized unit responsible for managing unpaid local earned income taxes. This department focuses on ensuring compliance among taxpayers who may have overlooked their obligations. It plays a crucial role in maintaining the financial health of local municipalities by collecting taxes owed, which fund essential services and infrastructure.

Steps to Complete the Delinquent Earned Income Tax Department Process

To navigate the Delinquent Earned Income Tax Department process effectively, follow these steps:

- Identify any outstanding tax obligations by reviewing your tax records.

- Gather necessary documentation, including previous tax returns and income statements.

- Contact the Delinquent Earned Income Tax Department to clarify your status and any penalties incurred.

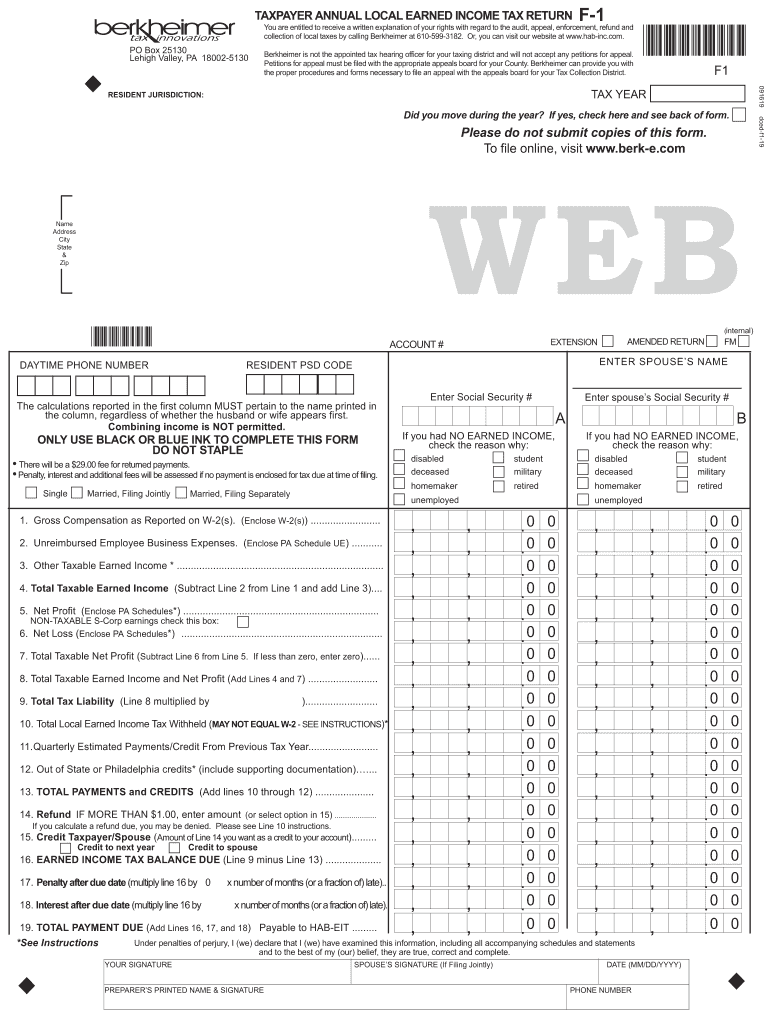

- Complete the required forms, such as the berkheimer local earned income tax return F-1, accurately reflecting your income.

- Submit the completed forms either online or via mail, ensuring you adhere to any specified deadlines.

Filing Deadlines and Important Dates

It is essential to be aware of critical filing deadlines to avoid penalties. Generally, local earned income tax returns are due annually, but specific dates may vary by locality. Taxpayers should mark their calendars for:

- Annual filing deadline for the berkheimer local earned income tax return F-1.

- Extensions, if applicable, and their respective deadlines.

- Due dates for any estimated tax payments throughout the year.

Required Documents for Filing

When preparing to file the berkheimer local earned income tax return F-1, ensure you have the following documents ready:

- W-2 forms from all employers.

- 1099 forms for any additional income sources.

- Records of any deductions or credits you plan to claim.

- Identification information, such as your Social Security number.

Penalties for Non-Compliance

Failure to comply with local earned income tax regulations can result in significant penalties. These may include:

- Late filing fees, which accumulate over time.

- Interest on unpaid taxes, compounding until the debt is settled.

- Potential legal action, including wage garnishments or liens against property.

Digital vs. Paper Version of the Form

Taxpayers have the option to submit their berkheimer local earned income tax return F-1 in either digital or paper format. The digital version offers several advantages:

- Faster processing times compared to paper submissions.

- Immediate confirmation of receipt, reducing uncertainty.

- Enhanced security features when using eSignature solutions.

Conversely, some individuals may prefer the traditional paper method for record-keeping or personal comfort.

Quick guide on how to complete delinquent earned income tax department dear

Complete DELINQUENT EARNED INCOME TAX DEPARTMENT Dear effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to obtain the appropriate form and securely save it online. airSlate SignNow provides you with all the resources required to create, modify, and eSign your documents promptly without delays. Manage DELINQUENT EARNED INCOME TAX DEPARTMENT Dear on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign DELINQUENT EARNED INCOME TAX DEPARTMENT Dear with ease

- Locate DELINQUENT EARNED INCOME TAX DEPARTMENT Dear and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for submitting the form, whether by email, text message (SMS), invitation link, or download to your computer.

Put an end to lost or mislaid documents, tedious form navigation, or errors that require new document copies to be printed. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Edit and eSign DELINQUENT EARNED INCOME TAX DEPARTMENT Dear to guarantee excellent communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct delinquent earned income tax department dear

Create this form in 5 minutes!

How to create an eSignature for the delinquent earned income tax department dear

How to create an electronic signature for a PDF document in the online mode

How to create an electronic signature for a PDF document in Chrome

How to generate an eSignature for putting it on PDFs in Gmail

How to create an eSignature from your mobile device

How to create an eSignature for a PDF document on iOS devices

How to create an eSignature for a PDF file on Android devices

People also ask

-

What is the berkheimer local earned income tax return f 1 and who needs to file it?

The berkheimer local earned income tax return f 1 is a form required by residents working within Berkheimer jurisdictions to report earned income for tax purposes. Individuals who earn income in Pennsylvania and meet certain thresholds must file this return to ensure compliance with local tax laws.

-

How can airSlate SignNow help me with the berkheimer local earned income tax return f 1?

airSlate SignNow streamlines the process of preparing and submitting your berkheimer local earned income tax return f 1 by providing an intuitive platform for eSigning and document management. This ensures that you can easily manage your tax documents without the hassle of printing or mailing.

-

What are the costs associated with using airSlate SignNow for my berkheimer local earned income tax return f 1?

airSlate SignNow offers several pricing plans to accommodate different business needs. By choosing the right plan, you can efficiently manage your berkheimer local earned income tax return f 1 at a competitive price while enjoying the benefits of advanced eSignature features.

-

Can I integrate airSlate SignNow with my accounting software for filing the berkheimer local earned income tax return f 1?

Yes, airSlate SignNow supports integrations with various accounting software solutions, allowing you to import data directly into your berkheimer local earned income tax return f 1. This seamless integration minimizes manual data entry and enhances accuracy in your tax reporting.

-

What features does airSlate SignNow offer for filing the berkheimer local earned income tax return f 1?

airSlate SignNow provides features like customizable templates, real-time tracking of document status, and secure cloud storage. These functionalities make filing your berkheimer local earned income tax return f 1 easier and more efficient, ensuring that you stay organized throughout the tax season.

-

Is airSlate SignNow suitable for businesses of all sizes when filing the berkheimer local earned income tax return f 1?

Absolutely! airSlate SignNow is designed to support businesses of all sizes, making it ideal for everyone filing a berkheimer local earned income tax return f 1. Whether you’re a freelancer or a large corporation, our platform offers scalable solutions to meet your specific needs.

-

How does airSlate SignNow ensure the security of my berkheimer local earned income tax return f 1 information?

airSlate SignNow employs industry-leading security protocols, including encryption and secure access controls, to protect your data. This means that your berkheimer local earned income tax return f 1 information remains safe and confidential throughout the filing process.

Get more for DELINQUENT EARNED INCOME TAX DEPARTMENT Dear

- Limited liability llc 497427967 form

- Virginia pllc form

- Quitclaim deed from individual to husband and wife virginia form

- Warranty deed from individual to husband and wife virginia form

- Revocable transfer on death deed from individual to individual virginia form

- Quitclaim deed from corporation to husband and wife virginia form

- Warranty deed from corporation to husband and wife virginia form

- Affidavit of military service virginia form

Find out other DELINQUENT EARNED INCOME TAX DEPARTMENT Dear

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed