Local Earned Income Tax Return Form 2017

What is the Local Earned Income Tax Return Form

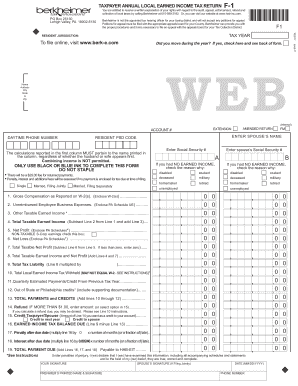

The local earned income tax return form, commonly referred to as the berkheimer local earned income tax return F 1, is a document required by certain municipalities in Pennsylvania for residents who earn income. This form is essential for reporting local earned income and calculating the appropriate tax owed to local authorities. It is specifically designed for individuals and businesses to ensure compliance with local tax regulations.

How to use the Local Earned Income Tax Return Form

Using the berkheimer local earned income tax return F 1 involves several key steps. First, gather all relevant income information, including W-2 forms and any other documentation that reflects your earnings. Next, accurately fill out the form, ensuring that all sections are completed to avoid delays. Once the form is filled out, it can be submitted electronically or via traditional mail, depending on the local regulations.

Steps to complete the Local Earned Income Tax Return Form

Completing the berkheimer local earned income tax return F 1 requires careful attention to detail. Here are the steps to follow:

- Collect all necessary income documentation, such as W-2s and 1099s.

- Ensure you have your personal identification information ready, including Social Security number.

- Fill out the form, starting with your personal information and then detailing your income sources.

- Calculate your total earned income and any applicable deductions.

- Review the completed form for accuracy before submission.

Legal use of the Local Earned Income Tax Return Form

The berkheimer local earned income tax return F 1 is legally binding when filled out correctly and submitted as required by local tax authorities. It must comply with the regulations set forth by the local government, ensuring that all income is reported accurately. Failure to submit this form can result in penalties, including fines or additional taxes owed.

Form Submission Methods

The berkheimer local earned income tax return F 1 can be submitted through various methods, providing flexibility for taxpayers. Options typically include:

- Online submission through authorized e-filing platforms.

- Mailing the completed form to the appropriate local tax office.

- In-person submission at designated tax offices, if available.

Required Documents

To successfully complete the berkheimer local earned income tax return F 1, certain documents are required. These typically include:

- W-2 forms from employers.

- 1099 forms for any freelance or contract work.

- Proof of any deductions or credits you intend to claim.

- Personal identification information, such as your Social Security number.

Quick guide on how to complete local earned income tax return form

Effortlessly Prepare Local Earned Income Tax Return Form on Any Device

Digital document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely save it online. airSlate SignNow provides all the tools you need to create, alter, and electronically sign your documents quickly and without delays. Manage Local Earned Income Tax Return Form on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to Modify and Electronically Sign Local Earned Income Tax Return Form with Ease

- Locate Local Earned Income Tax Return Form and click on Get Form to begin the process.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with the tools offered by airSlate SignNow specifically for this purpose.

- Create your electronic signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you'd like to send your form, via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Local Earned Income Tax Return Form and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct local earned income tax return form

Create this form in 5 minutes!

How to create an eSignature for the local earned income tax return form

The best way to create an electronic signature for a PDF file in the online mode

The best way to create an electronic signature for a PDF file in Chrome

How to create an electronic signature for putting it on PDFs in Gmail

The best way to generate an eSignature from your smartphone

The way to create an eSignature for a PDF file on iOS devices

The best way to generate an eSignature for a PDF file on Android

People also ask

-

What is the berkheimer local earned income tax return f 1?

The berkheimer local earned income tax return f 1 is a form used by individuals to report their earned income for local tax purposes. It's essential for residents of areas governed by Berkheimer, as it ensures that local income taxes are accurately calculated and paid. Completing this form correctly helps avoid penalties and ensures compliance with local tax laws.

-

How can airSlate SignNow help with the berkheimer local earned income tax return f 1?

airSlate SignNow streamlines the process of filling out and submitting the berkheimer local earned income tax return f 1. With its user-friendly interface, you can easily eSign and send your tax documents securely. This not only saves time but also ensures that all submissions are safe and compliant.

-

What are the pricing options for using airSlate SignNow for my berkheimer local earned income tax return f 1?

airSlate SignNow offers flexible pricing plans suitable for businesses and individuals who need to manage their berkheimer local earned income tax return f 1. Plans vary by features and number of users, ensuring you can find a solution that fits your budget. Additionally, a free trial is available to test the platform's capabilities.

-

Are there any features specifically designed for managing the berkheimer local earned income tax return f 1?

Yes, airSlate SignNow includes features tailored to help you efficiently manage the berkheimer local earned income tax return f 1. You can create custom templates, automate workflows, and track document status in real-time. These features enhance accuracy and efficiency in tax preparation and submission.

-

What are the benefits of eSigning the berkheimer local earned income tax return f 1 with airSlate SignNow?

eSigning the berkheimer local earned income tax return f 1 with airSlate SignNow offers numerous benefits. It provides a secure and fast way to sign documents, eliminating the need for physical signatures and paper forms. This not only saves time but also reduces the risk of errors and improves your tax filing experience.

-

Can airSlate SignNow integrate with tax software for the berkheimer local earned income tax return f 1?

Absolutely! airSlate SignNow can seamlessly integrate with various tax software, making it easier to manage your berkheimer local earned income tax return f 1. This integration allows for smooth data transfer, ensuring that all information is accurate and up to date for tax filing purposes.

-

How does airSlate SignNow ensure the security of my berkheimer local earned income tax return f 1?

airSlate SignNow prioritizes the security of your documents, including the berkheimer local earned income tax return f 1. The platform uses advanced encryption protocols and secure cloud storage to protect your sensitive information. You can confidently eSign and share your tax returns knowing that your data is well-protected.

Get more for Local Earned Income Tax Return Form

Find out other Local Earned Income Tax Return Form

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy

- eSign Indiana Debt Settlement Agreement Template Later

- eSign New York Financial Funding Proposal Template Now

- eSign Maine Debt Settlement Agreement Template Computer

- eSign Mississippi Debt Settlement Agreement Template Free

- eSign Missouri Debt Settlement Agreement Template Online

- How Do I eSign Montana Debt Settlement Agreement Template